These consumer products are most likely to be impacted by the port strike

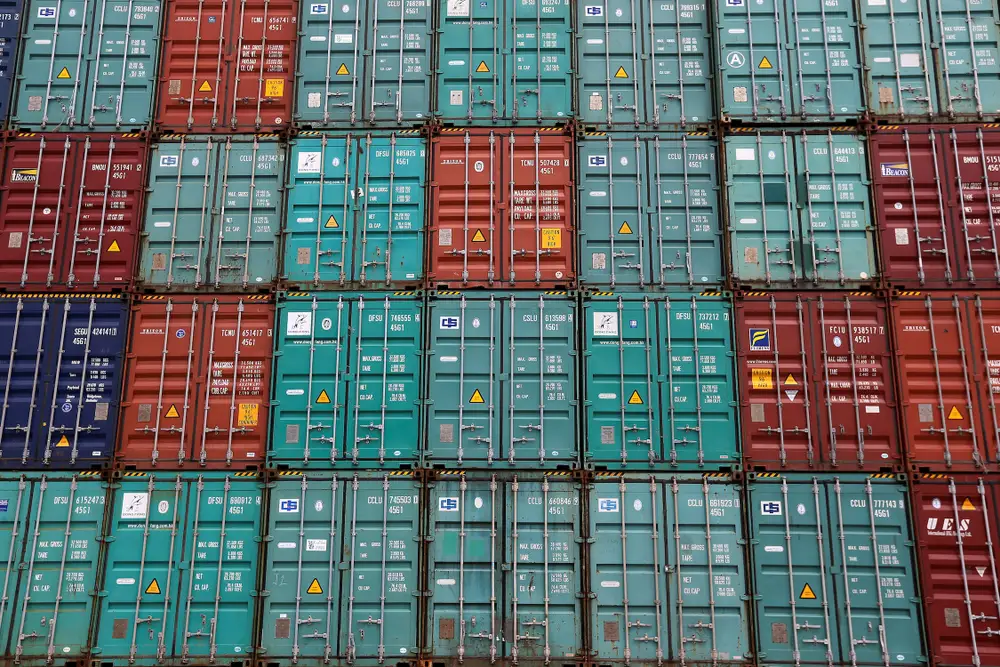

US port workers are on strike following the expiration of their labor contract Monday night.

US port workers with the International Longshoremen’s Association are on strike following the expiration of their union’s contract Monday night.

In the latest development of the ongoing labor dispute, the work stoppage at East and Gulf Coast facilities is expected to impact a host of consumer products.

Atlantic ports handle more than half of US imports, with an estimated economic impact of $540 million a day, according to The Conference Board.

While some companies have managed to work ahead of the impending deadline, accelerating shipments or routing to West Coast ports, others are in a tighter spot.

A wide range of everyday items could be affected

Fresh fruits and vegetables, especially those coming from Central and South America, are expected to be most impacted by the strike, said Margaret Kidd, a program manager and associate professor of supply chain and logistics at the University of Houston.

Top of the list: bananas and mangoes.

“Grocery stores and others in the supply chain aren’t holding a lot of inventory because they don’t want them to expire,” Brian Pacula, a supply-chain partner at the consulting firm West Monroe, told B-17 of bananas.

Tim Ryan, a Florida importer who supplies grocers including Walmart, told The Wall Street Journal he was having to fly in asparagus from Peru that he would ordinarily bring through the port of Miami.

Other food and beverage commodities, including beer, wine, and spirits could also be impacted because of their perishable nature, Pacula said.

European manufacturers are expected to face more disruption than brands that ship from Asia, according to analysts from Jefferies. That’s bad news for toymakers such as Playmobil and Lego, as well as Ravensburger puzzle-solvers.

Durable goods — which have less of an urgency to be rerouted because they’re not perishable — such as furniture and tires could also be stuck at ports, Pacula said. He noted that Continental Tire, Michelin, and Goodyear are all top importers through East and Gulf Coast ports.

Two supply-chain experts said that in addition to tires, shortages of other auto parts could plague consumers in the coming days, especially those coming from Europe or tied to secondary markets such as car maintenance and manufacturing.

When the Port of Baltimore was closed after the vessel Dali knocked out the Francis Scott Key Bridge, it shut down the largest point of entry for imported cars to the US. Baltimore is also a key site for importing sugar and gypsum, which is commonly used in construction and agriculture.

Parts of the East Coast, meanwhile, are still reeling from Hurricane Helene, which is expected to further slow the transport of goods throughout the US.

Michael Yamartino, the CEO of post-purchasing company Route, said smaller businesses without large inventories or the luxury of planning ahead, as well as companies dealing with complex products, would most likely be hit the hardest.

Three experts said that with less than two months until Black Friday, the likelihood that the strike could impact holiday shopping and shipping was high.

Chris Butler, the CEO of National Tree Company, a leading online seller of Christmas decorations, said that even with precautions in place, an estimated 15% of the company’s goods would be stranded amid a strike.