New York City renters are expected to soon save an average of $5,000 on apartments that used to have hefty move-in fees

House hunters Christine and Tom DeCillis Blaney start to move their things into their new home.

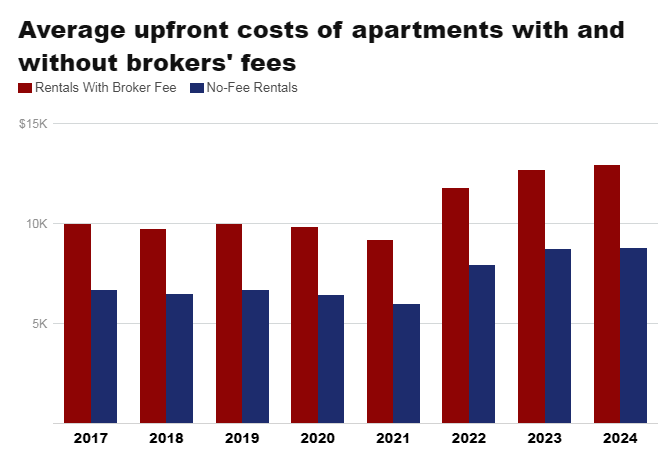

New Yorkers looking for a new apartment might save more than 40% at their next lease signing.

The New York City Council passed a law in November — the Fairness in Apartment Rental Expenses (FARE) Act — shifting the burden of real estate broker fees from renters to landlords. The new legislation will go into effect in June 2025.

For decades, it’s been typical for New York landlords to hire brokers who charge tenants an upfront fee of between one and nearly two months’ rent. Those fees have helped make the Big Apple one of the most expensive places in the country to sign a lease.

Under the FARE Act, the average cost of moving into an apartment that previously had a broker fee is expected to fall by 41.8%, per a new report from the online renting platform StreetEasy. That means the average upfront lease cost — which includes the first month’s rent, a security deposit, and the broker fee — would fall to $7,537, down from $12,951 in 2024.

The pain of broker fees

Broker fees — which this year applied to 47% of leases — create a so-called “lock-in” effect, discouraging tenants from moving and paying another broker fee.

While apartments without broker fees command a premium — charging about 4% more in rent per year, on average, than units with fees — those moving into apartments with broker fees face higher rent increases than for no-fee units, according to StreetEasy. Apartments that switched to no-fee between 2022 and 2024 saw a 4% average annual rent hike after a new tenant moved in, while apartments that kept charging a broker fee hiked rents by 6%, StreetEasy found.

“Once the FARE Act takes effect, a no-fee rental won’t be a marketing tool, and the associated premium should evaporate, and that will really make the New York City market more aligned with the national market,” Kenny Lee, an economist at StreetEasy and the author of the report, told B-17.

This year, a majority of apartments with broker fees — 57.3% — have rents below the median asking price, according to the StreetEasy report. Lee says this is likely because there’s more competition for cheaper apartments. “People with smaller budgets have to compete really fiercely for more affordable homes, but with broker fees,” Lee said.

The expected impact of the law

StreetEasy expects the FARE Act to enable many more renters to move and create more transparency when they sign a lease.

Brokers and the city real estate lobby are up in arms about the legislation. New York City Mayor Eric Adams also criticized the law, saying it has the “right intention” but would backfire by encouraging landlords to raise rents further to cover the fees. “If you pass the cost on to the small property owners, nothing in that law stops them from building it into their rent, so it goes from a one-time fee to a permanent fee,” Adams said last month.

Proponents of the bill dispute the mayor’s claim, arguing that asking rents are mostly determined by the forces of supply and demand rather than landlords’ expenses and that rising rents are mostly caused by the city’s severe shortage of housing. In 2023, the city’s vacancy rate sunk to 1.4%, the lowest rate in more than 50 years.

“The housing shortage for the past decades really allowed landlords to take advantage of the competition in the market,” Lee said. “What our research says is that the rents that landlords set are ultimately determined by the supply and demand, rather than just the expenses.”

This isn’t the first time lawmakers have taken aim at brokers’ fees. In 2020, brokers’ fees were set to be banned under New York Department of State guidance, but that ban was ultimately overturned after a lawsuit from the Real Estate Board of New York. The FARE Act passed the city council with the support of 42 of its 51 members, giving it a veto-proof majority.