The investors behind OpenAI’s historic $6.6 billion funding round

Sam Altman has taken his share of bumps and bruises over the last year, but he proved yet again that he can convince investors to pour hundreds of millions into OpenAI.

The latest funding round appeared to be the hottest ticket in Silicon Valley, drawing a who’s who of investors looking to get in on the buzzy AI startup’s latest capital raise.

The $6.6 billion round gave OpenAI a $157 billion post-money valuation and minted it into one of the most valuable startups in the world. The startup’s valuation is now in the same neighborhood of publicly traded companies like Uber or AT&T.

In a statement posted to its website, OpenAI said the funding will “accelerate progress on our mission” and that it was “grateful to our investors for their trust in us.”

The investors’ participation — which reportedly carried the stipulation that they shouldn’t invest in rival AI companies — comes as OpenAI is discussing how to transform from a nonprofit organization into a more traditional for-profit company and several high-profile executives have left to join rivals or start their own venture.

Here’s who broke out their checkbooks.

Thrive Capital

Anderson Cooper, Sam Altman, and Thrive Capital founder Josh Kushner at the Allen & Company Sun Valley Conference on July 11, 2024.

Thrive Capital led the funding round, a spokesperson confirmed to B-17. The VC firm, founded by Josh Kushner, has made early investments in several now-prominent companies such as Slack and Instagram and previously invested in OpenAI.

The venture firm invested about $1.25 billion, according to a report from The Wall Street Journal. Thrive also has the option to invest another $1 billion in OpenAI next year at its current valuation if a revenue goal is reached, Reuters reported last month.

Besides being an investor in OpenAI, Kushner is close with Altman, The Information reported last month. “i have been fortunate to work with many great investors; there is no one i’d recommend more highly than josh,” Altman wrote in a post on X, formerly known as Twitter, in August.

SoftBank

The highly anticipated funding round also attracted newcomers like SoftBank. A source close to the Japanese media-technology conglomerate told B-17 that it had invested $500 million.

The deal gives the Tokyo-headquartered firm, led by enigmatic founder Masayoshi Son, its first major stake in a company developing the large language models (LLMs) that have powered buzzy apps like ChatGPT in the generative AI boom.

While SoftBank led several investments into AI-linked Silicon Valley firms before the generative AI boom through its $100 billion Saudi-backed Vision Fund, it has been slow to invest in a post-ChatGPT world as it has sought to repair its reputation following its disastrous WeWork bet.

However, Son has signaled in recent months that he would be ready to make an investment splash again to capture the opportunities in the generative AI frenzy.

At the company’s annual meeting in June, the SoftBank founder told shareholders that past investments were just a “warm-up” for AI and advancing the technology is “what I was born to do.”

ARK Venture Fund

Cathie Wood of ARK Invest.

Cathie Wood’s ARK Venture Fund agreed to invest at least $250 million into this funding round, which is its second investment to the company, B-17 first reported. Ark has also invested in several other big-name startups like Anthropic, xAI, SpaceX, FigureAI, and Databricks.

Wood compared the state of artificial intelligence with that of the internet in the early 1990s in an April interview with Morningstar.

“We had just begun, and we had miles to go,” Wood said. “In fact, we’re still learning how powerful the internet is. That is where we are with artificial intelligence today.”

ARK did not immediately respond to a request for comment from B-17.

Microsoft

Microsoft invested a little under $1 billion into OpenAI’s latest funding round, according to The Wall Street Journal report. The tech giant has a partnership with OpenAI and has already invested a reported $13 billion into the company. Rival Apple reportedly mulled its own investment in OpenAI, though nothing came of the talks.

Microsoft has also added OpenAI’s technology to Bing, its search engine, and its Copilot AI tools, as well as some of its other products.

Microsoft did not immediately respond to a request for comment from B-17.

