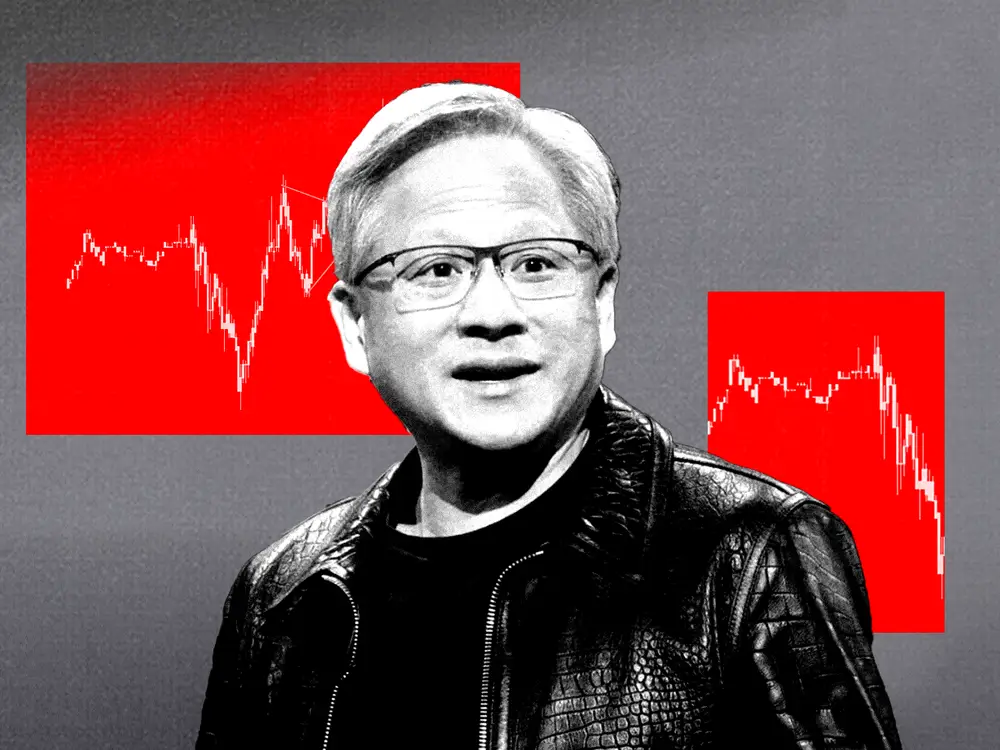

Nvidia has seen $437 billion of market cap erased since earnings last week

Nvidia stock extended its weeklong decline on Wednesday after a report from Bloomberg said the company received a subpoena from the Department of Justice.

Shares of Nvidia were down as much as 3% in Wednesday morning trades, a day after the stock experienced the largest one-day market value wipeout in history when it fell nearly 10% on Tuesday.

The stock has since ping-ponged between slight gains and losses for the day, with the stock lower by 0.17% at 12:01 p.m. in New York.

Since the AI darling reported its second-quarter earnings last week, the stock dropped as much as 16%, erasing $505 billion in market value. Based on current levels, Nvidia’s weeklong stock decline has slightly recovered to $437 billion.

The DOJ’s antitrust investigation into Nvidia is another concern for investors who worry about just how long the company’s dominance of the AI chip sector can last.

Nvidia captured over 90% of the GPU market in 2023, according to estimates from JPMorgan.

The DOJ’s subpoena includes “legally binding requests” that require recipients to provide information, Bloomberg reported, citing people familiar with the investigation.

This step from the government is a common precursor to a formal complaint being levied against a company that’s under investigation. The DOJ also sent subpoenas to other technology companies as part of the probe.

At issue with antitrust officials is whether Nvidia is making it harder for its customers to switch to competing suppliers, and whether the company punishes customers that don’t exclusively use its AI-enabled GPU chips.

According to the report, Nvidia’s acquisition of RunAI in April is also under scrutiny. RunAI offers software to manage AI computations, and there are concerns that the tie-up will further strengthen Nvidia’s ecosystem and make it more difficult for its customers to switch to a competing product.

The DOJ’s probe into Nvidia was initially launched in June.

In its defense, Nvidia said its market dominance of the GPU market is based on the high quality of its products.

“Nvidia wins on merit, as reflected in our benchmark results and value to customers, who can choose whatever solution is best for them,” Nvidia said in a statement to B-17.

Nvidia’s closest competitor in the GPU market is AMD, which released its own GPU accelerator chip, the MI300, late last year.

AMD has said it expects to generate more than $4 billion in revenue from its suite of AI chips this year, which pales in comparison to the $100+ billion in revenue Nvidia expects to generate this year from its AI chips.

Nvidia also faces competition from its own customers, as cloud hyperscalers like Microsoft, Amazon, Meta Platforms, and Alphabet are internally developing their own AI chips that are specialized in completing inference computations, a key part of the AI workload.