Stocks are being whipsawed by tariffs for a 5th straight day. These 4 parts of the market are getting hit hardest.

NYSE Traders working during the opening bell.

US stocks were pummeled by trade-war volatility for a fifth day in a row on Wednesday after President Trump’s tariffs officially took effect at midnight.

Since Trump announced the tariffs last week, the S&P 500 has plunged about 13% and is on the verge of entering a bear market, which would be the second fastest bear market in history after the COVID-19 pandemic.

Here’s where indexes stood shortly after the 9:30 a.m. opening bell on Monday:

- S&P 500: 4,963.41, down 0.39%.

- Dow Jones Industrial Average: 37,286.40, down 0.95% (359 points).

- Nasdaq composite: 15,307.40, up 0.26%.

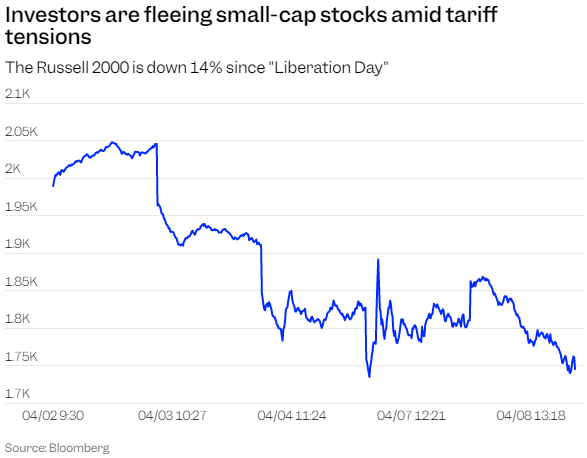

As to what’s getting hit the hardest on Wednesday, some of the biggest losers included oil, small-cap stocks, and international stocks.

- WTI crude oil: down 4.4%

- Russell 2000: down 1.3%

- Nikkei 225: down 1.95%

- Euro Stoxx 50: down 2.98%

Investors’ worries on Wednesday were twofold: that the trade war was showing no signs of de-escalating and that the bond market was showing signs of intense stress.

After Trump imposed a 104% tariff on China, that country retaliated with an 84% tariff on US goods, signaling no sign of de-escalation in the ongoing trade war.

The European Union also announced tariffs against about $23 billion of US goods, set to go into effect in mid-April. Those tariffs are in retaliation for Trump’s earlier tariffs on European steel and aluminum exports.

The immense uncertainty about the tariffs led Delta Air Lines and Walmart to pull their earnings guidance.

“With the level of uncertainty we’re seeing and the amount of changes happening on a daily basis in global trade, it’s very difficult to predict what policies may look like over the course of the year,” Chief Executive Officer Ed Bastian said.

Bastian warned that his company was “acting as if we’re going into a recession.”

Meanwhile, Treasury bond yields surged, with the 10-year surging to an intraday high of 4.51%. The 10-year US Treasury yield is up nearly 50 basis points since last week.

Bank of America said the surge in Treasury yields served as a “confidence test” for investors, as concerns of higher inflation from the tariffs and a potential deficit spike continue to linger.

Dario Perkins, an economist at GlobalDataTS Lombard, called the bond yield surge America’s “Liz Truss” moment, suggesting that incompetence among US policymakers was leading to a loss of confidence among investors.

“For the first time in my career, I’m hearing widespread skepticism about the competency of US policymakers. This isn’t about politics,” Perkins said. “It is about recklessness.”