‘This bull market is alive and well’: BMO’s strategy chief explains why history supports a continued rally for US stocks in 2024 — and shares 22 companies poised to outperform

- The S&P 500 is 53 weeks into a bull market, and BMO Capital Markets is expecting more gains.

- Next year will be more volatile and may contain a correction, but stocks should still rise.

- Here are 22 stocks that BMO is bullish on now as markets regain momentum.

A bullish strategy chief recently warned that US stocks are in for a bumpy ride in the coming year, though history suggests that the market rally has plenty of room to run.

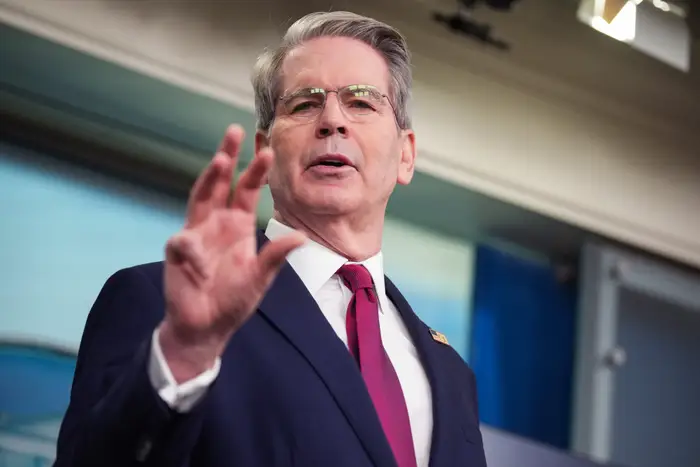

“We continue to believe this bull market is alive and well,” wrote BMO Capital Markets’ chief investment strategist Brian Belski in an October 18 note.

The S&P 500 emerged from a 25% decline that began in early 2022 just over a year ago. After months of being battered by higher interest rates in the aftermath of multi-decade-high inflation, the index reached a low on October 12 before beginning its recovery.

Stocks rose 21.6% the following year, which was less than the typical 38.3% gain in the first 12 months of a bull market, according to Belski.

Belski wrote that investors should consider that solid, if unremarkable, return a win. Given how bleak the economic outlook was last fall, BMO is pleased with the steady gains that have coincided with the lowest market volatility since the early 1990s.

“While this one-year gain is certainly not impressive by bull market standards, we believe it is notable since many entered the year prognosticating doom-and-gloom for US stocks,” Belski wrote in a blog post. “In addition, we think it is also important to point out how orderly the rally has been judging by the standard deviation of daily returns.”

Don’t expect a second-year slump for stocks

As the S&P 500 enters the second year of a bull market, all eyes are on it. Stocks typically rise 11.1% in the next 12 months, according to Belski, which is well below their usual first-year gain but higher than the index’s average year.

“While there is certainly no perfect historical comparison that can be used to lay out the road map for stocks in the future, we are confident that the secular bull market can continue to roll on, especially given the current fundamental states of US stocks and the economy,” Belski said in a statement.

Those gains, however, will not come easily. Volatility has historically been about 25% lower in the second year of a bull market, but Belski cautioned that another year of relatively quiet trading is no guarantee.

“Despite history pointing to lower volatility in the months ahead, we still believe there will likely be some choppiness along the way as the believability of the bull market continues to get questioned,” Belski wrote in a blog post.

Belski went on to say, “The S&P 500 has still averaged a roughly 10% max drawdown in the second year of bull markets, suggesting to us that investors should remain active and disciplined when it comes to their investment process rather than being passive or reactive to shorter-term performance trends.”

According to BMO, the secular, or long-term, bull market has legs.

22 stocks to buy right now

Stock selection will become increasingly important if the S&P 500 falls, according to BMO.

The Montreal-based investment firm maintains several model stock portfolios to provide investment ideas to its clients. One of these baskets is its US all-cap equity portfolio, which outperformed the market by one percentage point in the third quarter but still outperformed by one percentage point in 2023.

The following are 22 US-listed stocks in BMO’s all-cap portfolio that the firm rates as a buy. Each one is accompanied by its ticker, market capitalization, previous close, sector, and industry.

