Real estate expert explains why ‘buying a home is a liability’ — and how to figure out if you should rent or buy

- If you finance a property, you will have to pay a mortgage, which is a monthly expense.

- As a result, according to real estate expert Ricky Beliveau, a home should not always be considered an asset.

- You’ll need to crunch some numbers to determine whether you should rent or buy.

Unless you’re buying a home in cash, don’t consider it an asset.

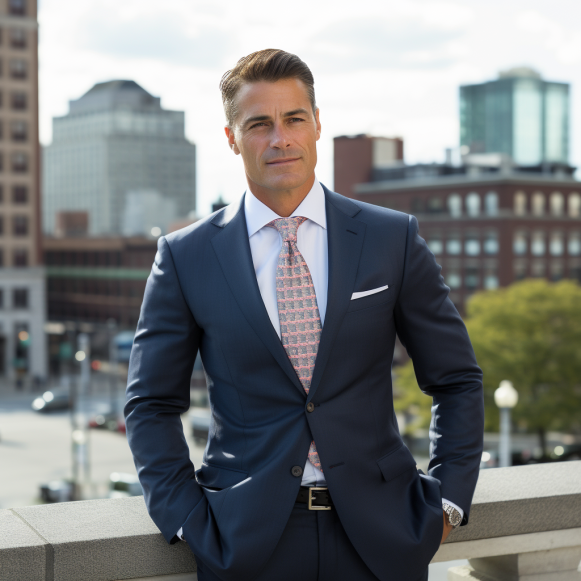

“Owning real estate is an extremely important part of building wealth, but the problem is, when you look at your home, it’s not really an asset,” Ricky Beliveau, founder of Volnay Capital and co-founder of V10 Development, told Insider. “Buying a home is a liability.”

He pointed out that if you’re financing the home, you’ll be paying a mortgage: “Yes, you are paying down principal.” At the end of the day, however, a monthly mortgage payment is an expense. “It’s not creating money for you.”

Rent is, of course, a monthly expense, which begs the question, “Do I rent or buy?”

“There are both sides of the table,” Beliveau explained. Home prices continue to rise, and the Federal Reserve has been raising interest rates since March 2022, making borrowing more expensive. If renting in your area is significantly less expensive, “that’s the right decision.”

He suggests using the extra money you save on housing to increase your down payment, fund, and buy when interest rates fall.

However, if you run the numbers on buying a property — that is, you factor in the home price, mortgage rate, down payment size, closing costs, and maintenance costs — and your monthly payment is the same or less than rent, the right decision is to buy and begin building equity in your home.

Your mortgage payment will be affected by how much you can put down, so if you have significant savings and can put down 20% or more, it will lower your mortgage payment to the point where it may make sense to buy.

There are numerous other factors to consider when deciding whether to rent or buy, and it all comes down to the unique circumstances of each individual.

Beliveau’s main point is that owning a home can be an expensive investment, and he cautions against assuming it’s the best financial decision to make.

How to Purchase a Home That Functions as an Asset

According to an asset sheet viewed by Insider, Beliveau has over 1,000 units between his personal rental units, Volnay Capital’s portfolio, and properties he owns with partners. Beliveau, a successful real-estate investor, understands how profitable real-estate investing can be. To use it as a tool for wealth creation, he advises investors to focus on acquiring an actual asset — something that generates money.

One option is to purchase an owner-occupied rental property. Your primary residence doubles as a rental property in this situation, and “that’s an asset,” he says. “You’re paying off your mortgage with rental income, not cash from your pocket.” Even if you’re not living rent-free — even if you’re paying $500 a month for your unit but it’s worth $3,000 — you’re still creating value.”

This is exactly how Beliveau began.

He purchased an owner-occupied triplex with an FHA loan, which is a government-backed mortgage that allows people to buy a home with as little as 3.5% down. He rented the other two units and moved into one.

“The numbers worked out perfectly,” he told me. “The mortgage on it was about $4,000 a month and the two other units were paying $2,100 a month.”

He renovated each unit over the next year, transforming the building from a nine-bed, three-bath to a 12-bed, six-bath. Beliveau was able to afford his second property, a quadplex, thanks to a year’s worth of rental income and his salary from the finance industry.

Both properties are still owned by Beliveau today.

The first, which he bought for $930,000 in 2010, is now worth about $2.6 million, he says, adding, “The rents were $2,100 when I bought it; now they’re $4,700 a unit.”

Beliveau emphasizes getting your first “rental asset” — not just your first rental unit — to achieve financial freedom.