Stock market today: S&P 500, Dow end at record as investors shake off tariff fears, digest Fed minutes

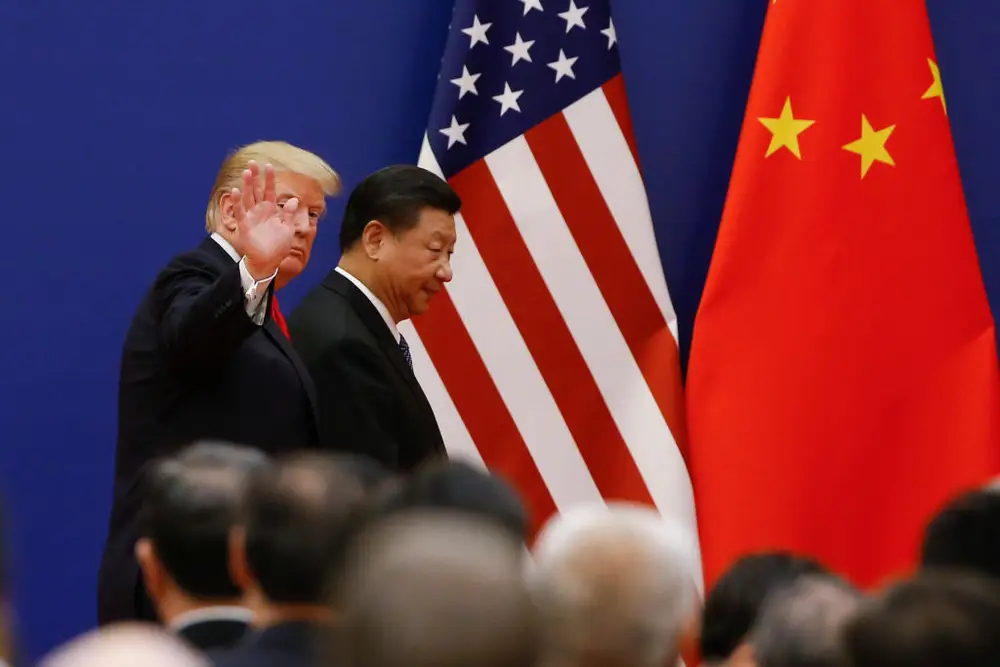

Donald Trump and Xi Jinping at a 2017 event in Beijing

US stocks rose to records on Tuesday, as indexes recovered from Donald Trump’s market-moving tariff plans announced Monday evening and as traders digested the minutes of the Federal Reserve’s last meeting.

Investors were surprised on Monday evening by the President-elect’s social media announcement that imports from China will face an extra 10% tariff, while products from Mexico and Canada should expect a 25% duty.

Trump argued on Monday that these will stay in effect until drug and migrant flows are addressed by each country. Stocks sold off after hours before recovering early Tuesday.

The S&P 500 and Nasdaq rose 0.47% and 0.33%, respectively, while the Dow Jones increased by nearly 100 points.

The 10-year Treasury yield rose three basis points to 4.298%. The US dollar jumped against the Canadian dollar and Mexican peso. Meanwhile, international stocks slid on fears of a widening trade war, with European, Japanese, and South Korean indexes falling after Trump’s posts.

Mexican President Claudia Sheinbaum Pardo hinted that US tariffs would be met with retaliation, while Canada’s Prime Minister Justin Trudeau called for cooperation.

Meanwhile, US-oriented investors parsed through the latest minutes from the Fed’s last policy meeting. Central bank officials shared consensus for “gradually” cutting rates moving forward.

“Many participants highlighted that uncertainties concerning the equilibrium fed funds rate, or the final destination, have complicated the assessment of how restrictive monetary policy should be,” wrote Ryan Sweet, chief US economist at Oxford Economics.

The market is awaiting several more data points this week.

Initial jobless claims, a third-quarter GDP revision, and personal consumption expenditures data is also scheduled for release Wednesday morning.

Here’s where US indexes stood at the 4:00 p.m. closing bell on Tuesday:

- S&P 500: 6,021.63, up 0.57%

- Dow Jones Industrial Average: 44,860.31, up 0.28% (+123.74 points)

- Nasdaq composite: 19,174.30, up 0.63%

Here’s what else happened today:

- The Fed won’t cut rates at all in 2025, Deutsche Bank says.

- The area of the stock market investors should avoid next year, according to Wells Fargo.

- How Trump’s latest tariff plans are roiling global markets.

- The rise of passive investing in the stock market could lead to more volatile trades during risk-off periods.

In commodities, bonds, and crypto:

- Oil markets fell. West Texas Intermediate crude oil slid 0.55% to $68.57 a barrel. Brent crude, the international benchmark, slumped 0.56% to $72.61 a barrel.

- Gold rose by 0.41% to $2,629.3 an ounce.

- The 10-year Treasury yield rose 3 basis points to 4.298%.

- Bitcoin dropped 4.03% to $91,075.72.