The influencer middle class is feeling the pain

Sabrina Carpenter recently collaborated with coffee company Blank Street.

A few years ago, influencer marketers were ditching their plans to hire celebrity content creators for brand deals in exchange for influencers with smaller audiences. Goodbye, Kim Kardashian. Hello, small-town beauty influencer.

Smaller creators, often categorized as “micro” influencers, typically have fewer than 100,000 fans. Marketers believed that cohort could reach a more intimate audience than celebrities and appear more authentic in their messaging, driving up engagement rates. They were also cheaper to hire, costing a few hundred dollars for a sponsored post instead of the thousands that an influencer with millions of followers might charge. Nano influencers, or creators with as few as 5,000 fans, could charge as little as $5 for a promotional post.

But the race among marketers to work with less famous (and cheaper) creators may be on its way out.

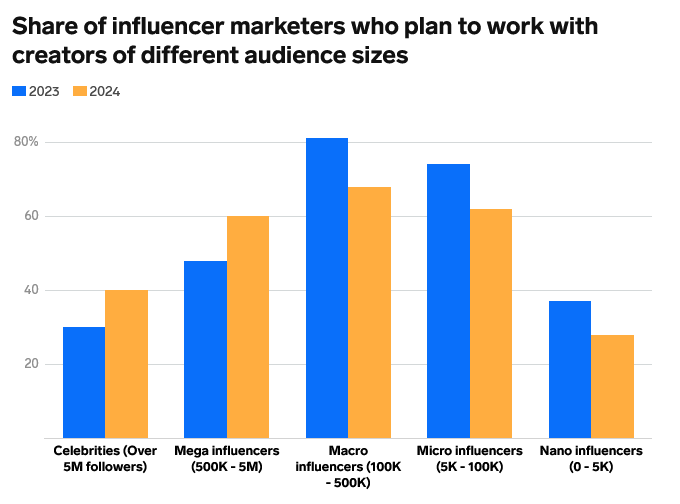

In a recent survey of 200 US enterprise marketers by the influencer firm Linqia, the agency found that between 2023 and 2024, the share of marketers who planned to work with celebrity and mega influencers grew, while interest in working with creators with fewer than 500,000 followers dropped. The survey ran between July and September.

The share of survey respondents who said they wanted to work with a celebrity grew from 30% to 40% between 2023 and 2024. For mega influencers, the share rose from 48% to 60% over the same period. But a smaller share of marketers said they planned to work with macro, micro, and nano influencers year-over-year. Micro influencers as a category of work dropped from 74% to 62% between 2023 and 2024, while nano influencer work fell from 37% to 28%.

One micro influencer, Bethany Everett-Ratcliffe, said she’d felt this impact on her business. Everett-Ratcliffe told B-17 she has been “getting less paid partnerships” than in years prior, and has also noticed that more brands are “going through agencies,” rather than reaching out directly.

Other influencer-marketing firms separately told B-17 that they’d seen a shift away from less popular creators and toward bigger stars this year.

So, why are micro and nano influencers losing their sparkle among marketers?

A few reasons, industry insiders told B-17:

- Micro influencers are becoming more expensive.

- They’re not driving engagement as much on social apps like TikTok that are flooded with content.

- And working with them can be resource intensive, particularly as brands aim to vet talent more heavily before launching campaigns.

“Some brands are requiring more vetting and approvals over creators and content so they don’t want to have too many on a given program, and are instead focusing on fewer and bigger creator partnerships,” Keith Bendes, VP of strategy at Linqia, told B-17.

While interest in larger creators is growing at the expense of smaller ones, macro and micro influencers still lead overall, with macro influencers being the most popular category for hire in 2024.

Go big or go home

One of the main reasons less famous creators are losing work is that they’re starting to charge more, making it harder for marketers to see a return on investment. Four creators with 25,000 followers can cost more than one creator with 100,000 fans, Bendes said.

“Micro influencer rates have been rising and it’s no longer a simple calculation,” Bendes told B-17.

Other marketers have reported up to 20% cost increases among micro influencers between 2023 and 2024.

Over-saturation on social apps is also a big factor. It’s harder than ever to get noticed on apps like TikTok and Instagram. Hiring creators with larger, established audiences can help a brand break through the noise, especially as organic reach on platforms continues to be unpredictable, Bendes said.

When Linqia respondents were asked about how they measured the success of a campaign, “reach” (tallied in views) was the top response, followed by engagement rate and conversions.

Instead of taking a gamble on a micro influencer, brands are focusing on “fewer and bigger” creator partnerships, as well as more vetting of which creators they work with, Bendes added.

“Macro and mega influencers are some of the big-swing bets that brands have been more willing to take, to invest in, and they’re paying off in big ways,” James Nord, founder and CEO at the influencer-marketing firm Fohr, told B-17.

Meanwhile, celebrity endorsement campaigns have also been on brands’ priority lists this year — from Sabrina Carpenter’s partnership with Blank Street and Michael Cera’s CeraVe Super Bowl campaign.

“These celebrity partnerships were successful because they felt natural, were clever, and also aligned with the celebrities’ brands, making them feel authentic versus simply a commercial move,” said Olivia McNaughten, a senior director at the influencer-marketing platform Grin.

Still, the trend wasn’t universally observed. Jonathan Chanti, chief growth office and talent president at Viral Nation, said: “We’ve seen a recent trend where brands have begun to shift their budgets away from mega influencers — those boasting over 5 million followers —toward mid-tier creators, who typically have up to 500,000 followers.

Plenty of opportunities remain for less-famous talent, even if some sponsored content deals are fading. User-generated content (UGC), affiliate links, and other performance-based marketing tactics continue to benefit creators with smaller audiences due to lower barriers to entry.

UGC, a format in which a creator makes content a brand can use on its channels (instead of the influencer’s own), is the third-most-popular way that brands and marketers choose to work with creators, according to Linqia’s survey.

The pool of money for sponsored content deals is still growing and is expected to hit around $8 billion in the US this year, according to eMarketer.

And within a year, micro influencers could very well be surging again among brands. The influencer marketing industry ultimately ebbs and flows at the whims of tech platforms’ algorithms.