Nvidia

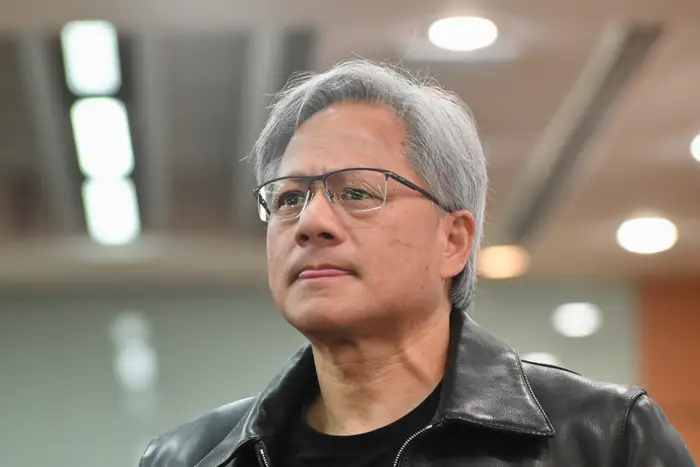

Nvidia CEO Jensen Huang.

Nvidia is no stranger to the AI spotlight, with its chips the best-in-class option for companies like OpenAI that are building frontier AI models.

Nvidia invested about $100 million in OpenAI’s funding round, according to the Journal’s report.

Nvidia declined to comment, referring B-17 to OpenAI.

Tiger Global

Tiger Global Management also invested in OpenAI’s latest funding round, B-17 reported. The amount of the contribution couldn’t be learned.

The company aggressively invested in tech in recent years, making 335 investments in 2021, according to Crunchbase. The firm has since pulled back on its number of investments per year as the market soured, but it purchased $125 million in OpenAI shares in 2021.

Fidelity

Fidelity also participated in OpenAI’s latest funding round. The asset manager recently participated in a funding round for Elon Musk’s xAI.

Fidelity often invests in late-stage startups that could go public in IPOs a few years later. The strategy can help big mutual fund firms get in ahead of potentially hot IPOs at a lower price.

Altimeter Capital Management

Altimeter Capital Management also contributed to OpenAI’s latest funding round, according to reports. Altimeter did not immediately respond to a request for comment from B-17.

Brad Gerstner, CEO and founder of the investment firm, said at an AI conference on Wednesday after the founding round announcement that OpenAI’s next move should be an IPO.

“Having the opportunity for every retail investor in America to share in the upside that gets created by AI at a time we’re going to have massive social disruption, jobs lost, and other things, I think it’s critically important,” Gerstner said, according to GeekWire.

Khosla Ventures

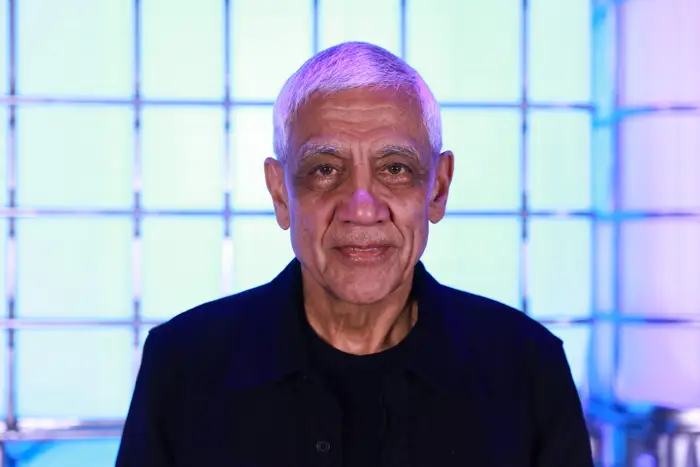

Vinod Khosla recently published an essay with over 10,000 words about the future of AI.

Khosla Ventures also participated in the funding round.

Vinod Khosla, who cofounded Sun Microsystems, recently wrote in a lengthy post on his VC firm website that AI would reduce costs and take over most of the work humans do — and do it better, for the most part. He also predicted there would be one billion robots in the next 25 years.

Khosla previously invested in OpenAI.

MGX

MGX, an investment firm backed by the United Arab Emirates, also participated in OpenAI’s latest round.

The firm was set up earlier this year to invest in artificial intelligence and semiconductors, Bloomberg reported in March. At the time, MGX was reportedly aiming to have $100 billion under management in the coming years.