Things are looking up for Wall Street, and Goldman’s third-quarter results show why

David Solomon, Chairman and CEO, Goldman Sachs, speaks during the Milken Institute Global Conference.

In the latest sign of a resurgence in Wall Street dealmaking, Goldman Sachs reported a 45% jump in profits driven by gains in key business lines, including M&A advisory and equity and debt underwriting.

The bank on Tuesday posted a profit of $2.99 billion for the three months that ended in September, up 45% from the same time last year. Revenue of $12.7 billion increased 7% over last year.

The results beat analysts’ expectations and set the stage for Goldman’s executives to discuss why Wall Street may be at the cusp of a surge in corporate dealmaking activity. They cited lower interest rates, a strong economy, and higher demand for corporate financing.

“We see significant pent-up demand from our clients,” CEO David Solomon said in a call to discuss earnings. “The beginning of the rate-cut cycle has renewed optimism for a soft landing, which should spur increased economic activity.”

Solomon said the M&A market still has a long way to go to reach historical 10-year averages. But he suggested there are reasons to be hopeful in a call that had one stock analyst asking about the potential for an “M&A supercycle.” (Solomon didn’t dismiss the idea, saying that 10-year averages could theoretically go up if much of the pent-up demand is released all at once.)

It’s not just M&A that’s seeing signs of a comeback. Lower rates could also boost demand for corporate lending, IPOs, stock issuance, and more.

Here are five key takeaways from the company’s third-quarter earnings call.

Investment banking revenues are up

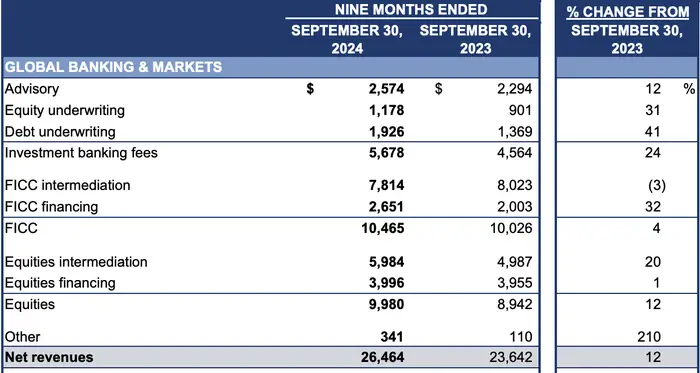

Investment banking revenues over the last 9 months

Investment-banking revenues grew 20% over last year to $1.86 billion. But as the above slide shows, this wasn’t a quarterly blip. Fees earned from M&A advice and debt and stock underwriting are up 24% this year versus the first nine months of 2023, including a 41% surge in debt underwriting.

Goldman CFO Denis Coleman said equity-capital-markets activity, such as public stock issuances, “are still well below long-term averages.” But in the last nine months, activity has surged 31%.

Solomon, meanwhile, said it’s only a matter of time before financial sponsors, a fancy term for private-equity firms, start transacting again.

Sponsors have been “slower to deploy than we would have expected, but we see more activity,” Solomon explained. “Some of that is indicative of the growth in our backlog that we have highlighted. And I do think that sponsor activity will continue to accelerate over the next six, 12, 24 months.”

Equity trading revenues surged

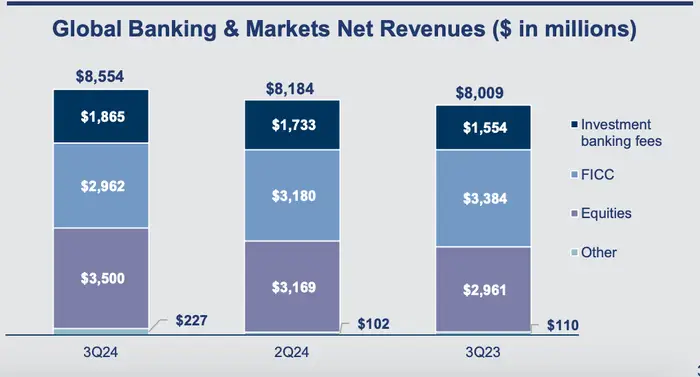

A bar chart showing Goldman’s investment banking and trading revenues

Revenues from trading, another key segment of the global banking and markets division, were also up.

The firm reported $3.5 billion in equities trading revenue, up 18% over last year. That was offset by declines in the firm’s fixed income, currencies, and commodities trading, which declined 12% to just under $3 billion.

For the first nine months of the year, however, Goldman’s FICC trading operation is up 4% versus last year, thanks in part to a 32% gain in revenues tied to the financing of FICC trades. (See the prior slide for more info.) Goldman’s equities trading division is up 12% for the year.

Volatility in the markets has created anxiety for traders, Solomon said.

“This is an environment that is filled with uncertainty,” he said, creating a need for clients to “constantly be engaging and repositioning and reshaping.”

