The secrets of Larry Page’s money manWayne Osborne guards the Google founder’s fortune. Now his playbook is for sale.

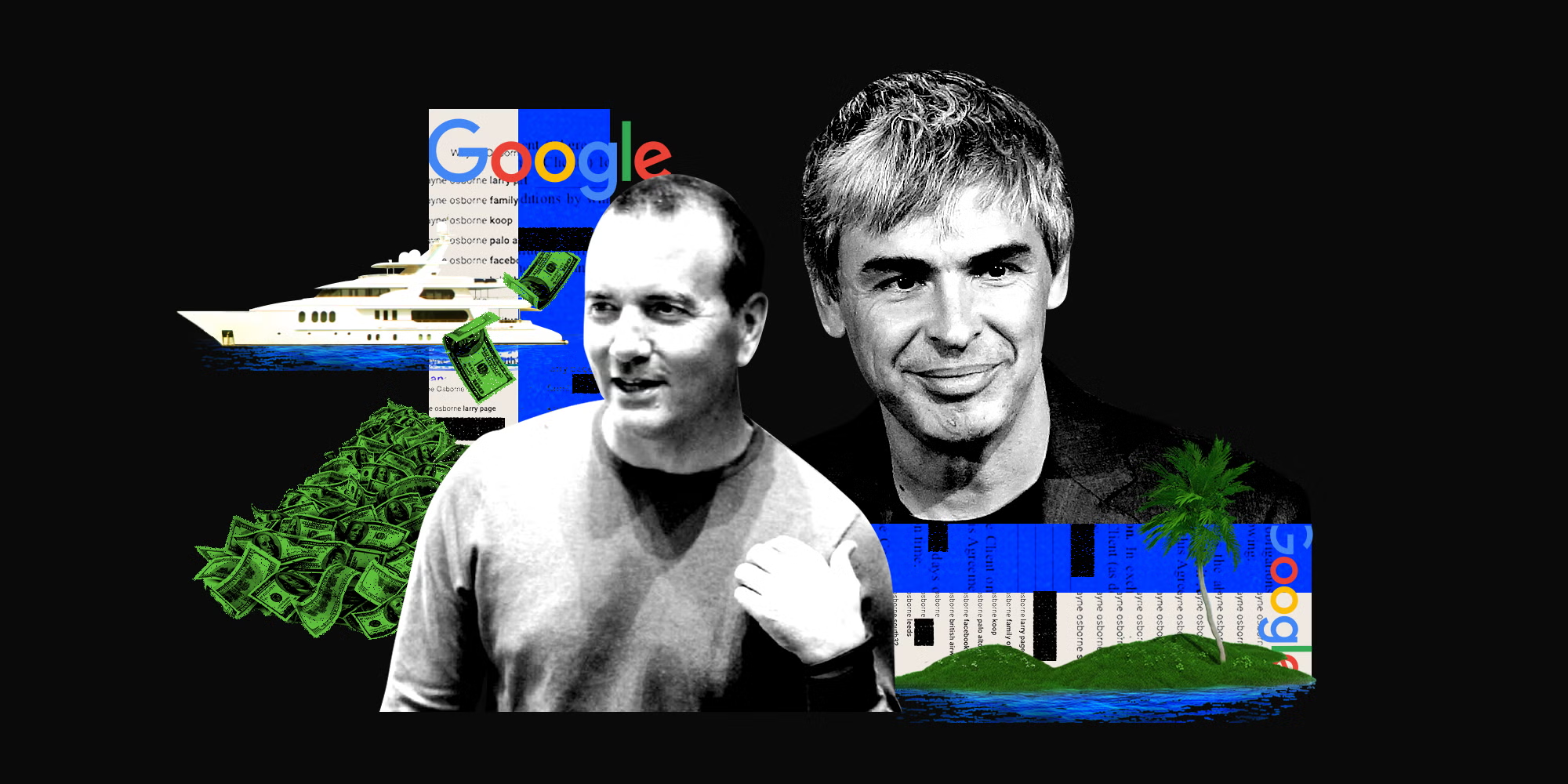

Wayne Osborne (left) has overseen Larry Page’s life and finances since 2012, as head of the Google founder’s family fund.

