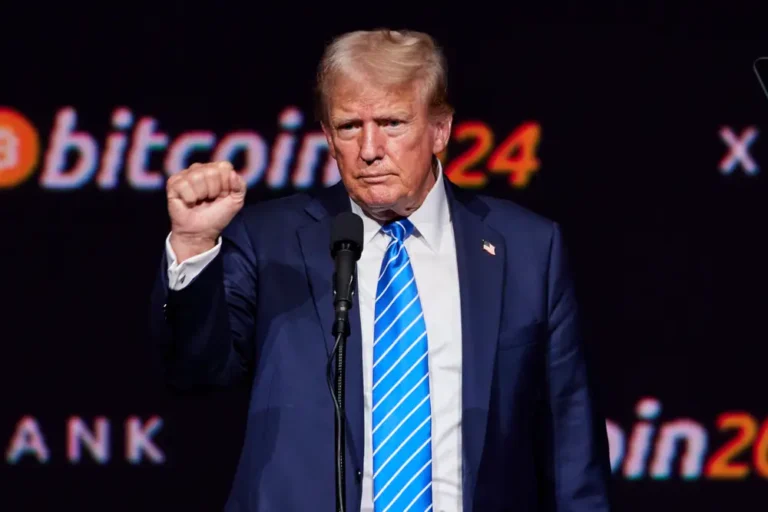

The big economic pitfalls facing Trump 2.0The president-elect is inheriting a worse economy than the last time he took office.

There is conventional wisdom developing in Washington and on Wall Street that President-elect Donald Trump has been handed a gift when it comes to the US economy. I get it. By most traditional metrics, the economy looks like it’s in good shape: Unemployment is low, GDP growth is strong, and labor productivity has been robust. Any president would want to ride into the White House on the coattails of this kind of expansion, the thinking goes. However, I think the reality is somewhat more complicated in ways that are not so traditional.

For Trump, this economy looks like a mirror image of the one he inherited in 2017. At the start of his first term, there was plenty of room to grow, and the cyclical momentum was turning up. Trump 1.0 came into office at a time of low inflation, some slack in the jobs market, and, importantly, a synchronized upturn in global manufacturing activity: Well over half of the global manufacturing purchasing managers’ index — a private measure of factory activity — stood in expansion territory in early 2017.

This time around, the US economy is operating at a reasonably strong level, but its momentum is slowing. The labor market is cooling, over half of the world’s manufacturing industries are in contraction, and the American consumer is losing steam rather than picking up speed. These challenges are coupled with the limited ability of the Trump team to address the underlying problems: Thanks to the large stimulus and buildup of federal debt during the pandemic, there’s not as much fiscal room to respond to a downturn as there once was. Those factors leave the new administration in a tougher position than it may initially appear.

The soon-to-be Trump economy is facing down a trio of weak spots that could start to rear their heads pretty soon after Inauguration Day.

The first is the stumbles of the global manufacturing sector. Manufacturing tends to be highly tradeable, so what happens abroad has more of a bearing on our own industrial base. In Germany, long thought of as an industrial powerhouse, factory production is lower than it was in 2018. There has been some enthusiasm for China-led growth, but the rise in China’s trade surplus implies that China’s recovery is not really doing much for the rest of the world. It appears to have traded overinvestment in its property sector for overinvestment in its industrial sector. In the US, there has been a remarkable boom in nonresidential manufacturing structures, partly due to the nation’s semiconductor base getting built out, but beyond that, there has been little to show for it. Actual manufacturing production has been moving broadly sideways. Growth in semiconductors and batteries, thanks to massive new government incentives, has been offset by weakness in areas like aircraft manufacturing and those related to housing, to the point where total factory production has been flat for the past two to three years.

In other words, the engine of the US economy — Americans’ willingness to go out and spend — is running out of fuel.

The labor markets are another obvious source of anxiety. Yes, the unemployment rate sits at just 4.1%, only a bit higher than its multidecade low. A variety of measures, however, suggest that the low headline unemployment rate overstates the degree of strength in the jobs market.

- The rate of people in the private sector who are quitting their jobs recently sunk to a low last seen in April 2015, while the private-sector rate of hiring has declined to 2014 levels. In both cases, the unemployment rate was quite a bit higher, suggesting that the unemployment rate likely overstates the degree of health in the labor market.

- The decline in the quits rate predictably coincides with a decline in the rate of compensation growth — if more people are worried about leaving their jobs, they’re less likely to push hard for a raise. Given that the movement of the quits rate tends to be a precursor for compensation, we can expect ongoing cooling in wage and salary growth.

- The rate at which people are able to find a new job has plunged, which is one reason the median duration of unemployment — or the amount of time that a newly unemployed person spends out of a job — keeps climbing

- The rate of private payroll employment growth has ebbed too. Payroll growth was relatively stable the first time Trump was swept into office. By contrast, payroll growth has recently slowed from its once-strong pace. Over the past six months, private payroll employment has advanced roughly 143,000 a month on average.

The slowdown in labor markets is important. Trump may well be inheriting a consumer with strong balance sheets, but their income isn’t going to increase by much, and by extension, they will buy fewer things. In other words, the engine of the US economy — Americans’ willingness to go out and spend — is running out of fuel.

The final yellow flag in the US economy is real estate. Put simply, housing is a complete mess. America’s housing market simply cannot operate normally with mortgage rates this high. Mortgage purchase demand has been flat since September 2023. Meanwhile, lending standards on residential mortgages have generally been tightening in recent years. By contrast, the last time Trump assumed office, mortgage lending standards were improving. Absent a bigger decline in mortgage rates, I would expect residential investment to remain sluggish over the coming year.

