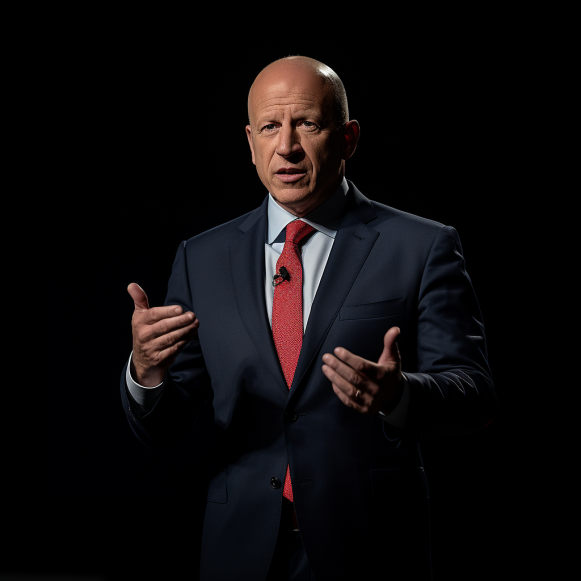

The number of partners to leave Goldman Sachs since David Solomon took over as CEO just hit 90

- It’s been a busy summer for Goldman Sachs’ partner departures.

- Two more farewell memos went out on Tuesday, including for Lisa Opoku and David Rusoff.

- The bank said goodbye to Julian Salisbury and Takashi Murata on Friday.

David Solomon may want to forget this summer.

Just weeks after reporting a 58% drop in profit, Goldman Sachs CEO David Solomon was hit with a wave of high-profile defections, bringing the total number of partners who have left the firm under Solomon to 90.

Goldman said goodbye to two more partners, Lisa Opoku and David Rusoff, on Friday, just days after losing two high-ranking members of its asset & wealth management unit:CIO Julian Salisbury and Takashi Murata, Asia Pacific co-head of private investing and global co-head of real estate*

Goldman’s partners are the company’s highest-ranking executives outside of the C-suite. They wield considerable power and prestige, both within the bank and throughout the world. Goldman has refuted claims of high turnover, including Solomon’s claim at this year’s Investor Day in February that turnover was at a five-year low. However, Solomon has made numerous changes to the bank.

Solomon, the third person to lead Goldman since it went public in 1999, has been trying to run it more like a public company than a partnership for the majority of its 154-year history. His efforts have included multiple reorganizations as he seeks to grow businesses that can help stabilize earnings, including one that elevated the money-losing consumer banking business before switching gears to reduce its size.

Tammy Kiely, a semiconductor investment banker, left the bank in June, and rates trader Frederick Baba and Dina Powell McCormick, a former government official who ran the bank’s sovereign business and sustainability efforts, both left in May.

Opoku previously served as global head of the Goldman Sachs Partner Family Office, which is in charge of the firm’s wealth management offerings for current and retired Goldman Sachs partners, managing directors, and alumni. According to a memo from Marc Nachmann, head of the bank’s wealth and asset management unit, she is leaving after 20 years.

According to a memo from Kathryn Ruemmler, Goldman’s chief legal officer and general counsel, David Rusoff, general counsel of Global Banking & Markets, is leaving the firm after 23 years.

Rusoff and another colleague have both accepted positions with Ken Griffin’s rapidly expanding financial empire. Rusoff has been appointed as the chief legal officer of the market-making firm Citadel Securities. He will begin in early 2019 and report to CEO Peng Zhao.

David Thomas, Goldman’s deputy general counsel, will join Citadel as head of global markets, legal, where he will be in charge of leading the trading and markets legal and compliance teams.Thomas, a Goldman managing director, will join the firm early next year and report to Shawn Fagan, the firm’s Chief Legal Officer.

Here are the memos announcing Opoku and Rusoff’s departures:

To: All AWM, Partners, and Engineering Managing Directors

Lisa Opoku to Retire from Goldman Sachs Lisa Opoku, global head of Goldman Sachs Partner Family Office, is leaving the firm after nearly 20 years of distinguished service. Lisa oversees the firm’s wealth management offerings for current and retired Goldman Sachs partners, managing directors, and alumni in her current role. She has served in a variety of roles across several divisions and regions during her long tenure at the firm, working closely with leaders across the organization and bringing her deep expertise and strong judgment to each position. Lisa was previously the global chief operating officer (COO) for Engineering, and prior to that, she was based in Hong Kong and served as COO for the Securities Division in Asia Pacific. She previously worked in New York and London as the COO for the Fixed Income, Currency, and Commodities Bank Loan Syndications and Trading businesses. Lisa has served as a role model and mentor to many, devoting her time to developing and mentoring our people in addition to her significant commercial contributions. She has also worked to advance the firm’s diversity and inclusion priorities, serving as a sponsor of the Firmwide Black Network and as co-chair of the Americas Inclusion and Diversity Committee in the past. Lisa also serves on the boards of Launch With GS and the Black Economic Alliance. Lisa is a current member of the Firmwide Conduct Committee. She joined Goldman Sachs in 2004, was promoted to managing director in 2006, and became a partner in 2012. Please join me in thanking Lisa for her commitment to the firm, our people, and our clients, and in wishing her and her family all the best in the future. Nachmann, Marc

David T. Rusoff, general counsel of Global Banking & Markets, will retire after 23 years of distinguished service. David has held various leadership positions of increasing responsibility within Equities Legal and other practice groups that provided legal coverage for the Securities Division (later to be known as the Global Markets Division) since joining the firm in 2000 in the Legal Department’s Investment Management Practice Group. He was the general counsel of Global Markets Legal before taking on his current position. In 2005, David was named managing director, and in 2016, he became a partner. David has advised a number of our businesses for more than two decades, demonstrating strong judgment and deep expertise. David has also recruited and mentored many of our Legal Division employees. I am grateful for his leadership, as well as his dedication to the firm’s culture and core values in all of his interactions. David currently advises and serves on the Firmwide Technology Risk Committee, the Firmwide Operational Risk and Resilience Committee, the Firmwide Volcker Oversight Committee, and the Capital Policy & Procedures Oversight Committee. In addition, he serves on the Global Automated Trading Controls Committee. Please join me in thanking David for his contributions to the firm and wishing him and his family the best in the coming years.