September is a historically scary month for stocks. Why they’ll surge through year-end anyway, according to a market-calling strategist.

Keith Lerner is encouraging his clients to stay the course in stocks.

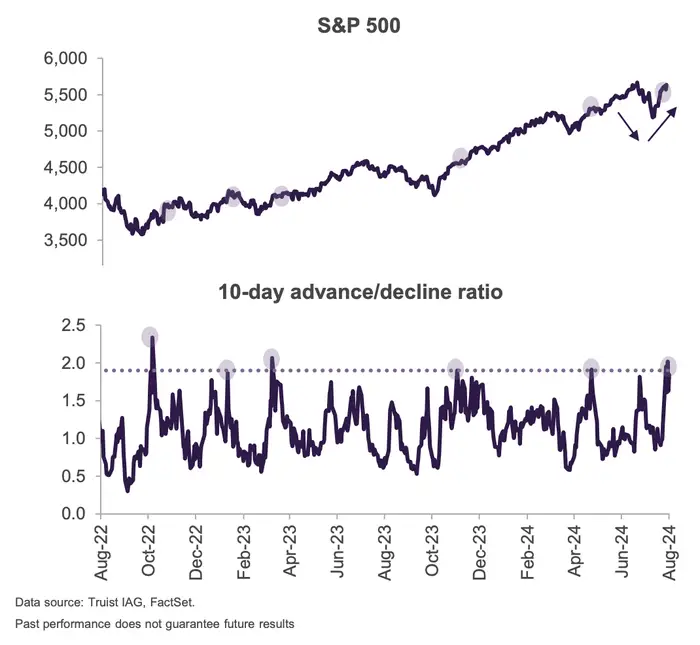

The early-August market meltdown proved to be a massive buying opportunity, and a bullish strategy chief believes the same could be true of a possible September scare.

Investors who listened to Keith Lerner, the chief market strategist at Truist, are likely richer for it. During the depth of the late-summer slump on August 5, Lerner wrote that the risk-reward setup for US stocks had just improved meaningfully, especially since the long-term uptrend was intact.

What looked like the beginning of the end for the bull market was instead “an overdone scare,” as Lerner put it in a recent interview. A 7.9% rally in the last three weeks has the S&P 500 roughly 1% away from a record high, and history suggests it will get there soon.

Why stocks may fall at the start of autumn and then recover

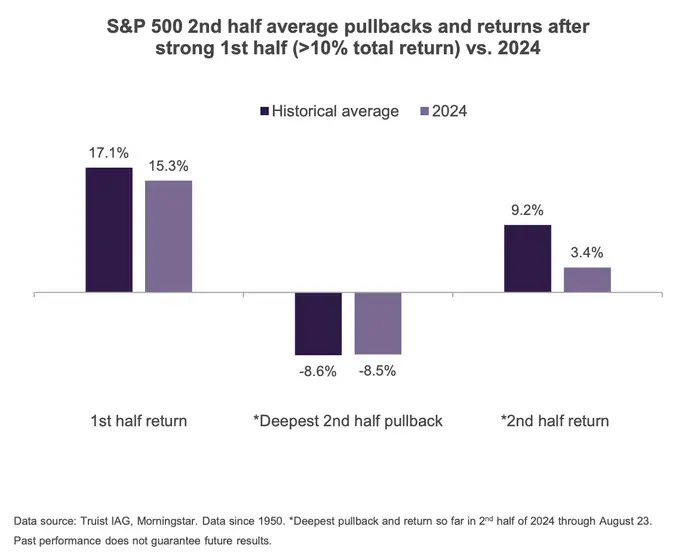

When US stocks rise more than 10% from January through June, as they did this year, they tend to add another 9% in the second half, Lerner wrote in a chart-heavy August 26 note. That’s even after an 8.6% pullback, which was eerily reminiscent of this summer’s 8.5% drawdown.

