These 2 factors will help unlock the housing market in 2025, according to Realtor.com’s chief economist

2024 has been a tough year for homebuyers.

Affordability levels are still low with elevated home prices and mortgage rates. A huge jump in mortgage rates to around 6.8% today from under 3% in 2022 has also created a “lock-in” effect, where existing homeowners don’t want to sell into a higher mortgage rate environment than when many of them bought — further limiting home inventory coming onto the market and sending prices soaring even higher.

There’s reason to be optimistic, though. The US housing market will see more favorable buying conditions in 2025, according to Danielle Hale, chief economist at Realtor.com. Hale sees two trends that will help encourage existing homeowners to put their homes up for sale.

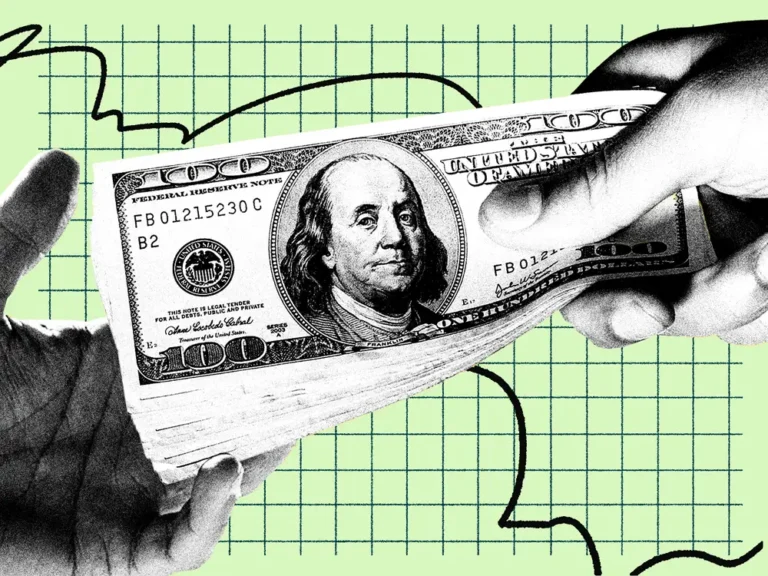

Existing homeowners have built up home equity

Existing homeowners have reaped big home equity gains in recent years thanks to rapidly rising home values.

Homeowners are also increasing their home equity by making monthly mortgage payments, as those who bought houses a few years ago have had the opportunity to make a sizable dent in their mortgage, Hale said. Homeowners with a smaller mortgage balance may be less sensitive to the higher interest-rate environment of today’s housing market.

According to Lawrence Yun, chief economist of the National Association of Realtors, homeowners are feeling richer now thanks to the home equity they’ve accumulated over the last few years of dizzying home price increases. As a result, more listings are being put on the market.

Homeowners can put their home equity to work when they move and buy a new house.

“If they’re using their home equity to make a move, that enables them to either be a cash buyer or take out a very small mortgage,” Hale said. “That gives them a bit more flexibility in today’s market.”

Mortgage rates may become less important to buyers and sellers

Homebuying decisions can also be influenced by factors other than mortgage rates or home prices, according to Hale.

The more time that passes since a homeowner’s initial purchase, the more likely it is that they’ll have a life change requiring them to move, regardless of the cost of moving, Hale said.

People buy houses for reasons other than financial ones, Hale pointed out. Big life changes that could spur a move include a new job, retirement, marriage, or having children.

“All of these can be reasons that people might make a move even if the costs are more expensive to buy a home,” Hale said.

Additionally, consumers might be getting accustomed to high mortgage rates, according to Redfin.

“Buyers realized mortgage rates may not drop below 5%, and probably not below 6%, in the near future,” Mimi Trieu, a Redfin real-estate agent, said. Existing homeowners holding off on moving due to high mortgage rates may soon give up on waiting it out.

A more “buyer-friendly” housing market

These changes won’t be immediate, but they will have a noticeable impact on the housing market, according to Hale. She believes that the housing market is trending in a more “buyer-friendly direction.”

“It’s going to take more time,” Hale said of the lock-in effect. “But as it diminishes, that’s going to free up more sellers.”

Lower interest rates — and subsequently, lower mortgage rates — would certainly speed up the erosion of the lock-in effect, Hale said. However, even if mortgage rates hover around the 6% range in 2025, which is what Realtor.com expects, the lock-in effect will still fade.

Homebuyers could see a notable change by the end of next year, Hale predicted.

“In mid-2024, 84% of homeowners with a mortgage had a mortgage rate under 6%. We think that by the end of 2025, that share will be 75%,” Hale said.