These big shipyards are China’s shipbuilding power players and are cranking out new warships at a breakneck pace

A handful of shipyards are most notable in contributing to China’s naval buildup.

It is no secret that China’s shipbuilding capacity is unmatched on the world stage and that its shipyards are churning out new warships at a breakneck pace.

Across its monstrous shipbuilding empire, a few yards stand out for their significant role in China’s rapid naval buildup, producing capable warships that strengthen China’s military and push it closer to achieving its goal of modernizing its fighting force.

China’s shipbuilding industry has over 230 times the capacity of the US, according to recent estimates from the Office of Naval Intelligence, representing about 50% of the total global shipbuilding capacity.

Its dual-use shipyards, where both commercial and military ships are built, have been bolstered by China’s growing status as the largest shipbuilder in the world.

Jiangnan Shipyard was recently expanded and is now being merged with another yard.

And that industry is building it a massive navy. The Chinese People’s Liberation Army’s Navy “is the largest navy in the world with a battle force of over 370 platforms, including major surface combatants, submarines, ocean-going amphibious ships, mine warfare ships, aircraft carriers, and fleet auxiliaries,” the Pentagon said last fall in its report on China’s military power. And that number doesn’t include around 60 Houbei-class patrol combatants that carry anti-ship cruise missiles.

China’s naval buildup, in particular, has been noted by the US as a point of concern amid the Pentagon’s recognition of China’s military as its “pacing challenge” and a motivation for the US military’s decision to shift its focus toward the Indo-Pacific.

The country’s naval vessels are being constructed at incredible speeds, boasting increasingly advanced capabilities, sometimes even demonstrating impressive technological jumps. By 2030, the Pentagon expects China’s PLAN to have an overall battle force of 435 ships, a notable increase mostly in “major surface combatants.”

The shipyards building China’s navy

Dalian is another significant Chinese shipyard and was site of production for the CNS Shandong aircraft carrier.

When looking at Chinese shipbuilding capacity, four shipyards stand out: Dalian in northeastern China, Huangpu Wenchong near Hong Kong, and the Jiangnan and Hudong-Zhonghua yards near Shanghai.

All four of the shipyards are operated by subsidiaries of the state-owned China State Shipbuilding Corporation and pump out various vessels for China’s military while making record profits in the commercial shipbuilding sector. Other shipyards of note include Bohai, the site of China’s nuclear submarines, and Wuchang, which constructed the Chinese Coast Guard’s large Haixun 06 maritime patrol ship.

There are dozens of yards across China, too, that produce military vessels.

The Shanghai shipbuilding facilities are particularly notable. Jiangnan Shipyard has been the site where many of the Chinese navy’s more advanced warships were built, including its third aircraft carrier CNS Fujian, which features a new catapult launch system, and the Type 055 and Type 052 destroyers.

Wuchang Shipyard, located in Wuhan, produced the Chinese Coast Guard’s Haixun 06, which has deployed in the Taiwan Strait several times in response to events related to US-Taiwanese relations.

And Hudong-Zhonghua, meanwhile, has constructed some of the Chinese navy’s other surface combatants, such as Type 075 amphibious assault vessels, Type 071 amphibious transport dock ships, and Type 054 frigates.

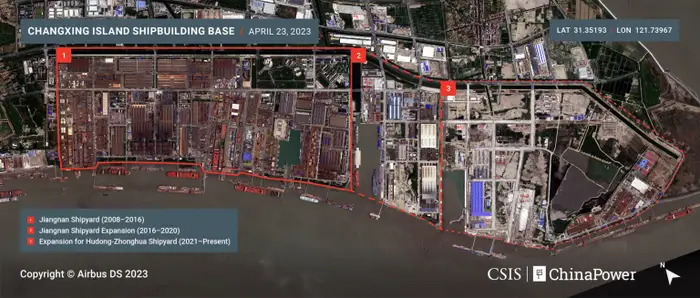

The crown jewel for Chinese shipbuilding is Changxing Island, which was part of a massive overhaul that saw the combination of the recently expanded Jiangnan Shipyard and the Hudong-Zhonghua Shipyard into one. China effectively relocated a shipyard to make this possible, and it did it while still turning out ships.

“It’s impressive; it’s a very Chinese way to do things,” Brian Hart, a fellow with the China Power Project at the Center for Strategic and International Studies, said. “I don’t really think any other country has the scale and resources to just pick up and essentially move such a massive industrial base.”

The China Power Project at CSIS has carefully documented developments in Chinese shipbuilding, including work at the yards and new vessels.

Jiangnan Shipyard and Hudong-Zhonghua Shipyard are becoming the epicenter of Chinese shipbuilding.

The combination of two major Chinese shipyards to build Changxing Island is the “clearest sign” of one of China’s biggest strengths in shipbuilding, said Matthew Funaoile, a senior fellow with CSIS’ China Power Project, explaining that “China is finding ways to continue to be more efficient and more productive, and it’s leveraging its industrial capability to modernize its navy.”

China calls its Changxing Island operation a “shipbuilding base,” and recent satellite images have shown substantial shipyard construction. It’s also building new ships.

The first Yulan-class assault ship, which features a catapult launching system for fixed-wing aircraft, is being built there. Once it’s complete, this vessel, known as the Type 076, will be the largest amphibious assault ship in the world.

More than warships

China’s commercial shipbuilding capacity overshadows the rest of world.

But what makes some of these yards significant isn’t just the military vessels coming out of them, though that is a big part of it; it’s also the commercial shipbuilding capacity.

At the Changxing Island and Dalian yards, for example, Chinese shipbuilders are also rapidly buidling commercial ships. The dual-use nature of the yards is a unique factor in China’s shipbuilding success, and its clear investments in its capacities indicate it’s focused on both building up its navy and continuing its dominant role in shipping and shipbuilding industries.

The lines between military and commercial shipbuilding in Chinese yards is often blurred.

Notably, there seems to be little to no distinction between how some of these facilities are used for producing military vessels versus commercial ships. Both Funaoile and Hart said the blurring of lines between those industries at this scale of production is fairly unique to China and one of the strong points in its shipbuilding empire.

“These investments show that China is in it for the long haul when it comes to shipbuilding, both commercial and naval,” Hart said.

That push in military shipbuilding is propelled by China’s political motivations and blue-water navy goals. By 2027, Chinese Communist Party leader Xi Jinping expects the PLA to be fully modernized, giving the country the ability to invade Taiwan should it choose to do so. And by 2049, China has goals for a national transformation into a modern power with a “world-class military.”