People are still flocking to Florida. It could help them ride out a slowdown in the economy.

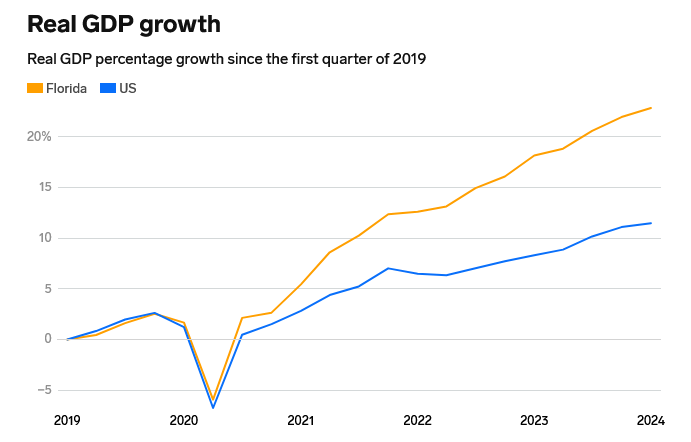

Florida’s economic growth has outpaced the nation on an annual basis for the past 11 years.

People are still flocking to Florida — and it could help residents ride out a potential economic slowdown.

Economists at Wells Fargo wrote in a report published on August 27 that they expect the Sunshine State’s economy to fare better than the national average in the case of a slowdown, as strong population growth over the last five years has boosted the state’s economic growth.

This comes as the Sahm rule — a closely watched recession indicator created by Claudia Sahm, a former Federal Reserve economist — was triggered on August 2 after a surprise jump in US unemployment. To be sure, economists, including Sahm, are conflicted on whether it’s correct this time.

Florida’s economic growth has outpaced the nation on an annual basis for the past 11 years, according to Wells Fargo. What’s more, the state’s economy grew at the sixth fastest pace in the nation in the first quarter of this year.

Jackie Benson, an economist at Wells Fargo and one of the report’s authors, told B-17 that Florida’s growth is due to the influx of new residents. The state’s above-average population growth has helped it outpace the nation in real GDP growth, Benson said.

Population growth insulates the state

Florida had the second-fastest state population growth in 2023, following South Carolina, according to data from the US Commerce Department and Wells Fargo.

There were nearly 195,000 domestic movers and 178,000 foreign movers on net relocating to Florida in 2023, according to Wells Fargo. From 2000 to 2019, the average number of domestic relocations to Florida was roughly 140,000.

Benson said an influx of residents means more workers in the labor force, more people buying homes, and more people spending money at the grocery store.

“That creates a feedback loop that kind of insulates an economy from a broader macroeconomic slowdown that might drag certain states down,” Benson said. “If you have greater population growth, your chances of growing better through that is increased.”

Wells Fargo said population growth is a tailwind for Florida, and post-pandemic shifts in migration have benefited states in the Sun Belt, including the Southeast and Southwest. Nonetheless, Benson said people have been moving into Florida before the COVID-19 pandemic.

B-17 has previously reported on movers to Florida from coastal hubs like New York and California.

“A lot of people are looking for family reasons or homebuying reasons, just quality of life or lower cost of living,” Benson said. “That’s kind of what drives them down south, and with Florida, it’s a lifestyle, too, right? Warmer weather and a more relaxed atmosphere.”

Movers to Florida might fare better than the average

Wells Fargo did not forecast an upcoming recession, Benson said. However, it does expect a slowdown.

“We are expecting momentum to slow,” Benson said. “That’s largely driven by a deceleration in the labor market that is already starting to happen.”

Wells Fargo economists noted in the report that Florida’s unemployment rate has recently moved higher with national trends and might be losing some momentum but is still “comfortably below” the national average.

“There are some signs of caution, particularly when it comes to rising unemployment,” Benson said. “I don’t think Florida will be completely insulated from this slowdown, given that the labor market is showing signs of cracks, but I would expect it to perform better than other states do.”

In 2023, nearly half of Florida’s job gains were concentrated in healthcare, construction, and government. Construction jobs grew 5.1% year over year, the fastest rate of any job in the state.

In particular, South Florida is performing well. The Miami metro area was responsible for almost 30% of the state’s job gains in 2023, according to Wells Fargo.

To be sure, if the country did enter a recession, Florida would be impacted.

Job growth in Florida’s information and finance sectors lagged in 2023, largely due to high interest rates, according to Wells Fargo. Yet, Benson said she expects the Federal Reserve to cut rates in September, which would bode well for those industries.

One sector most at risk in case of slowdown is Florida’s leisure and hospitality sector, however international travelers could help keep it afloat.