Stagflation can be worse than recession. Investors are already bracing for it.

Fears of stagflation, a scenario thought to be even worse than a recession, are picking up steam.

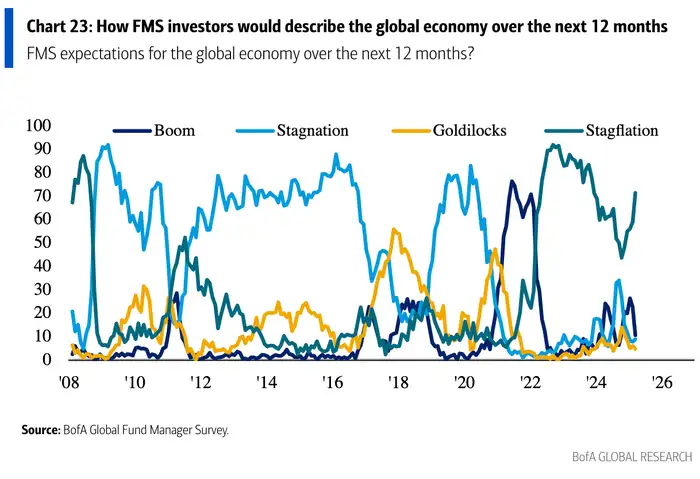

Fears of stagflation are gaining traction on Wall Street, with more investors anticipating an economic situation that entails high inflation and low growth over the next year.

Stagflation is thought to be even harder for policymakers to deal with than a typical recession. While the Fed can normally cut interest rates to boost the economy, a stagflationary economy would leave its hands tied, as higher prices would prevent policymakers from lowering borrowing costs to stimulate growth.

That situation, which ushered in a major slowdown and high unemployment during the 1970s, is rising into view once more, with more investors eyeing the possibility of such an outcome.

According to a March Bank of America survey, 71% of fund managers said they expected to see stagflation in the global economy in the next year. The survey also found that they reduced their holdings of US stocks by a record amount the week of March 7 to March 13.

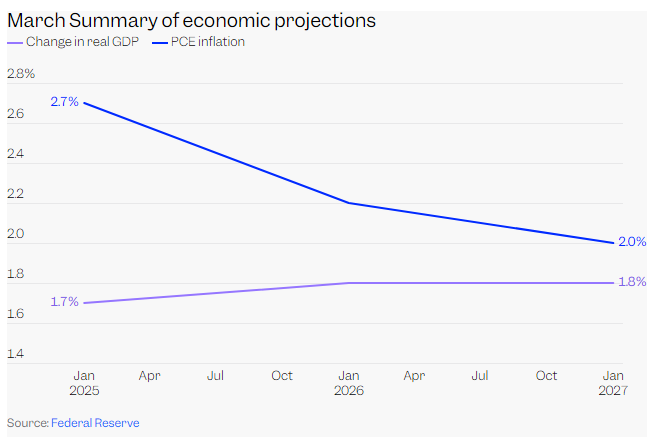

Fears among investors picked up on Wednesday after the Fed’s latest policy meeting, when the central bank lifted its inflation forecast and lowered its growth forecast for 2025.

Policymakers now expect PCE inflation to be around 2.7% this year, up from December’s 2.5% projection.

Real GDP, meanwhile, is expected to grow 1.7% this year, down from the previous forecast of 2.1%.

Even before the Fed meeting, stagflation chatter was growing on Wall Street.

UBS Global Wealth Management said it now saw a 20% risk that the US economy would see a period of stagflation, up from the prior forecast of 15%. That’s partly due to pressures stemming from Trump’s trade policy, Solita Mercelli, an investment chief at the firm, said in a note on Monday.

“We expect aggressive trade policy to weigh on US economic growth, but not so much as to drive the US toward a recession or to prevent a recovery for equity markets,” Marcelli, wrote. “That said, last week we changed our scenarios to reflect that the risks around our central scenario are now skewed to the downside.”

Stifel also reiterated its forecast that the US economy could see a bout of “mini-stagflation” in the second half of 2025. That could spark another sell-off in the stock market, Barry Bannister, the managing director of the firm, wrote in a note on Thursday.

“We see US economic growth fading again more sharply into year-end 2025, as well as fewer Fed rate cuts than implied by futures. This is due to slowing economic growth combined with sticky inflation in 2H 2025E, a mild form of stagflation that is historically adverse for the broad equity market,” Bannister said.