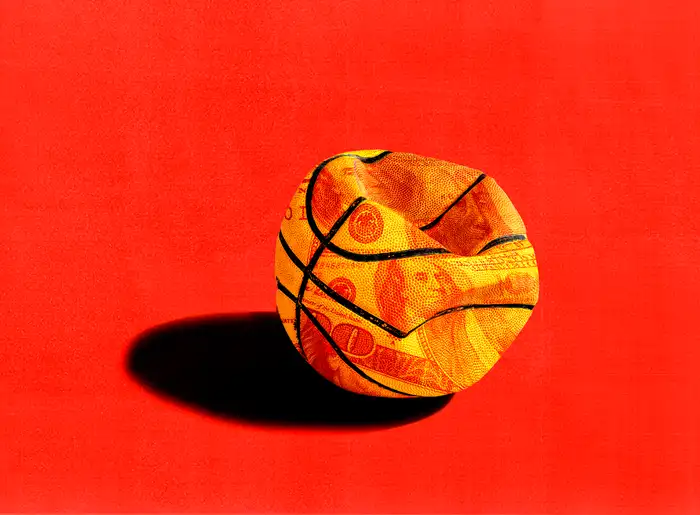

Risk, rewards, and wagers: America’s new betting addiction

Good morning! I’m not sure if they’re planning a sequel to “Catch Me If You Can,” but the Delta stowaway suspect is making a great case for it. Svetlana Dali was arrested after removing her ankle monitor and trying to flee the country.

In today’s big story, America is now all about making wagers, from sports to investing and elections.

What’s on deck

Markets: The Fed is projecting two interest-rate cuts in 2025, and investors aren’t happy.

Tech: You’ve probably never heard of Broadcom, but there are about a trillion reasons to get to know it.

Business: Apologies MBAs. VCs aren’t as interested in you anymore.

The big story

Wanna bet?

Same-game parlays. Teasers. Prop bets.

If the above doesn’t make sense, congratulations! You somehow managed to avoid the sports gambling bug that swept across America this year.

It’s been more than six years since the Supreme Court paved the way for widespread legalized sports gambling, but the industry really hit its stride in 2024. It’s estimated roughly $150 billion was bet on sports in America this year, a sizable jump from 2023 ($120 billion).

But it’s not just sports gambling that Americans are hooked on, as the whole country is all-in on making bets anywhere it can, writes B-17.

Prediction markets. Meme coins. Risky, volatile investments. Anything to fill Americans’ insatiable urge to keep wagering.

Emily, who has covered this space extensively, broke down what’s driving Americans to want to bet on just about everything (and the business motivations feeding into those urges).

A key part of America’s “gamblification” is how clean and accessible it is.

Sports betting no longer means meeting up with a shady character once a week in a McDonald’s parking lot to exchange cash.

Commercials with familiar faces now welcome you to join fun-looking apps that offer enticing promos. What could possibly go wrong?

Gambling also speaks to a wider audience than you might realize. A colleague who doesn’t fit the typical profile of a sports gambler (see: young male) recently told me about how they had a run of betting the over/under on the speed of individual baseball pitches.

(They stopped after going up $100, for the record.)

Unfortunately, many aren’t as lucky. The legalization of sports gambling has proved financially catastrophic for some.

It’s also not going so well for the players we’re all betting on. Some are getting themselves lifetime bans from their leagues for leaking inside information or betting on their own games.

Even athletes who want nothing to do with gambling are getting caught in the crossfire.

The NCAA president and an NFLPA representative recently asked Congress to consider implementing more rules around sports gambling. At a congressional hearing, they cited the abuse athletes have reported facing from bettors when things don’t go their way.

The professional leagues employing those players might feel slightly different, however. As much as they want to protect their athletes, they have millions of reasons — in the form of partnership deals with sportsbooks — for keeping viewers betting.

3 things in markets

Fed Chair Jerome Powell

- The Fed projects two cuts in 2025. Investors groan. After cutting rates for the third straight time, Chair Jerome Powell said the central bank is penciling in two rate cuts next year. The modest outlook sent stocks cratering.

- Santa Claus is coming to Wall Street. The last five trading days of the year and first two of the new year — dubbed the Santa Claus trading window — have historically been good for investors. (The S&P 500 posted an average return of 1.3% since 1950.) Here’s why this year could be more of the same.

- Let’s make an (AI-powered) deal. Louisa AI analyzes CRM systems, messaging platforms, and emails to suggest deal ideas based on people’s personal and professional connections. Rohan Doctor, the startup’s founder and a former Goldman MD, told B-17 how he’s used his own company to secure contracts with one of the biggest AI chipmakers and a top consulting firm.

3 things in tech

Zoe Perret, Yuri Lee, and Jennifer Li

- Meet the women breaking into VC’s old boys’ club. Women are gaining ground in venture capital, with more becoming partners in 2024. These 33 made partner or higher this year at firms like Andreessen Horowitz and IVP.

- The $1 trillion dark horse of the chip game. Broadcom is suddenly worth a dizzying $1 trillion thanks to the rise of AI and the computing power it requires. The company is crucial for those seeking alternatives to Nvidia’s AI chips.

- Move over, Sora. Veo 2 is here. Early testers said OpenAI’s Sora can’t compete with Google’s new AI video generator, Veo 2, which is still in early previews. The reason may have to do with YouTube, which Google tapped to train its AI models.

3 things in business

- Leaked docs reveal the terms a “Beast Games” contestant agreed to. MrBeast’s reality show has come under fire by contestants who said there were subpar working conditions on set. Documents obtained by B-17 give an idea of what exactly some participants signed up for.

- MBAs and consulting backgrounds are out. Technical skills are in. VC firms are increasingly looking to hire those with deep domain expertise, especially in AI. “The traditional MBA background will not be sufficient for the best investors going forward,” Matt Hoffman, head of talent at M13, told B-17.

- In the fight over remote work, companies are relying on one magic word. When addressing workers’ fears of losing remote work, companies are carefully hedging their answers with the P-word: productivity. Some major companies, like Google and Microsoft, are reluctant to dive head-first into an Amazon-style RTO without knowing the effects on productivity first. One company that isn’t: AT&T, which ordered a five-day-a-week return starting January 2025.