The market’s top stocks need to keep winning to hold back a ‘stealth correction,’ Bank of America says

With investors souring on the outlook for interest rates in 2025, it’s up to the market’s most dominant stocks to keep the party going and avoid sparking a correction, Bank of America said.

Risk appetite has become “suddenly twitchy” as investors’ uber-bullishness came face-to-face with the Federal Reserve’s toned-down view on rate cuts next year.

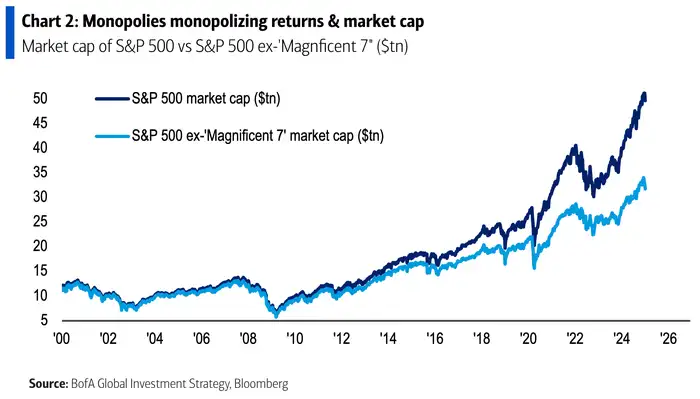

According to BofA analysts led by Michael Hartnett, US and global equity breadth appears “dire,” given that a handful of leading equities are propping up major indexes. Without the best-performing “Magnificent Seven” stocks, the S&P 500 would have only gained 8% year-to-date—not the 23% it has returned so far.

“Winners must keep winning to keep stealth correction ‘under the hood,'” Hartnett wrote on Thursday.

If the Magnificent Seven and Treasurys can hold at current levels, the analysts say that the index’s recent lows following Wednesday’s Fed meeting are a buying opportunity.

Investors should monitor banking stocks to determine whether the trading melt-up has legs through the next month. The SPDR S&P Bank ETF must hold at its 2022 high of $55 per share to avoid a “bull trap” ahead of the January 20th presidential inauguration.

In this scenario, investors are lured into the market by a short-term price jump, which can quickly reverse.

As of Friday morning, some Magnificent Seven stocks, including Nvidia and Tesla, are recouping losses. Meanwhile, the 10-year Treasury yield has reversed course after climbing to its highest level since spring.

Others on Wall Street remained convinced that this week’s sell-off will prove itself brief, offering a chance to load up on cheaper equities. Still, correction forecasts have risen among analysts. Fairlead Strategies founder Katie Stockton said this week that she is watching for a dramatic market recovery by the end of the week, or else intermediate-term “sell signals” will be triggered.