Stocks stage $3 trillion reversal to soar 9% after Trump pauses trade war

New York Stock Exchange traders working during the opening bell.

He got the message.

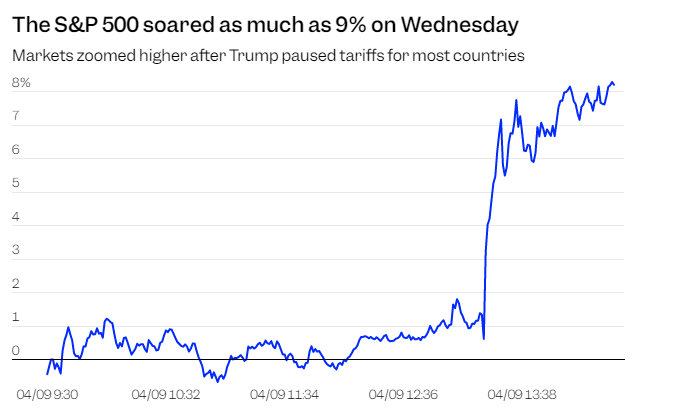

After cratering for days amid extreme volatility brought on by the trade war, US stocks soared on Wednesday afternoon after President Trump announced a 90-day tariff pause for some countries.

The S&P 500 soared as much as 9%, adding more than $3 trillion in market value. The Dow posted its largest gain in five years.

Here’s where indexes stood around 2:36 p.m. ET. on Wednesday:

S&P 500: 5,394.17, up 8.3%

Dow Jones Industrial Average: 40,300.40, up 6.9% (+2,597.76 points)

Nasdaq composite: 16,883.30, up 10.3%

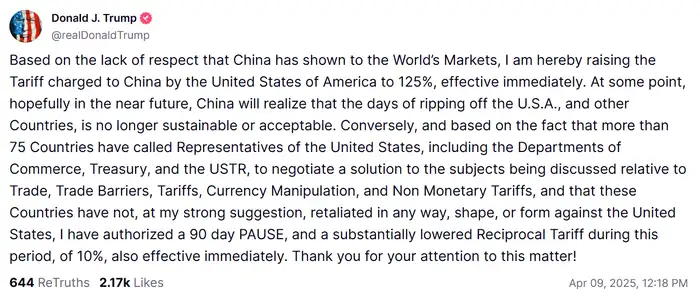

“I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately,” Trump said in a post to Truth Social.

Trump had faced mounting backlash from billionaires, companies, and investors in the week since he unveiled sweeping tariffs, all while insisting that the market crash was akin to taking medicine.

Now, the president seems to be responding to the deep fears that his trade war has drummed up, with top voices like Jamie Dimon and big backers like Bill Ackman sounding the alarm on the potential damage to the economy

“This is the pivotal moment we’ve been waiting for. The immediate market reaction has been overwhelmingly positive, as investors interpret this as a step toward much-needed clarity. The timing couldn’t be better, coinciding with the start of earnings season,” said Gina Bolvin, President of Bolvin Wealth Management Group.

“This pause may provide companies with a clearer backdrop for their guidance, offering some relief to a market hungry for direction.”

However, the trade war isn’t paused for everyone. Trump said he was raising the tariff rate on China to 125% from 104% due to a “lack of respect.”

According to Mark Hamrick, senior economic analyst at Bankrate, the focus has shifted to trade deals.

“Something akin to a worst-case scenario has been delayed, if not averted,” Hamrick said in an e-mail to B-17. “Now, the focus turns to what happens with scores of countries including China.”

The big takeaway, according to Hamrick, is that fears of an imminent recession and spike in inflation can be “dialed down a bit.”

Investors are buying first and asking questions later. These were the biggest movers within the S&P 500.

- United Airlines: +25.4%

- Microchip Technology: +25.3%

- Delta Air Lines: +24.5%

- ON Semiconductor: +20.7%

- Advanced Micro Devices: +20.7%

- Monolithic Power Systems: +20.5%

- Albermale: +20.3%

- Tesla: +18.3%

The enormous reversal follows what had looked to be another day of withering volatility in the stock market as investors navigated trade war uncertainty.

Investors’ worries on Wednesday were twofold: that the trade war was showing no signs of de-escalating and the bond market was showing signs of intense stress.

China and The European Union each announced retaliatory tariffs, ratcheting up tensions with the US.

Meanwhile, Treasury bond yields surged, with the 10-year reaching an intraday high of 4.51%. The 10-year US Treasury yield is up nearly 50 basis points since last week.

Bank of America said the surge in Treasury yields served as a “confidence test” for investors, as concerns about higher inflation and a potential deficit spike linger.