1. TJX Companies

BMO Capital Markets

Ticker: TJX

Market cap: $101.9B

Previous close: $89.10

Sector and industry: Consumer Discretionary; Retail

Source: BMO Capital Markets

2. Costco Wholesale

BMO Capital Markets

Ticker: COST

Market cap: $244.8B

Previous close: $552.93

Sector and industry: Consumer Staples; Discount Stores

Source: BMO Capital Markets

3. Walmart

BMO Capital Markets

Ticker: WMT

Market cap: $427.3B

Previous close: $158.76

Sector and industry: Consumer Staples; Discount Stores

Source: BMO Capital Markets

4. Chevron

BMO Capital Markets

Ticker: CVX

Market cap: $318.4B

Previous close: $166.83

Sector and industry: Energy; Oil & Gas Integrated

Source: BMO Capital Markets

Advertisement

5. Goldman Sachs

BMO Capital Markets

Ticker: GS

Market cap: $98.9B

Previous close: $300.05

Sector and industry: Financial Services; Capital Markets

Source: BMO Capital Markets

6. Morgan Stanley

BMO Capital Markets

Ticker: MS

Market cap: $121.2B

Previous close: $73.13

Sector and industry: Financial Services; Capital Markets

Source: BMO Capital Markets

7. Visa

BMO Capital Markets

Ticker: V

Market cap: $475B

Previous close: $233.38

Sector and industry: Financial Services; Credit Services

Source: BMO Capital Markets

8. Eli Lilly

BMO Capital Markets

Ticker: LLY

Market cap: $555B

Previous close: $584.64

Sector and industry: Healthcare; Drug Manufacturers

Source: BMO Capital Markets

Advertisement

9. Pfizer

BMO Capital Markets

Ticker: PFE

Market cap: $173.1B

Previous close: $30.65

Sector and industry: Healthcare; Drug Manufacturers

Source: BMO Capital Markets

10. Regeneron Pharmaceuticals

BMO Capital Markets

Ticker: REGN

Market cap: $87.8B

Previous close: $808.47

Sector and industry: Healthcare; Biotechnology

Source: BMO Capital Markets

11. Union Pacific

BMO Capital Markets

Ticker: UNP

Market cap: $128.8B

Previous close: $211.34

Sector and industry: Industrials; Railroads

Source: BMO Capital Markets

12. Waste Connections

BMO Capital Markets

Ticker: WCN

Market cap: $35.2B

Previous close: $136.45

Sector and industry: Industrials; Waste Management

Source: BMO Capital Markets

Advertisement

13. Advanced Micro Devices

BMO Capital Markets

Ticker: AMD

Market cap: $164.5B

Previous close: $101.81

Sector and industry: Technology; Semiconductors

Source: BMO Capital Markets

14. Salesforce

BMO Capital Markets

Ticker: CRM

Market cap: $198.2B

Previous close: $203.73

Sector and industry: Technology; Software

Source: BMO Capital Markets

15. Microchip Technology

BMO Capital Markets

Ticker: MCHP

Market cap: $41B

Previous close: $75.36

Sector and industry: Technology; Semiconductors

Source: BMO Capital Markets

16. Microsoft

BMO Capital Markets

Ticker: MSFT

Market cap: $2,430B

Previous close: $326.67

Sector and industry: Technology; Software

Source: BMO Capital Markets

Advertisement

17. Nvidia

BMO Capital Markets

Ticker: NVDA

Market cap: $1,020B

Previous close: $413.87

Sector and industry: Technology; Semiconductors

Source: BMO Capital Markets

18. Palo Alto Networks

BMO Capital Markets

Ticker: PANW

Market cap: $75B

Previous close: $243.10

Sector and industry: Technology; Software

Source: BMO Capital Markets

19. DuPont de Nemours

BMO Capital Markets

Ticker: DD

Market cap: $33.5B

Previous close: $72.98

Sector and industry: Materials; Specialty Chemicals

Source: BMO Capital Markets

20. Freeport-McMoRan

BMO Capital Markets

Ticker: FCX

Market cap: $48.6B

Previous close: $33.88

Sector and industry: Materials; Copper

Source: BMO Capital Markets

Advertisement

21. Entergy

BMO Capital Markets

Ticker: ETR

Market cap: $19.7B

Previous close: $93.08

Sector and industry: Utilities; Utilities

Source: BMO Capital Markets

22. NextEra Energy

BMO Capital Markets

Ticker: NEE

Market cap: $105.2B

Previous close: $51.96

Sector and industry: Utilities; Utilities