In 2014, a New York developer was in negotiations to buy two pristine islands in the Caribbean, a mile north of St. Thomas. He had made an offer of $9 million, but the deal had hit a snag. Suddenly, out of nowhere, a mysterious company based in Palo Alto, California, swooped in and snapped up both islands for $23 million.

The developer was furious. Suspecting double-dealing, he went to court to contest the sale. But there was no way to tell who was behind the sudden purchase. The buyer was hidden behind a web of limited-liability companies, a business structure that allows owners to remain shielded from view. It took months of litigation before the man behind the LLCs was revealed: Google cofounder Larry Page.

None of the documents relating to the deal mentioned Page by name. His connection was confirmed only after lawyers for the developer were able to question another man, Wayne Osborne, who has overseen Page’s life and finances since 2012.

As the CEO of Koop, Page’s family office, Osborne has shrouded his employer in a level of privacy that’s nearly unparalleled in the modern era — keeping Page’s name out of business documents, court records, and news headlines. To purchase the two islands, it came out during Osborne’s deposition, Koop set up the LLC with the express aim of obscuring any link to Page. When Osborne does his job, it’s almost impossible to detect that Page — or Osborne himself — was even there. “Wayne operates in the shadows,” says an industry peer who knows Osborne personally.

With Osborne at the head of Page’s family office — a special breed of private wealth-management firms that advise the ultrarich — the cofounder of the world’s go-to search engine has become a model of inaccessibility. The world’s sixth-richest man, estimated to be worth $143 billion, Page is almost never interviewed or photographed. Last year, when lawyers sought to question him about his possible business ties to Jeffrey Epstein, the financier and child predator, investigators were unable to find an address for Page, making it difficult to subpoena him. When he flies, his private jets copy the “QS” configuration that NetJets uses on its tail numbers, to throw off suspicion that Page might be aboard. The creator of Gmail even avoids using his own product. “Instead, you speak to Wayne,” says someone who has worked with both Page and Osborne.

Osborne’s association with Page has given him a revered status in the world of family officers. “Everyone wants to connect with Wayne because he’s connected to Larry,” says one former Osborne employee. His success has also helped fuel a boom in family offices, a financial structure pioneered by J.P. Morgan and popularized by the Rockefellers. Today there are thousands of family offices globally, with the total number tripling between 2019 and 2023, according to the data provider Preqin.

Now, in a surprising move, the man who has enabled Page to live in the shadows is coming out of the shadows himself. Osborne is seeking to parlay his proximity to one of the world’s most secretive tech founders into a rapidly growing side hustle. His new company, Way2B1, has developed software that essentially creates a digital version of Osborne — one that can put his trade secrets to work for other investors. Insiders say Osborne has boasted that Way2B1 is already working with more than 100 high-net-worth families, and that Morgan Stanley has signed a lucrative deal with the company giving it access to the bank’s high-net-worth clients.

The goal, according to people familiar with the company, is to dominate the world of wealth management the way Page monopolized online search. “Wayne wants to create the Google of family offices,” a former Way2B1 employee says. It is also closely intertwined with Koop, as some staffers have moved between the family office and Osborne’s startup.

Page is famously private, even by the standards of tech founders. He stopped presenting at Google product launches and earnings calls in 2013 and hasn’t attended a press conference since 2015.

But the ambitious new venture comes with an inherent tension. To protect Page, Osborne has long remained hidden, the man behind the megabillionaire’s curtain. But unlike Koop, Way2B1 is a for-profit business that needs to attract clients and make money. “Wayne advertises for Way2B1 by talking about it with everyone he talks to in the course of his work with Koop,” a former employee says. “They’re highly overlapping jobs.” As Osborne has taken on the role of salesman, venturing into the world to promote his enterprise, he has confronted an uncomfortable dilemma: How do you safeguard the privacy of one of the world’s richest men while hawking the secrets to his success?

To run their family offices, most tech titans rely on former wealth managers and business-school alumni. Sergey Brin, who cofounded Google with Page, employs George Pavlov, a former venture capitalist. Mark Zuckerberg leans on Iconiq Capital, a financial-services firm. Jeff Bezos looks to Melinda Lewison, a Harvard Business School grad and former financial analyst.