Given the economy’s wobbles, the Trump team will likely want to hit the ground running with an agenda to boost growth. Historically, a new administration starts off by doing something tangible. President George W. Bush passed the Economic Growth and Tax Relief Reconciliation Act of 2001, President Barack Obama had the American Recovery and Reinvestment Act of 2009, Trump had his Tax Cuts and Jobs Act, and President Joe Biden had the American Rescue Plan, Infrastructure Investment and Jobs Act, and CHIPS Acts. Trump 2.0 will have no such opportunity.

The huge fiscal packages passed during the pandemic and the subsequent need to jack up interest rates to deal with inflation mean the options for the new administration are somewhat limited in scope. Politically, there is less will to increase the deficit with a swath of new measures, and economically, higher interest rates make it not only more costly to enact new pieces of legislation into law but also raise the risk of causing another upturn in consumer prices. Nominal interest rates are higher than they were at the time of Bush’s 2003 tax cut. Of course, at that time, potential growth was not thought to be as low as it is now. And with a thin GOP majority in the House of Representatives, it’s not immediately obvious that a package of tax and spending can easily make it through Congress.

So what options does the Trump team have? I can think of two.

First, it ought to recognize that the age of abundance no longer exists. You can’t do everything. There is no world where we can add millions of new homes over the next few years and reorient the US manufacturing sector. You must pick and choose which priorities are the most important. For the time being, this probably means trying to phase out or cancel planned spending from the Biden spending bills. While this would be difficult to do given the tight Congress, there are things Trump could do unilaterally. One target could be the roughly $200 billion designated for the Energy Department’s Loan Programs Office. Under Biden, the office has announced or completed nearly $30 billion in loans or loan guarantees to 23 commercial projects, per Politico, supporting efforts including the domestic supply chain for electric-vehicle batteries, clean hydrogen, and replacing fossil fuels in steelmaking. The Trump administration could shut off the spigot.

While canceling some of the projects would take some wind out of America’s manufacturing sails, taking steps to consolidate the budget would likely bring some relief to the bond market. After all, a dramatic increase in government outlays in recent years is thought to have contributed, at least in part, to the run-up in consumer prices we’ve seen. Politically, I think the trade-off makes sense for Team Trump. After all, Democrats targeted this spending to battleground states like Georgia and Arizona. The results were clear: Economic development was not sufficient to deliver the states to Vice President Kamala Harris. People would likely prefer lower rates instead — the benefits are more widespread. Interest rates are a blunt tool, having a broad impact on the economy and financial markets. And with affordability being a critical issue for the electorate, getting rates down might be more useful than a new factory cranking out semiconductor chips.

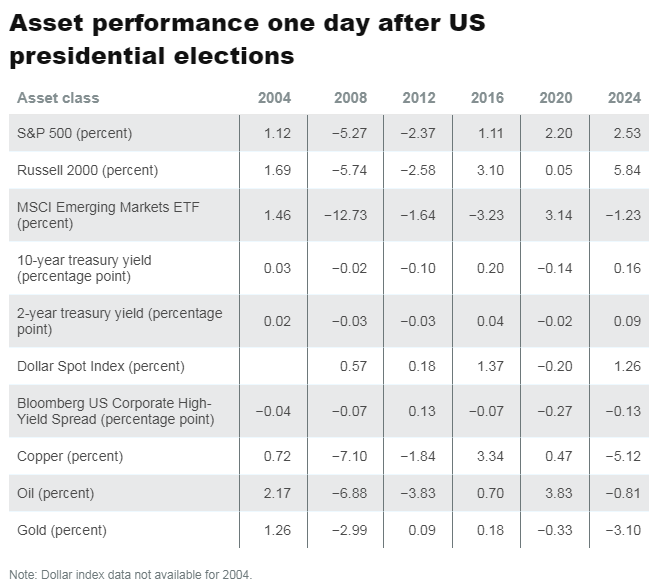

Second, I wonder whether Trump can provide a continued lift to animal spirits. Rightly or wrongly, there is confidence in the marketplace now that Trump has won. Our nearby table shows the performance of various asset classes one day after the past several presidential elections. US growth expectations have been rerated higher relative to the rest of the world — hence why US small-cap stocks jumped relative to emerging markets. What’s different about the latest market reaction relative to the last time Trump was voted into office? Oil, copper, and gold all declined the day following the 2024 election but rose the day following the 2016 one. That does not strike me as particularly inflationary. In describing the market move following the election, Federal Reserve Chair Jerome Powell said: “It appears that the moves are not principally about higher inflation expectations. They’re really about a sense of more likely to have stronger growth and perhaps less in the way of downside risks.”

Consumer and business confidence remain well below where they were when Trump was in office and have plenty of room to move up. This can work to Trump’s advantage. If Trump is able to rein in some of his more economically worrisome instincts, like broad-based tariffs, then declining inflation risk keeps the Fed at bay, while animal spirits keep the economy humming.

This is one reason the building out of Trump’s economic team is so important. The last time Trump was president, he was new to Washington, and the wider Republican majority in Congress had an agenda ready for him to sign into law. This time, the slimmer House margin means the agenda will be driven more by the White House itself. So this is why Trump’s pick for Treasury secretary had unusually high stakes to set the tone for how we should expect economic management in the coming years. Given the stock-market reaction, it’s clear that picking Scott Bessent was well received.

For investors, it seems an uphill climb to deliver on the fiscal expectations the bond market has baked in. With the economy in a still challenging spot, there’s probably opportunity in the fixed-income market: Treasury bonds are undervalued. For the financial press, it is worth being honest. Things are not as cut-and-dried as “Trump is inheriting a strong economy.” Across a variety of dimensions, the picture appears quite challenging. After all, if things were so great, why did the incumbent party lose in the first place?