Nearly a million more children fell into poverty last year. Both presidential campaigns want to give parents money to fix that.

More children fell into poverty last year — and it could signal a major issue for both candidates as the presidential election heats up.

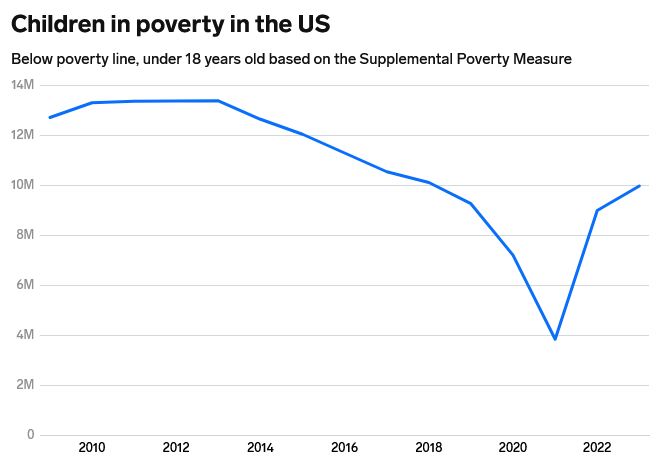

From 2022 to 2023, the number of children in poverty rose by 979,000, bringing the total number of people under age 18 in poverty last year to 9,962,000.

That’s from the latest release from the Census Bureau on the state of poverty in the US. Those figures show the Bureau’s Supplemental Poverty Measure, which reflects a broader array of income, government support, and expenses than the traditional official poverty line.

The overall Supplemental Poverty Measure slightly increased from 12.4% in 2022 to 12.9% in 2023. But child poverty rose faster than that, from 12.4% to 13.7%.

However, the data shows that policy measures can have a substantial effect on child poverty. According to the report, refundable tax credits for parents, which are paid out even if you don’t owe taxes, lifted 3.4 million children — and 6.4 million people total — out of poverty in 2023. And the refundable child tax credit had a particularly big impact; it was responsible for pulling a third of those Americans above the poverty line.

“The obvious answer to reducing poverty is to increase assistance to the poor,” Steven Durlauf, a professor at The University of Chicago and the director of the Stone Center for Research on Wealth Inequality and Mobility at the Harris School of Public Policy, told B-17 in a statement. “The effectiveness of such a policy is evident when one considers the effects of the Child Tax Credit.”

That credit was made fully refundable and bolstered to $3,600 in early 2021 under President Joe Biden’s American Rescue Plan, and led to a dramatic fall in child poverty that year. But that expansion was ultimately left to lapse in December 2021, and over 5 million people under 18 years old slid into poverty over the next year — leading to calls for a renewal but no tangible legislative action.

The credit has received newfound attention in the run-up to the presidential election. Vice President Kamala Harris has proposed restoring the enhanced child tax credit as part of her presidential campaign and giving new lower and middle-income parents a $6,000 credit in their child’s first year of life.

“Billionaire-bought Donald Trump’s ‘plan’ for making child care more affordable is to impose a $3,900 tax hike on middle class families,” Joseph Costello, a Harris-Walz 2024 spokesperson, told B-17 in a statement. “The American people deserve a President who will actually cut costs for them, like Vice President Harris’ plan to bring back a $3,600 Child Tax Credit for working families and an expanded $6,000 tax cut for families with newborn children.”

Meanwhile, JD Vance, former President Donald Trump’s running mate, has floated a $5,000 child tax credit.

“As this data shows, there is a terrible, direct correlation between Kamala Harris’ policies and parents struggling to keep their children housed and nourished,” RNC Spokesperson Anna Kelly told B-17 in a statement. Kelly added: “Families across the country know that they were better off four years ago, and they are ready return to lower costs and commonsense policies under President Trump.”

Americans already have the economy top of mind as they head to the polls. According to a Pew Research Center survey conducted from August 26 to September 2, 81% of all voters said that the economy is very important to their vote. And with child poverty only worsening, what candidates can deliver for parents might be particularly salient.

“The facts speak for themselves: millions of children are going to bed hungry and parents can’t access basic needs like groceries, gas, and prescription drugs, all because polarized politicians have failed to keep this historically effective program going,” Adam Ruben, vice president of campaigns and political strategy at Economic Security Project, said in a statement to B-17.

The new Census Bureau report also showed that the official poverty rate declined from 11.5% in 2022 to 11.1% in 2023.

“The official poverty rate ticking down tells us that the macroeconomy is strong,” Josh Bivens, the chief economist at the Economic Policy Institute, told B-17 in a statement. “The fact that it is still 11.1% at near-full employment and the SPM rose tells us the U.S. system of anti-poverty programs needs strengthening. These programs keep tens of millions out of poverty, but if we expanded them, they’d bring tens of millions more out of poverty.”