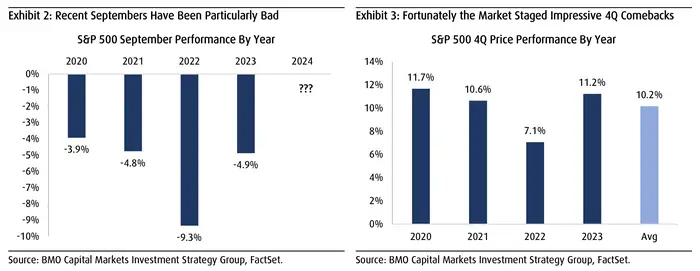

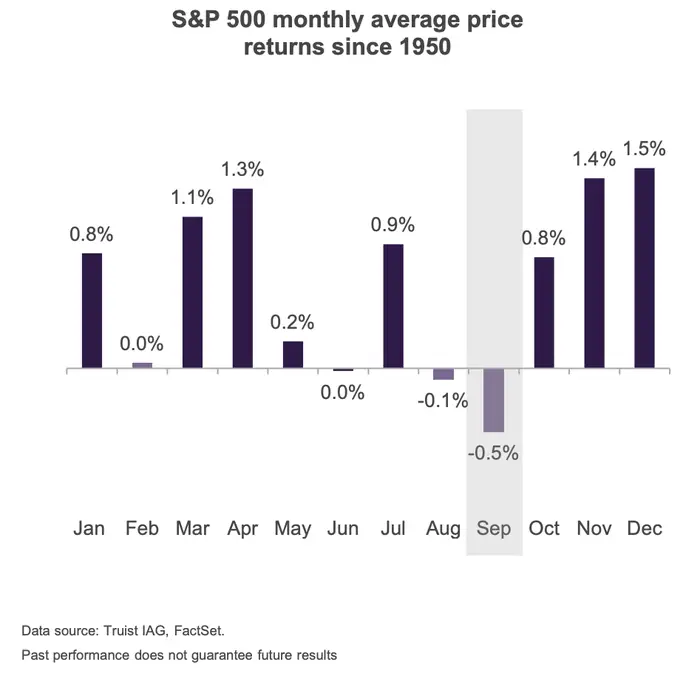

Speaking of similarities, a striking pattern has played out for the last four years: the S&P 500 wilts at the end of the third quarter before finishing the year strong. The S&P 500 has been walloped in September, falling between 3.9% and 9.3% since 2020, before soaring by an average of just over 10% to close the year, strategists at BMO Capital Markets have noted.

This trend isn’t new, as Truist found that September has been the market’s worst month for decades.

Lerner suspects that the script could play out again this year. This fall’s elections may take the spotlight over interest rate cuts, which are already priced in, before clarity on the political front shifts the market’s focus to rising earnings estimates and improving market breadth.

“In the fourth quarter, as you get past the elections, you tend to have a bit of a relief rally,” Lerner said. “Those things suggest that there’s still upside in this market.”

Market breadth has improved during this recovery, according to Truist.

As for how investors should prepare for a potential September slide before a robust recovery, the strategy chief said he’s encouraging his clients to stay the course.

“The investors that I deal with — they’re not investing for September,” Lerner said. “They’re investing for the next three, five, 10 years.”

3 top investing ideas — and 4 other areas to watch

Truist’s sector recommendations are similar to what they were two months ago, with one notable change. Lerner’s team has been steadfastly bullish about communication services and utilities, but their view on technology has seesawed from overweight to neutral and back.

Growth-focused groups like communication services and tech have impressive earnings and are beneficiaries of the artificial intelligence boom, while the defensive-oriented utilities have solid momentum and enticing valuations.

Lerner said he’s also eyeing another trio of sectors: financials, industrials, and real estate. These groups don’t have much in common besides their economic sensitivity. Financials are trading better but have so-so fundamentals; industrials have strong long-term catalysts but haven’t been on sale; and real estate has been shaky but will benefit greatly from rate cuts.

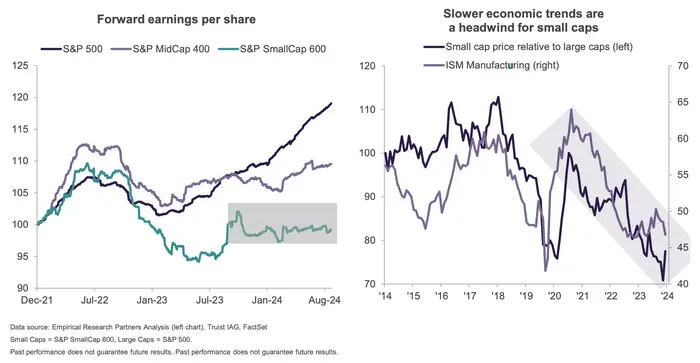

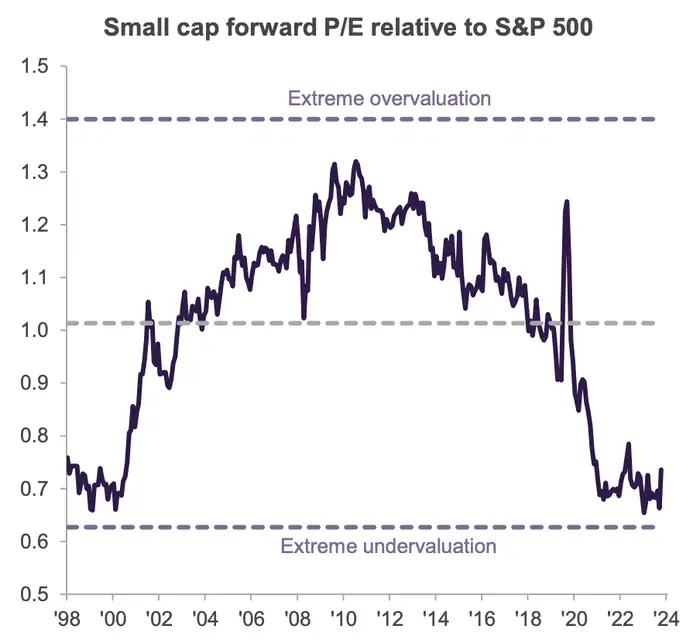

The same is true for small caps, which may add to their gains with the Federal Reserve set to slash rates, Lerner said. He said in his note that the group still trades at a significant discount to the broader market, though a lackluster earnings outlook and slowing momentum in the economy are challenges for the cyclical group — making larger stocks a safer long-term bet.