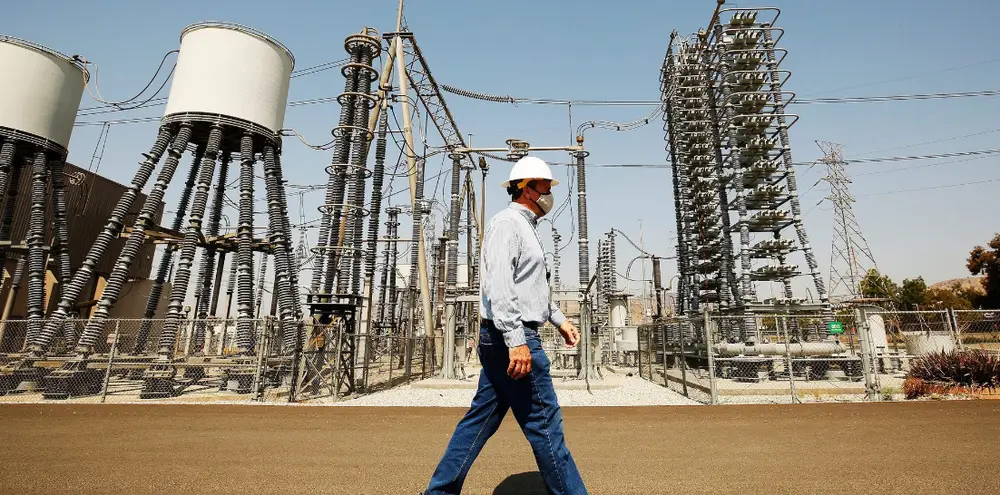

The rise of AI means the latest rally in utility stocks isn’t the warning for investors it once was

Utility stocks are booming, but don’t take that as a warning sign for the economy and the broader stock market.

Historically, utility stocks’ outperformance relative to the rest of the market has been considered a bad omen, as investors would bid up the reliable slow-growth defensive sector amid concerns of an economic slowdown.

“There are few sectors as ‘recession-proof’ as Utilities — this is a sector to have exposure when the economy cools off. They offer a margin of safety most other sectors of the stock market do not when the going gets rough,” economist David Rosenberg said in a note on Tuesday.

So, with the defensive utility sector up about 19% year-to-date, outpacing the S&P 500’s gain over the same time period, it’s not surprising to see cause for concern among investors.

“People are kind of worried about utilities, the strength we’ve seen out of utilities,” Carson Group strategist Ryan Detrick said in a CNBC interview on Monday.

But this time around, the ongoing rally in utility stocks doesn’t amount to the same warning sign for the economy as it has in the past.

That’s because secular trends like AI and EVs are stimulating unprecedented demand for electricity.

The sentiment was on full display during the recent string of utility companies’ second-quarter earnings results.

Brookfield CEO Bruce Flatt told investors, “The electrification of industrial capacity, automobiles, heating for houses, and other uses is driving unprecedented growth in the demand for electricity.”

The interim CEO of American Electric Power Benjamin Fowke said it has received commitments for more than 15 gigawatts of incremental load by the end of this decade, which represents a 43% increase from its current capacity.

“We continue to work with data center customers to meet their increased demand,” Fowke said in an earnings call with analysts.

Duke Energy CFO Brian Savoy echoed similar sentiments during his company’s earnings call in early August.

“We are forecasting unprecedented growth in power demand from advanced manufacturing projects across multiple sectors as well as data centers,” Savoy said.

Altogether, a transformation is taking hold in the utility sector, which for decades has been categorized as a sleepy but reliable corner of the stock market that experiences growth on par with the rate of GDP growth.

And that means the recent outperformance of utilities and the sectors pending breakout to new closing highs on a monthly basis in August shouldn’t be seen as a warning sign, but as validation that the broadening in the stock market that investors have been waiting for has arrived.

“If utilities were the only thing going higher, I think that’d be a message of the market that maybe something is off, but we’re seeing a lot of other participation,” Carson Group’s Detrick said, pointing to solid year-to-date gains in other sectors including financials, industrials, and consumer staples.