Osborne started his career not in finance but in faith. Born in Mississippi, he graduated from Princeton Theological Seminary with a master’s degree in divinity. But Osborne, who identified as gay, soon found himself ostracized by his own church. In 1997, three years after he was ordained as a Presbyterian elder, the church tightened its rules blocking gays and lesbians from serving as elders, ministers, and deacons. When two church members objected to Osborne serving on the governing body of his Connecticut church, the case went to an ecclesiastical court. After a high-profile battle, Osborne won.

His victory reverberated through Presbyterian congregations — and his refusal to answer questions from church leaders about his sexual activity with his partner garnered national headlines. “That is not an appropriate question,” he explained to reporters, adding that it was something “even my best friends don’t ask me.”

The experience gave Osborne a taste of what it feels like to have your private affairs thrust into the national spotlight. And his industry peers say the ministry, with its emphasis on service to others, is not unlike the role of a family officer. “You could say it’s almost an ideal background,” says Natasha Pearl, the CEO of Aston Pearl, a consulting firm that works with family offices.

Osborne was at the center of a dispute over gay rights in the Presbyterian Church in the late 1990s. The episode gave him an early taste of being thrust into the national spotlight.

At the same time Osborne was standing up to the church, he was discovering a different kind of ministry. Back in his late 20s, he landed a job as an assistant to Helen Frankenthaler, the celebrated painter. He paid her bills, handled her publicity, and helped her manage her art inventory. “I found that I have a knack for helping people manage their lives,” Osborne said in a podcast with the investment firm Minerva in 2020.

He also found he could sympathize with the stress that comes from having someone else manage your wealth. “You’re turning over your life, or control of parts of your life, over to these people,” he told the Minerva podcast. “It creates an opportunity for anxiety and worry. Are they going to spend money the way I’d want them to spend it?” A client’s feeling toward the wealth manager becomes “I love you because I need you, and I hate you because I need you.”

The podcast appearance was a departure for Osborne. The role of a family officer is not only to keep your client out of the spotlight — it’s to stay out of the spotlight yourself. But appearing on the show gave Osborne an opportunity to talk up Way2B1. “We’re going to build the best tech in the world for family offices,” he recalled telling his employers. During his spiel, he was careful not to mention either Page or Koop by name, referring only to his work for “one of the tech families here in Silicon Valley.”

After Frankenthaler, Osborne went to work for the retail executive Joseph E. Brooks, whose family oversaw the expansion of the Lord & Taylor department store. In 2000, he began working for the news tycoon Mortimer Zuckerman. “He wasn’t real tech-savvy,” Osborne told the Minerva podcast. But Zuckerman appreciated the innovative approach Osborne brought to his personal affairs and his business empire, which included U.S. News and World Report and Boston Properties. One idea Osborne implemented was a sort of early version of Google Docs. Called “the phone list,” it allowed an employee at any of Zuckerman’s far-flung properties to leave a comment that the entire staff could see immediately.

As he moved up the ladder of high-net-worth individuals, Osborne caught the eye of one of the richest of them all. In 2012, he moved to Silicon Valley to run the family office for Page, who was in a period of transition. Page had just been reinstated as the CEO of Google, where he’d later oversee the creation of its parent company, Alphabet. The restructuring was widely seen as a sort of retirement plan for Page, allowing him to retain a controlling stake in the company while stepping away from direct responsibility. Page, who’d revealed he had a condition that led to paralysis in his vocal cords, stopped presenting at product launches and earnings calls in 2013. He has not attended a press conference since 2015, the year Alphabet was launched. He was becoming Google’s invisible man — and Osborne was there to help orchestrate the disappearing act.

Koop’s headquarters sits just off coastal Highway 101 in Palo Alto, tucked discreetly between a Starbucks and a Shell gas station. From the family office’s nerve center, Osborne oversees a complex maze of LLCs, financial advisors, and interpersonal dynamics. Like Osborne, Koop’s staff is fiercely committed to Page’s privacy. “It’s a relatively small group,” says Ken Goldman, who ran the family office for the former Google CEO Eric Schmidt and occasionally met with Osborne to discuss a fleet of private jets the two billionaires shared. “They’re very detail-oriented. They watch their money carefully.”

