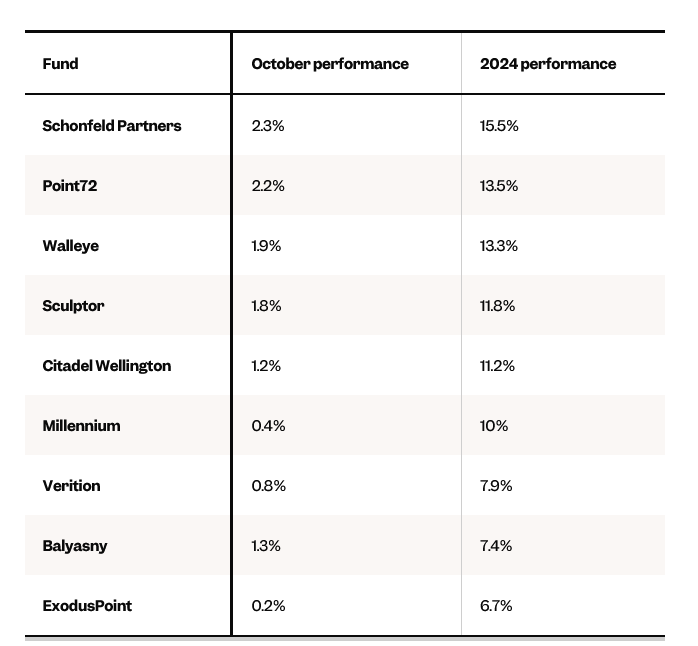

Schonfeld is leading its peers a year after the $11.6 billion firm ended tie-up talks with Millennium. How the industry’s biggest funds did in October.

Ryan Tolkin is the CEO and chief investment officer of Schonfeld Strategic Advisors.

In a year full of strong months, October still stood out for Schonfeld Strategic Advisors.

The $11.6 billion New York-based fund is roughly a year removed from nixing a potential takeover by its larger rival Millennium, and the manager’s strong 2024 has been a big help in solidifying its standing in the hedge-fund industry.

The firm’s flagship fund, its Partners strategy, is up by 15.5% in 2024 through October thanks to a 2.3% gain last month, according to people familiar with the matter. It’s the second-largest monthly gain for the fund this year, trailing only March’s standout return.

The firm has been led by its stockpickers, and its Fundamental Equity fund was up by 4% in October, bringing its 2024 returns to 16.5%, the people said. They said the flagship fund had been up in 17 of the past 18 months.

October was a strong month generally for the large multistrategy managers that have dominated industry headlines in recent years. The resiliency of the business model — which accumulates the returns from dozens or even hundreds of trading teams into a single strategy — was once again on display as stock markets faltered at the end of the month thanks to sell-offs of mega-cap stocks like Microsoft.

The S&P 500 closed October slightly lower than it opened the month, the first down month since April.

Walleye, which has leaned on its volatility strategies in rocky months this year, was up by 1.9%, a person close to the manager told B-17. That return bumped the manager up to a 13.3% gain for 2024.

Ken Griffin’s Citadel was up by 1.2% last month in the firm’s flagship Wellington fund, a person close to the Miami-based fund told B-17. The fund is up by 11.2% through October. The firm’s Tactical Trading fund, which includes quant and equity strategies, is up by 18% for the year after a 2% gain last month, the person said.

Millennium, meanwhile, made 0.4% last month, pushing its annual return to 10%, a person close to Izzy Englander’s firm said.

The list below will be updated as more performance returns are learned. The firms declined to comment.