The manager of the top-performing small-cap fund this year outlined his 4 criteria for finding strong investments — and revealed his 3 favorite hidden gem stock picks right now

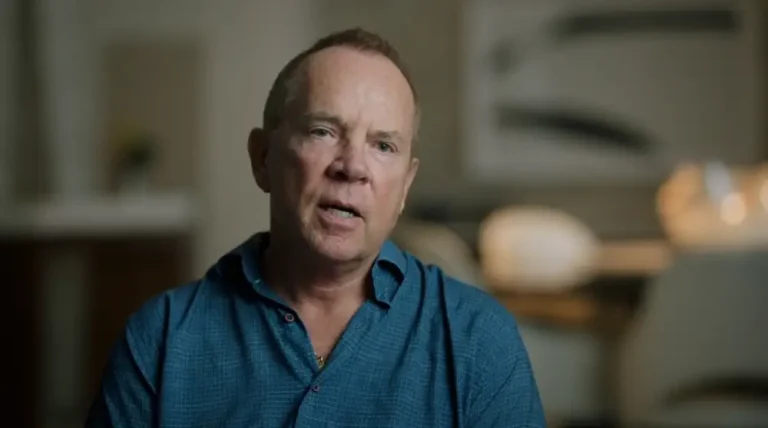

- John Barr has led the Needham Aggressive Growth Fund to another strong year.

- The small-cap investor shared his four criteria for finding great stocks.

- He also highlighted one of his best-performing investments, and three more he has high hopes for.

With a name like the Needham Aggressive Growth Fund, you’d be forgiven for thinking that portfolio manager John Barr seeks growth at all costs.

Despite the name, Barr’s fund has outperformed all of its competitors this year by employing a strategy that sounds suspiciously like value investing rather than growth investing.

“One of my favorite hobbies is going to the Berkshire Hathaway annual meeting,” Barr told the crowd. “And I’ve read everything written by or about Charlie Munger and Warren Buffett.” So, yes, it’s growth investing with a value twist.”

According to Morningstar, the Needham Aggressive Growth Fund has returned more than 25% year to date, making it the best-performing small-cap fund on the market. And it’s no fluke: the fund has consistently ranked in the top quartile of small-cap growth funds over the last three, five, ten, and fifteen years.

Barr, a former software salesman turned investing pro, told Business Insider what he looks for in investments, market themes he’s following, and his current stock picks.

An unusual way to invest in growth

Picks and shovels may not appear to be an exciting investment, especially in this age of technological advancements like artificial intelligence. Barr, on the other hand, believes that new technology will become more integrated with other industries in the coming years and has positioned his fund to benefit from this trend.

“From an industry perspective, I’ve been focused on the picks and shovels of the infrastructure economy for a long time,” he said. “And yes, we do have a concrete maker in the portfolio and there’s traditional infrastructure, but there’s also technology infrastructure, and that means data centers, it means semiconductor manufacturing, it means life sciences, labs and manufacturing, cybersecurity and other associated areas.”

Barr avoids investing in consumer-facing companies because he is concerned that changes in tastes and preferences will cause these stocks to fail. He stated instead that he is looking for “companies that sell to engineers, manufacturing, and research and development.”

Barr searches for investment opportunities from the ground up, focusing on four key criteria, some of which are familiar to most investors.

Barr, for example, is interested in determining whether a stock has a large addressable market, ideally five to ten times its current size. He also looks for companies with strong management.

“Every investor says they invest in great managers,” he went on to say. “And I’ve looked at it a lot and I’m still not sure what it means.” My shortcut is to look for founders, family members, or long-tenured employees. So, like us, management considers the long term.”

Barr is also looking for stocks with a margin of safety, which could be in the form of a large cash reserve, a strong balance sheet, or some other form of downside protection.

Barr’s primary investment criteria, however, set him apart from other growth-focused fund managers: identifying “hidden-to-quality compounders.”

“It’s finding companies when they’re in a stage where they have a legacy business that generates net income and cash, but they’re investing in something new,” that’s what he said. “And the ‘something new,’ we have to look out maybe a year, maybe two years, maybe it’s a little bit more than that before it’s going to have an impact on the earnings.”

He went on to add, “So it is likely beyond the models of most people that most people on Wall Street are focused on, but because there’s a legacy business that’s supporting it — it’s not a crazy multiple high-growth company that you are really making a speculative bet on — that the company is going to make it through to the other side.”

Top stock picks from a top stock picker

Barr’s emphasis on companies that invest in their own growth while also having a successful core business has led to a focus on technology and industrials, particularly the combination of the two.

Some of Barr’s most successful investments this year have capitalized on trends in these two industries, such as the explosion of artificial intelligence or the slow and steady transition to electric vehicles.

“So I think big themes are electrification across industry and the continuing trend of semiconductors to smaller and smaller line widths and lower power; and I think it’s data centers, it’s security, and that security is not just cybersecurity, but it is real security; and it’s infrastructure, and technology is going to make its way into these,” he went on to say. “I believe that is the key point. These industries are adopting technology, and when technology meets a need, an inflection point can occur in these types of businesses.”

Barr cited Super Micro Computer (SMCI) as an example of a “hidden-to-quality compounder” that has progressed from the hidden stage to the quality compounding stage.

His fund has owned the server manufacturer since 2009, shortly after its IPO, and the company has steadily risen since then. However, in 2017, companies such as Amazon and Google began to make concerted efforts to invest in data centers and semiconductor manufacturing, transforming the investment from a cyclical business to a more secular growth story, according to Barr. And, as interest in artificial intelligence has grown in recent months, so has the stock price of Super Micro Computer, a key picks and shovel provider in that space.

Barr was eager to share three additional stocks that are still in the “hidden” stage of his investment. Vishay Precision Group (VPG) manufactures specialty sensors for industrial companies.

“It was a spinout from the Vishay Group about 12 years ago,” Barr explained about the stock. “We’ve owned this for about six years and the stock has not done a whole lot in the last few years and is, I think, quite attractively valued, and they’ve been investing in new manufacturing and in new products that we think are poised to contribute, and it ties in very well with the reshoring of manufacturing theme.”

Parsons Corporation (PSN), a newer addition to Barr’s fund with a great management team, a solid core business, and growth opportunities catering to important government entities like the Missile Defense Agency and the Department of Defense, is one of his favorite stock picks this year.

“The company is divided into two parts. “One is architecture, engineering, and construction; they do infrastructure and are the leading domestic airport A&C company,” Barr explained. “The second part of their business is federal systems, and they do cybersecurity in this area, but it’s much more than that.” And I believe they are a national treasure that is vital to all of us.”

Finally, Barr mentioned nLight (LASR), a company that manufactures laser diodes and cutting systems used in industrial manufacturing. However, Barr noted that this tried-and-true business is being supplemented by a new venture: directed energy for defense purposes — or, as Barr put it, “using lasers to shoot down incoming things.”

“But what’s really exciting about them is that they’ve put in the infrastructure to be a much larger company five to 10 times, and they have a defense portion of their business, which has won directed energy awards,” he said. “And they just announced a contract a few weeks ago, coinciding with their earnings, and the stock hasn’t moved this year.” It’s basically flat; it IPO’d at 14 or 15 a few years ago and is now at 10, and they’ve made significant strategic progress.”