More CEOs seem to be using the P-word

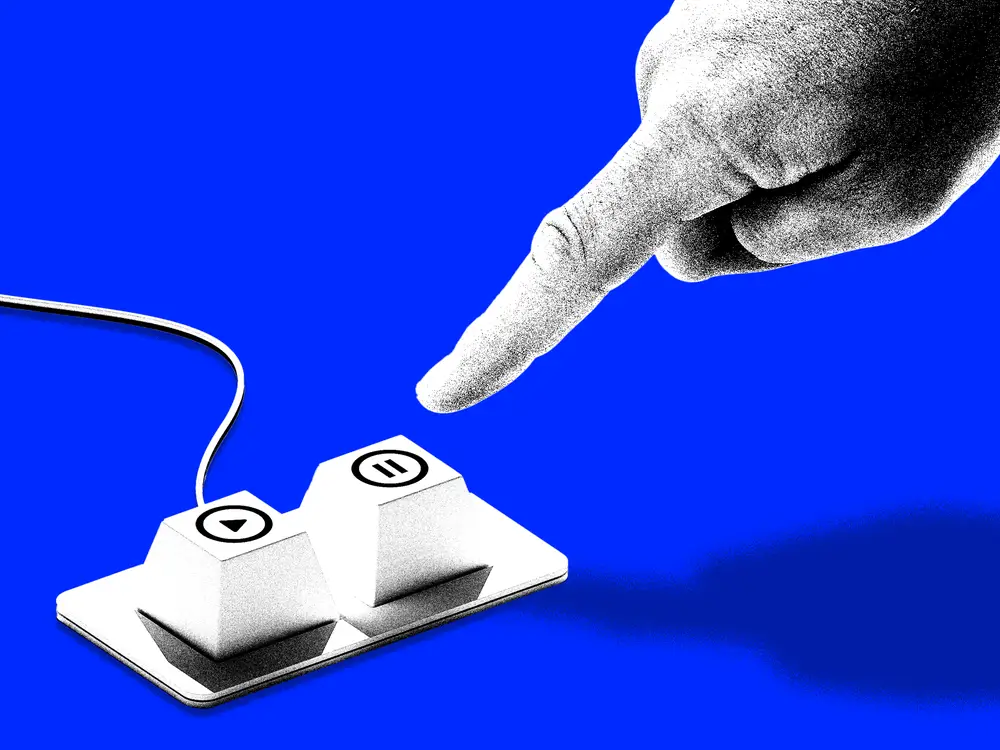

President Donald Trump’s tariffs have pushed some businesses to pause big decisions.

Welcome to the great pause.

From smaller firms to giants like Morgan Stanley, some CEOs are reaching for the word “pause” as the term of the moment.

It’s hardly surprising to see it get a C-suite glow-up.

The word received star treatment earlier this month when President Donald Trump announced a 90-day hiatus for some tariffs. His April 9 declaration in a Truth Social post featured an all-caps “PAUSE” as the operative word. It was enough to send stock market indexes rocketing to their best day in years after a string of steep losses.

Now, besides using it as shorthand for the partial tariff reprieve, some CEOs appear to be offering the word as a balm — a blend of prudence and veins of hope that the grinding uncertainty about the fallout from tariffs won’t last too long.

Keith Lambert, the CEO of Oxidizers, a company near Los Angeles that provides pollution-control equipment and services to industrial sites around the US, told B-17 that because of the unknowns surrounding the impacts of tariffs, his company and many of the firm’s clients feel compelled to be cautious.

For Oxidizers, which Lambert said did more than $20 million in sales in 2024, and some customers, vigilance means not moving too aggressively in areas like hiring, he said.

“Right now, it’s just that pregnant pause of ‘OK, wait, let’s see,'” Lambert said.

For many businesses, the unpredictability of the economy has paralyzed decision-making, Joe Galvin, the chief research officer at the executive-coaching firm Vistage, previously told B-17.

The choices that might be easier — and not require a time out — are ones that reduce risk.

Catalynt Solutions, a company near Seattle that makes and distributes chemicals used in products from soft drinks to paint, is holding off on capital spending projects and some investments in technology and services because of uncertainty over tariffs, CEO Megan Gluth told B-17.

“We’re just putting pause on signing all those contracts right now because we just don’t know,” she said. Catalynt had $91 million in sales in 2024, the company said.

‘Pause versus delete’

As unwelcome as it might be, CEOs could say much worse than the P-word.

Ted Pick, who heads Morgan Stanley, told investors on April 11 that while uncertainty and swings in financial markets have slowed some corporate rights of passage like initial public offerings, sentiment around such transitions, for now, appears to have landed on “pause versus delete.”

As a verb or a noun, pause has emerged as a clutch term for some businesses navigating murky waters.

A day after Trump’s April 2 Rose Garden speech laying out his “Liberation Day” tariffs policy, the industrial technology company Acuity said in an earnings call with investors that it viewed the levies as “the equivalent of a supply shock.”

CEO Neil Ashe, discussing the Atlanta company’s lighting business, also said in the call that Acuity would “take a pause” while it digested the implications of the announcement.

In some cases, the word took center stage even before Trump announced the particulars of the tariffs.

BGSF, a Plano, Texas, staffing firm that operates across the US, told investors in mid-March that it was seeing “a lot of activity” in the company’s pipeline. CEO Beth Garvey also said in the earnings call that there had been a “slight pause” to the hopefulness that followed the US presidential election but that, broadly, “there’s a cautious optimism out there.”

GreenFirst Forest Products, a Canadian lumber company, also said in a mid-March investor call that it was prudent to “pause certain elements” of its plans to study the impact of the soon-to-come tariffs and safeguard the company’s balance sheet.

Taking it slow with big decisions

Companies may have landed on pause as a turn of phrase because it’s a simple way to convey they’re taking a beat before making weighty decisions that could appear rash in only a few months’ time.

Rejiggering supply lines, for example, is often difficult and expensive, so CEOs don’t tend to make those calls overnight, Erin McLaughlin, a senior economist at The Conference Board, told B-17. Instead, she said, business leaders often make those decisions three to seven years in advance.

McLaughlin said that even with a three-month halt to some tariffs, many medium and large businesses that make up the nonprofit’s membership are still grappling with uncertainty — and some have decided to hold off on major decisions.

She said many CEOs want to better understand “the why and the endgame” of the tariffs. Knowing that, McLaughlin said, could allow companies to ease up on the brakes and resume “a normal decision-making paradigm.”

A lasting delay could become problematic.

Morgan Stanley’s Pick said that if adjusting to new economic conditions takes too long, the appetite for corporate activity such as mergers could fade to where “the pause effectively becomes a relook and the books get put away.”

For now, though, the term is still doing yeoman’s work, including in relation to dealmaking.

“I am of the view that we are still on pause. We don’t know whether the economy is going to contract,” Pick said on the April 11 investor call.