The number of bitcoin millionaires has soared 111% in the last year as the cryptocurrency rallies

As crypto rallies, the number of bitcoin millionaires has more than doubled in the last year.

According to a new report from New World Wealth and Henley & Partners, the number of bitcoin millionaires has risen to 85,400, a 111% increase in 12 months.

Meanwhile, the number of crypto millionaires in general soared to 172,300, up from just 88,200 last year, the report said.

The rapid increase in crypto millionaires comes as newly approved spot ETFs in the US have pushed bitcoin to new highs in 2024. It his an all-time high above $73,000 in March. It has since pared that gain but is still up by about 45% to around $64,000. The price of bitcoin us up 138% in the last 12 months.

New bitcoin ETFs have garnered over $50 billion in assets since hitting the market in January after a yearslong struggle to get the funds approved by the Securities and Exchange Commission.

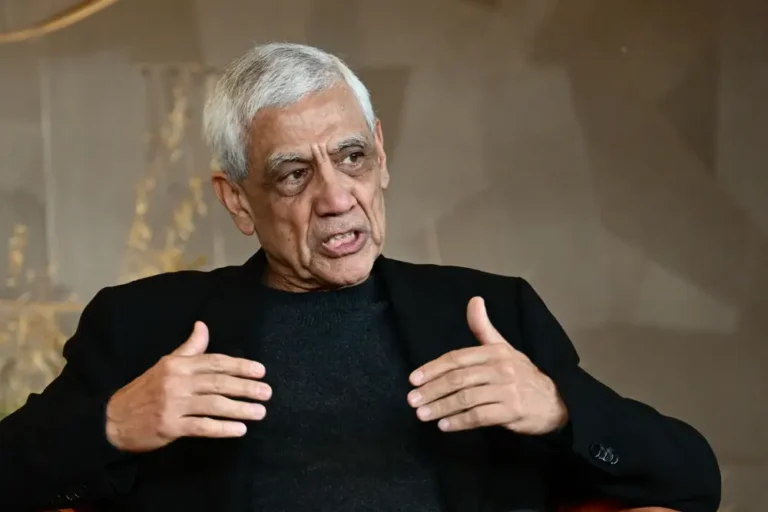

“The cryptocurrency landscape of 2024 bears little resemblance to its predecessors,” Dominic Volek, Henley & Partners’ head of private clients, said in a press release.

“Bitcoin’s rise to over USD 73,000 in March set a new all-time high, while the long-awaited approval of spot Bitcoin and Ethereum ETFs in the USA unleashed a torrent of institutional capital,” he added.

Crypto’s total market value is now at $2.3 trillion, up 89% from its $1.2 trillion valuation last year.

Volek added that as investors are now preparing for potential Solana ETFs, the series of industry milestones has set the stage for broader crypto adoption, “one where digital assets increasingly cross-pollinate with traditional finance and global mobility.”

Among those finding extraordinary success in the industry in the last year are six new crypto billionaires, making for 28 crypto billionaires worldwide. The report says most of those new crypto billionaires owe their success to bitcoin.

“Of the six new crypto billionaires created over the past year, five came from Bitcoin, underscoring its dominant position when it comes to attracting long-term investors who buy large holdings,” Andrew Amoils, New World Wealth’s head of research said.

The authors of the report say that with so many new crypto millionaires and billionaires, there’s more focus on which countries have the most crypto-friendly policies.

“Henley & Partners has seen a significant uptick in crypto-wealthy clients seeking alternative residence and citizenship options in 2024,” the report says.

Singapore and Hong Kong are particularly attractive options for their tax policies and regulatory frameworks relating to crypto, among other factors, the report says.