The head quant strategist at a $194 billion firm shares 4 trades he sees delivering at least 6% returns over each of the next 5 years as a recession gets ready to hit the US economy next year

- Robeco strategists see a mild recession coming next year.

- But they still see opportunities for returns in different pockets of global markets.

- These include global high yield bonds, developed market and emerging market stocks, and real estate.

The top quantitative strategist at Robeco, a $194 billion asset manager, believes the US economy will enter a recession next year.

The Federal Reserve has raised interest rates to combat inflation and to protect the economy from a downturn caused by the demand slowdown it seeks to induce. However, the central bank will struggle to strike this balance, according to Laurens Swinkels in a September 11 note co-authored with Peter van der Welle, Robeco’s sustainable multi-asset solutions strategist.

According to Swinkels, the Fed could send the economy into a downturn in 2024.

“Goldilocks sparkles, but turbulence looms.” “It will be difficult for central banks to take the sting out of (core) inflation without causing a rise in unemployment, which would provide the necessary cooling of an overheated services sector,” Swinkels said.

“Monetary policy operates with long, but variable, lags,” he continued. Finally, the recession signal that the US yield curve has been flashing since spring 2022 is unlikely to prove false.”

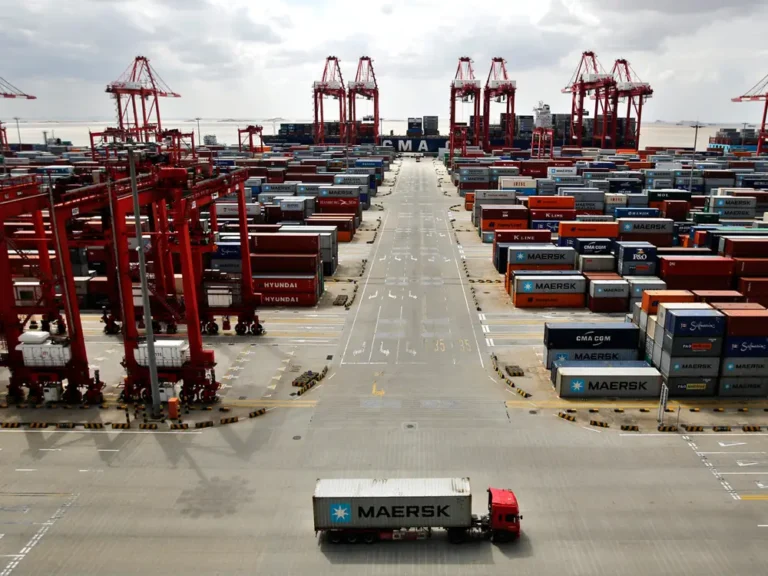

Swinkels anticipates a mild recession and a subsequent period of economic recovery. However, he predicted that the economy and thus investment returns would be more volatile as higher interest rates, artificial intelligence, and de-globalization represent a shift in the norm compared to previous decades.

We’ve compiled a list of the four areas Swinkels believes will provide the best returns over the next half-decade. These are his worst-case scenarios.

4 investments with a 5-year return of 6% or higher

Swinkels shared a number of investment ideas, but we’ve compiled a list of the four he believes will provide the best returns.

The first is to invest in global corporate high yield bonds (hedged), which he believes will provide annual returns of 6.25% on average until 2028.

“Over time, the quality of bonds in the investment grade index has gradually declined, particularly in the euro-denominated market.” The credit quality of the high yield index, on the other hand, has improved,” Swinkels said.

Even if a recession occurs, causing some companies to default, returns on high-yield bonds would still be attractive when compared to government bonds, he said.

His expected return includes the assumption that it is euro-hedged, which means that an investor who purchases a bond directly enters a currency forward contract to mitigate risk in more volatile markets. The iShares Global High Yield Corp Bond UCITS ETF (GHYG) is one way to gain broad exposure to global high-yield bonds.

Swinkels also favors developed market equities, which include stocks from France, Germany, the United Kingdom, Australia, Japan, and other countries. He anticipates 6.75% annual returns over the next half-decade.

“Most developed equity markets are currently neutrally or cheaply valued, but the United States is an outlier because it is expensive, albeit less so than it was two years ago.” Because the United States accounts for more than two-thirds of the developed world’s market capitalization, developed equity markets remain overpriced.”

The iShares MSCI EAFE ETF (EFA) invests in developed market stocks outside of the United States and Canada.

Third, Swinkels is optimistic about emerging market equities, or stocks in China, Brazil, India, and Saudi Arabia. His base-case forecast is for emerging market stocks to return 8.25% per year until 2028.

One way to invest in emerging market stocks is through exchange-traded funds such as the Schwab Emerging Markets Equity ETF (SCHE) or the Vanguard FTSE Emerging Markets ETF (VWO).

Finally, Swinkels predicts that listed real estate will generate 6.5% annual returns until 2028. He claims that real estate is inexpensive in comparison to both itself and stocks.

“The global real estate CAPE ratio is currently 13.3, well below its average of 19.4 since 2000,” Swinkels said. “The CAPE of global equities is more than twice as high at 27.0, making real estate look relatively cheap according to this measure.”

According to Swinkels, another method of measuring real-estate valuations is price-to-funds-from-operation (or net income generated by the properties).

Real-estate investment trusts, or REITs, are one way to invest in real estate without directly purchasing properties. American Tower (AMT), Simon Property Group (SPG), and AvalonBay Communities (AVB) are some examples of REITs.