These 2 market indicators with perfect track records since 1984 are flashing a Harris presidency — but they could be wrong this time

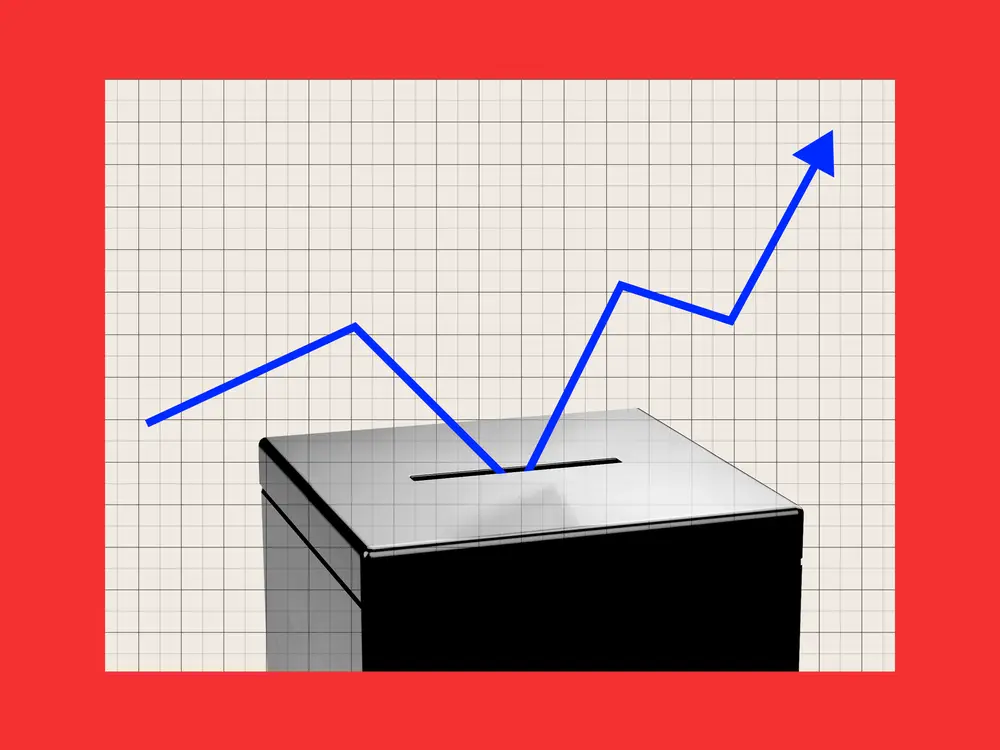

Historically, the stock market holds some clues about the outcome of the US presidential election.

Typically, when the stock market rises, and unemployment and inflation remain low, the incumbent party remains in power. The opposite is true when stocks fall and unemployment and inflation climb, according to LPL Financial’s Chief Technical Strategist Adam Turnquist.

The S&P 500’s performance from August to October before the election, as well as the Misery Index, which tracks the sum of inflation and unemployment, have historically been accurate predictors of the election outcome — and both are spelling out a Harris presidency right now.

This makes intuitive sense: if the economy is doing well, voters are more likely to be content with the existing administration, and vice versa. But before you bet on the election outcome, there are a few other factors you should consider, according to market experts.

Markets are pointing to Harris

Since 1984, the incumbent party has been reelected if the S&P 500 was positive or voted out if the S&P 500 was negative in the three-month period from August to October before the election, according to Comerica Wealth Management. The S&P 500 has gained 10% since August 5, and if it keeps going up, a Harris victory seems imminent.

Likewise, the so-called Misery Index is flashing a Harris victory. The index measures economic health calculated by adding the seasonally-adjusted unemployment rate and the annual inflation rate. Since 1980, the incumbent party has lost every contest when the three-month average of the Misery Index increases year-over-year leading up to election day, and vice versa.

The Misery Index has accurately predicted every election since 1980. It stands at 7.118 compared to 7.335 last October, signaling a Harris win.

Investors beware

Investors should note that these indicators don’t guarantee the election outcome, especially in today’s heightened-risk environment.

For starters, the incumbent party this year switched candidates — a rare occurrence highlighting that historical precedent isn’t always accurate.

There are other factors at play too, according to Turnquist. Volatility usually increases in election years, but this year promises be extra volatile due to geopolitical uncertainty, a cooling economy, and disruptive policies. While policies discussed during the campaign trail won’t necessarily be implemented in practice, Turnquist sees some of the proposals being discussed as having more disruptive potential than previous cycles.

Although November is rapidly approaching, Turnquist said it’s still too early to bet on the Misery Index readings. The last two non-farm payroll numbers have fallen short of economists’ estimates, which Turnquist sees as cause for concern.

Although Federal Reserve Chairman Jerome Powell recently stated that the labor market was on solid footing, Turnquist isn’t so sure.

“This labor market still seems to be on trial,” Turnquist said.

If the September data continues to fall below expectations, Turnquist believes the market will price in more rate cuts, and stocks could slide. A pullback similar to the one experienced during the first week of August this year isn’t out of the question, in his view.

“Even a correction would not be terribly surprising right now,” Turnquist said. If the stock market declines, the outlook for a Harris victory could quickly sour.

Lynch agrees with Turnquist. Harris has 15 basis points of leeway before the Misery Index exceeds October 2023’s reading, and September’s unemployment report could very well push the index over the edge, he pointed out in a recent note.

It’s going to be a choppy path for the stock market leading up to the election. While these indicators might be flashing a Harris victory for now, nothing’s set in stone leading up to this election.