Demand for loans will only grow as interest rates decline

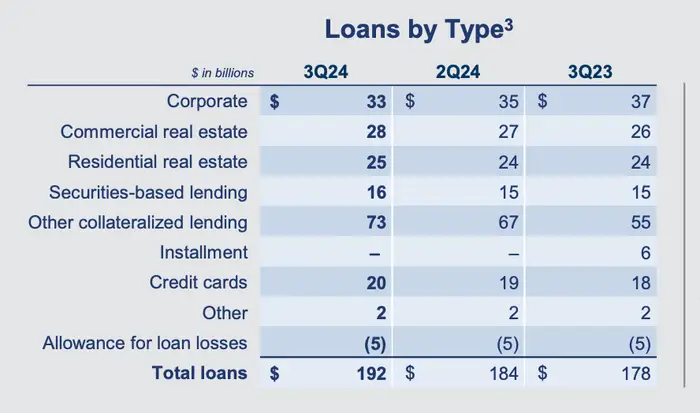

Goldman’s 3Q lending broken down by segment

While lending remains muted, Solomon highlighted several areas of potential growth as interest rates decline, including loans to high-net-worth individuals and more direct lending to corporations.

The bank, Solomon said, has made a “strategic decision” to invest in lending for “ultra-high-net-worth” clients, adding that he sees plenty of room for growth.

“While we’ve moved the needle, we’re still underweighted versus other competitors like JPMorgan and I would expect that we have a relatively good growth trajectory to continue to invest in that capability.”

Goldman also sees growing opportunities in corporate lending. The bank has long been a lender of leveraged loans and high-yield debt. But as interest rates start to cool, Goldman executives said they see more room to grow the bank’s direct and private-lending books.

Solomon said the firm is unique in its ability to syndicate, underwrite, and distribute loans. “We have an ability to direct lend. We have an ability to show clients alternatives that can best meet their needs,” he said. “The needs might be different in different transactional situations. So we like our positioning there.”

Goldman continues to attract investments in its assets and wealth management business

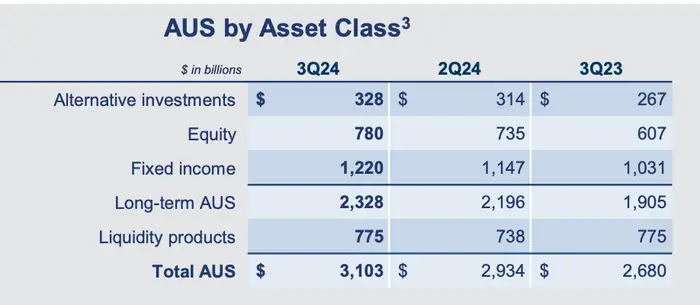

Assets under supervision hit a record $3.1 trillion

Goldman’s commitment to growing its asset-and-wealth-management business also appears to be paying off as investors seek help managing a difficult market environment.

Goldman’s assets under supervision swelled to a record $3 trillion in the third quarter, thanks to net inflows of $66 billion.

Some of that — $17 billion — came from an increase in assets through wealth management, wherein Goldman manages the portfolios of high-net-worth clients. Accounting for that growth, all in all, the bank reached total clients assets in wealth management of $1.6 trillion. Another $13 billion was sourced through the firm’s institutional client channels.

Goldman reorganized its asset-and-wealth-management unit two years ago, and it now encompasses products ranging from administering wealthy clients’ portfolios to private credit and equity capital to managing assets for large financial institutions, like pensions. In recent years, Goldman leaders have made clear the importance of expanding the bank’s footprint in this area. Solomon last year called it “the real story of opportunity for growth for us in the coming years” in a 2023 interview with CNBC, detailing the bank’s strategy after its retreat from consumer banking.

The increase in wealth-management assets is driving a need for additional staffing, the bank said. Goldman “continued to grow globally as we expand our advisor footprint and our leading lending offerings to clients,” Solomon said.

The consumer-banking retreat continues

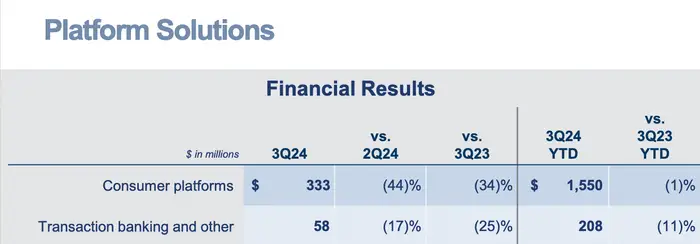

Consumer lending is waning

Meanwhile, the firm continues to withdraw from consumer banking. That function is housed in its platform-solutions division but was formerly combined with wealth management until the bank’s 2022 reorganization.

Solomon called it a “narrowing” of Goldman’s “consumer footprint.” The goal, the executives said, was to draw down the consumer activities the bank was heavily invested in a few years ago to the point that their impact becomes “negligible.”