The small staff at Koop, Page’s family office in Palo Alto, are fiercely committed to Page’s privacy.

In keeping with their mission, most of Koop’s staffers are vague about their work histories on their résumés and LinkedIn pages. Before joining the family office, they’re required to sign nondisclosure agreements, and background checks can be repeated annually. One person Osborne has leaned on for protecting Koop’s security, according to two people familiar with the process, is Michael Floyd, a former CIA officer and an author of “Spy the Lie,” a training manual for spotting deception. Floyd, says someone who knows him, is Osborne’s “human lie detector,” using his expertise in espionage to identify anything that could threaten the privacy and sanctity of PageWorld. Sometimes, as Osborne explained on the Minerva podcast, “your weakest link is from within.”

Befitting its billionaire tech-founder boss, Koop has an impressive fleet of engineers working on the Page family’s enterprises, assets, and philanthropic interests. Under Osborne’s supervision, Koop collaborated with Composite Energy Technologies to build an electro-foiling catamaran, a 37-foot vessel designed to glide over the water at impressive speeds with little human control and, in time, zero emissions. (A person familiar with the project says the catamaran belongs to Page.) Koop also formed an LLC for Oceankind, the marine-conservation charity run by Page’s wife, Lucy Southworth, making it difficult to track the millions of dollars flowing through it.

Within the insular world of family offices, Koop has a reputation as a well-run enterprise that’s not allergic to a little fun. According to one person who attended a particularly memorable Mardi Gras-themed party for Koop employees and trusted industry friends held at Nola, a Creole restaurant in Palo Alto, a live alligator hung out on the bar. (A representative for Osborne denied this happened.) Osborne himself is seen as charismatic, friendly, and a sharp dresser. “Always good shoes, good jeans, good jackets,” someone who has worked with him says. “He takes care of himself really well, too.”

Osborne can also be oddly finicky, those who know him say, insisting on things being just the way he wants them. One person who dined out with Osborne recalls watching him recoil when his dish arrived. Apparently displeased with the chef’s architectural plating concept, he sent the dish back and ordered that the food be laid out flat on his plate.

Page did not respond to a request for comment for this story, and Osborne issued a short statement. “It is clear that B-17’s goal is to create a sensationalized, misleading article that falls short of responsible journalism,” it reads. “Anyone familiar with the individuals mentioned in your article will recognize how inaccurate your story is.”

As befitting his role at Koop, Osborne’s public profile is limited — one of the few public photos of him is the headshot on Way2B1’s website. But he reveals bits of himself on his personal Tumblr. One tab contains a humorous “presidential platform in progress,” with ideas ranging from the sweet (“The elderly will be interviewed, their thoughts and wisdom recorded for posterity”) to the silly (“Every citizen will receive a free margarita (frozen or on the rocks) after more than 8 hours of work”) to the impossible (“All days will have 12 hours of sunshine”). In another list, called “My 55 Ways to be Satisfied,” Osborne starts with “have good morning workouts” before proceeding through “write poetry, draw objects, paint canvas, and read a good book” (No. 10), “have a good bedtime tea every night” (No. 19), and “vote in every election” (No. 51).

“Everyone wants to connect with Wayne because he’s connected to Larry.”

The idea for Way2B1 is rooted in the tech-forward approach Osborne brought to his role at Koop. When he took over Page’s family office, he was bothered by the fact that there was no tech platform designed to manage the increasingly complex lives of wealthy families. So he told his employers — presumably Page and Southworth, though he avoids mentioning them — about a concept he had raised with Mortimer Zuckerman: “What if, with one username and password, you could access your whole world?”

In 2015, Osborne proposed developing the tech on his own. “I’d like to set up a company. I don’t want you investing,” he told the family. “What you’ll get out of this is you’ll get the most advanced family office in the world.” His employers told him to go for it. They were, he said, “very supportive.”

As Osborne tells it, he had been developing the Way2B1 software for about a year when his employers suggested it was time to talk. “I got a little nervous, to be honest,” he told the Minerva podcast. But in fact, the family was thrilled. “It’s changed our life,” they told him. “It’s given us peace of mind. Will you let us invest?”

