Pharma stocks erase early losses driven by Trump’s plans to cut drug prices

Pharma stocks erased their early losses and rallied with the rest of the market on news of a trade deal with China on Monday, despite President Donald Trump announcing plans to bring drug prices down.

Eli Lily shares fell by about 3% premarket, while shares of Pfizer and Merck were down more than 2% before rebounding in early trading.

On Sunday, Trump announced plans to sign an executive order to bring back the “most favored nation” (MFN) pricing framework. The policy aims to lower US Medicare drug prices to the lowest level paid by other nations in the world.

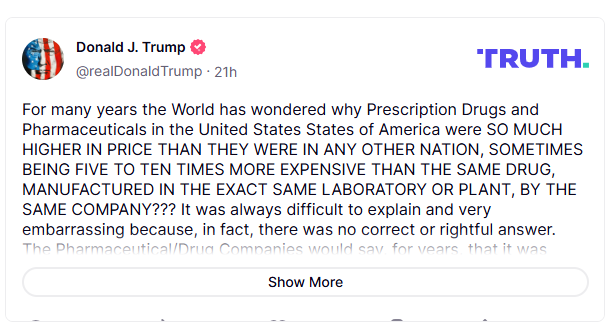

“Prescription Drug and Pharmaceutical prices will be REDUCED, almost immediately, by 30% to 80%,” the president wrote in a Truth Social post.

MFN was originally introduced by the Trump administration in 2020 and subsequently rolled back by the Biden administration. The MFN policy primarily targets the top 50 Medicare Part B drugs, which includes treatments for cancer and certain vaccines.

Americans often pay higher prescription drug prices than citizens of other countries across the world because other countries’ healthcare systems can negotiate costs down. For example, countries like the UK and Canada with single-payer systems buy drugs from pharma companies at a low price in exchange for providing access to international markets.

Despite Monday’s stock-market rally, Trump’s executive order would erode pharma companies’ pricing power and cut into profits in the long term.

“In a grey sky scenario, if it is total exposure across all drugs for each company assuming a 50% net price cut at 60% contribution margin, this would result in a -15% average net income cut,” UBS healthcare analysts wrote in a note Monday morning.

Here’s where major pharmaceutical companies stood shortly after 9:30 a.m. ET:

- Eli Lily (LLY): $731, -0.4%

- Pfizer (PFE): $23, +2%

- Bristol-Myers Squibb (BMY):$48, +3%

- Merck (MRK): $79, +4%