The Max-Hulu-Disney+ bundle seems to be off to a strong start

The Max-Hulu-Disney+ bundle appears to be a hit so far.

Old rivals in the media industry have formed new alliances as the streaming wars rage on — and their efforts appear to be paying off.

Earlier this summer, Warner Bros. Discovery teamed up with Disney to create an anticipated Max-Hulu-Disney+ bundle, which launched in late July for $17 per month. So far, it looks like both media giants’ streaming businesses are benefiting from the partnership.

Disney+ just reeled in its most monthly sign-ups in the US since last November, according to new data from research firm Antenna shared with B-17 on Monday afternoon. Hulu and Max each had their third-strongest month in that span, Antenna found. The services logged between 1.8 million and 2.2 million sign-ups in the US in August, per the data, which were between 158,000 and 277,000 higher than July’s figures.

Other major streaming services didn’t enjoy that same late-summer bump. In fact, Netflix’s July and August subscriber sign-up numbers in the US were its two lowest in the last 12 months, and the same was true of Paramount+ in August. Peacock still generated subscribers at an above-average rate, largely thanks to its exclusive Olympics streaming rights in the US.

This all suggests that the new, supercharged bundle drove gains for WBD and Disney’s streamers at the expense of rival services.

Disney+ accounted for 13% of sign-ups to streaming services in the US in August, which was tied for the highest rate in the last 12 months. Hulu’s 16% figure also matched its best rate since last fall, while Max pulled in 14% of US streamer sign-ups — its second-best clip in the last year.

WBD and Disney didn’t respond to requests for comment.

Don’t be fooled by spiking churn rates

The logic behind WBD and Disney’s streaming partnership is simple: By combining Max with the core of the popular Disney bundle, the two companies can attract new customers, save on marketing costs, and reduce the churn that plagues each of their businesses.

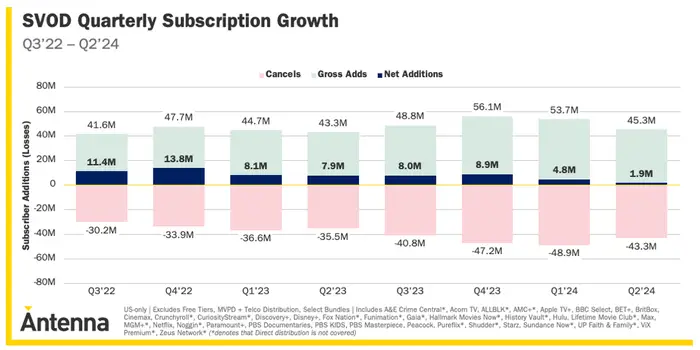

There were less than 2 million net streaming subscribers additions in the US in Q2, according to Antenna.

If the Max-Hulu-Disney+ bundle works as designed, subscribers will stick around throughout the year instead of canceling when the new season of their favorite shows ends, and churn rates should fall.

That hasn’t happened so far, though there may be a reason for that.

Disney+ had a 3.9% churn rate in August, according to Antenna, which is well below the industry’s weighted average churn rate of 5.2% but in line with where it’s been since the spring.

In August, Hulu’s cancellation rate rose to its highest level since January, and Max’s churn rate jumped to its highest mark since November. Such changes could always be seasonal patterns, though a closer look suggests that there’s another explanation.

When taken in the context of Antenna’s other data, it looks like some Hulu and Max customers are canceling their subscriptions so they can subscribe to the Max-Hulu-Disney+ bundle without paying twice. That would explain why all three services’ subscriber counts rose in August, despite what initially seems like discouraging churn data.

And although WBD and Disney would prefer that their customers pay full price for their streamers, switching to the bundle could be better in the long run. Average revenue per subscriber may take a hit, but the revenue that does come in should be more dependable.

The Max-Hulu-Disney+ bundle is one of several streaming packages that media giants have conjured up. Comcast put Peacock with fellow streamers Netflix and Apple TV+ at a cheaper rate, and Disney has long offered its own bundles of Disney+ and Hulu, and bundles with sports streamer ESPN+.

Streaming bundles aren’t going anywhere — especially if they’re as successful as WBD and Disney’s appears to be so far.