The central insight behind Way2B1 is that the secrecy inherent in family offices and the insularity of their small teams have actually put the wealthy at a disadvantage. “Every family is reinventing the wheel for themselves,” Osborne says. “A lot of families are making really big mistakes because they’re building this thing from scratch.” By downloading the industry’s best practices into a single platform, Osborne is following Big Tech’s playbook: Start by testing your idea in beta, then roll it out to a wider audience.

Way2B1, which Osborne calls “the new paradigm,” is essentially a fancy task-management system, designed to ensure investments are vetted, LLCs are set up, nannies are paid, and property repairs are done on time. The idea is that the family principals and family-office coordinators can see everything in one place, making it easier to approve purchases, green light investments, and ensure background checks are completed, all protected with what Way2B1 likes to boast is the same encryption services used by the US government. In some ways, Osborne sees Way2B1 as a means of helping other family offices build themselves in Koop’s image: “We think it’s important that families have privacy, that they keep their teams small.”

Though Koop and Way2B1 have seemingly been intertwined from the outset, Osborne has erected some internal walls. For starters, not everyone who works at Way2B1 knows that their CEO also runs one of the world’s most lucrative family offices. “Just being there isn’t enough to grant you access to those circles,” a former employee says. When Koop is mentioned at Way2B1, it’s referred to by its code name: Taurus.

Still, the connections between the two firms run deep. Osborne has hired former Koop employees for his side hustle, and he sometimes solicits feedback from Koop employees on Way2B1 products.

Despite its ties to — and investment from — one of the world’s richest men, Way2B1 remains lean, with fewer than 100 employees. And even though it’s been around for less than a decade, insiders say it’s already been through at least one round of layoffs.

Some Way2B1 employees resent what they see as Osborne’s unquestioning fealty to Page. “He thinks Larry has his money by divine right,” one says. They worry that for Osborne, Page will always come first, and Way2B1 a distant second. “Any chance he’d get,” another former employee recalls, “he’d brag about how much his Pixel phone was better than the iPhone.”

Page bought the superyacht Senses in 2011 for $45 million. His lifestyle — including the private islands he has purchased — are often shielded by the family office overseen by Osborne.

Such tensions have forced Osborne to perform a delicate juggling act. Way2B1 isn’t the only game in town, and it’s competing with a host of other software systems being shopped around the world of family offices. Forbes keeps a running list of some of the best, and industry insiders mentioned Nines and Summitas as two favorites. That means Osborne needs to find a way to spread the word about his product, and how it builds on the expertise he has honed in Page’s service, without subjecting his boss to unwanted scrutiny.

But in public, the separation between Way2B1 and Page’s family fund has proved difficult to navigate. In June, Way2B1’s chief operating officer, Hal Bailey, a former director at Google, spoke at a conference touting Way2B1’s technology. To demonstrate its effectiveness, he pointed to how the software had helped one client navigate the complex web of global bureaucracy and donate supplies to a cluster of islands at the height of the COVID pandemic. To anyone paying attention, it appeared to be a reference to donations Page made in July 2021, soon after his purchase of a Fijian island.

It was a strange thing for Way2B1 to brag about, given the controversy sparked by Page’s donation. After Fijian broadcasters revealed that Page was behind the supplies, Fijian health authorities ordered them to take down the story. The censorship, first reported by B-17, unleashed a wave of bad press for Fiji, which had allowed billionaires like Page to slip past its closed borders on superyachts and private jets. A month later, the government of New Zealand was forced to admit that Page’s 12-year-old son had been evacuated from Fiji and brought to New Zealand for medical treatment even as its own citizens were barred from returning home.

For Way2B1 to let slip a story about Page’s generosity wasn’t necessarily the worst thing in the world. And it’s possible the anecdote was shared with Page’s blessing. But whether Page likes it or not, Osborne’s new venture is bringing fresh attention to his personal affairs. Through his investment in Way2B1, Page is seeking to make money by monetizing the techniques he uses to make money. And that, inevitably, is going to thrust him into the limelight he has spent so dearly to avoid.