This leaked 2007 DoubleClick pitch deck is set to play a central role in Google’s blockbuster adtech antitrust trial

As Google prepares to travel to a federal court in Virginia to face down its adtech antitrust trial next week, a newly uncovered deck sheds new light on the 2007 DoubleClick acquisition that played a pivotal role in the growth of its advertising business.

The deck was obtained by adtech veteran Ari Paparo, CEO of Marketecture Media, which is producing “The Monopoly Report” newsletter to accompany Google’s adtech trial.

Paparo confirmed the document’s authenticity with two people with direct knowledge of the matter. (Paparo was a DoubleClick employee when the document was produced but didn’t have access to it at the time.) B-17 has separately confirmed the document’s authenticity with a person with direct knowledge. This person was granted anonymity amid the high-profile and active litigation. B-17 could not confirm with certainty whether this was a final draft. Five slides from a later version of the deck are also included in the trial’s exhibits, submitted by the plaintiffs in the case.

DoubleClick was pitching itself to potential suitors Yahoo, Microsoft, AOL, and Google — hence references to “YMAG” in the deck — all of which submitted bids for the company, according to a person with direct knowledge. Google won out, paying $3.1 billion in a 2007 deal that officially closed in March 2008.

The US Department of Justice and 17 states claim in their complaint that Google reached dominance in the $300 billion adtech and throttled competition by making key acquisitions and manipulating ad prices. The DOJ and the states are seeking a breakup of Google’s adtech business, which could have big ramifications on the broader digital ad market.

The case concerns the under-the-hood part of Google’s advertising business: The technology that connects advertisers with publishers and that runs the advertising auctions that take place in the milliseconds it takes a webpage to load.

Google didn’t provide a comment for this story. “We look forward to setting the record straight,” a spokesperson for the company told Reuters in June, when a judge ruled the case would go to trial.

Excerpts from the 49-slide pitch deck below outline how DoubleClick was positioning itself as a key asset to help a potential Big Tech acquirer become an advertising giant.

B-17 has analyzed how the 2007 document could become a central part of next week’s blockbuster trial, which is set to begin on September 9.

DoubleClick was pitching its business to the biggest players in adtech at the time: Yahoo, Microsoft, AOL, and Google.

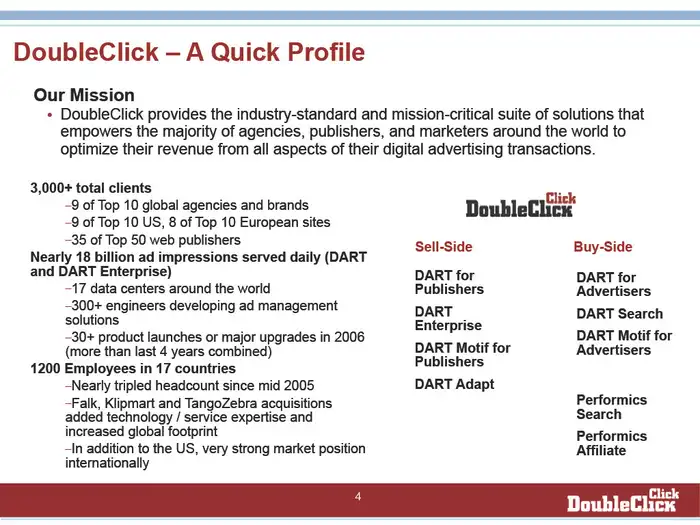

DoubleClick was the largest publisher ad server — technology that helps publishers manage their ad inventory and decide which ads should appear.

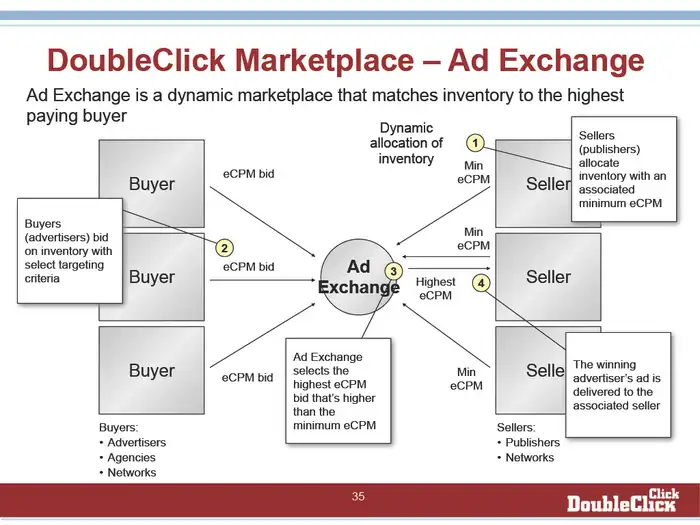

The DOJ claims in its suit that DoubleClick’s ad server had a roughly 60% market share at the time. It also owned a relatively new ad exchange called AdX that helped connect ad buyers and publishers in online ad auctions.

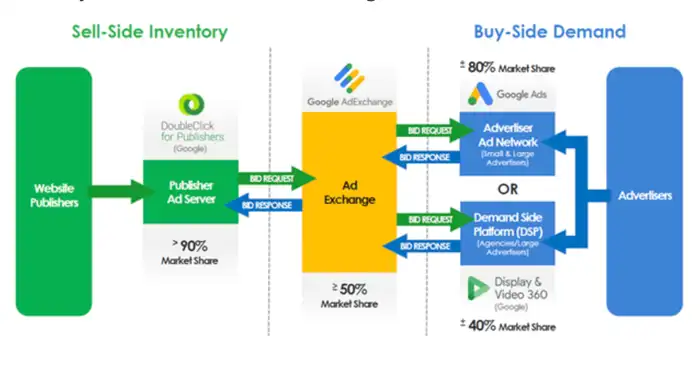

Here’s a slide from the DOJ’s complaint that maps out Google’s entire adtech business as of last year.

Post-acquisition, the DoubleClick assets later became Google Ad Manager, which the DOJ claims in its complaint has a roughly 90% share of the US publisher ad server market. The Google AdExchange grew to around a 50% market share, the DOJ says.

The Federal Trade Commission approved the Google-DoubleClick acquisition in 2007 after an eight-month investigation. The agency concluded that competition at the time among firms in the market was “vigorous, and will likely increase.”

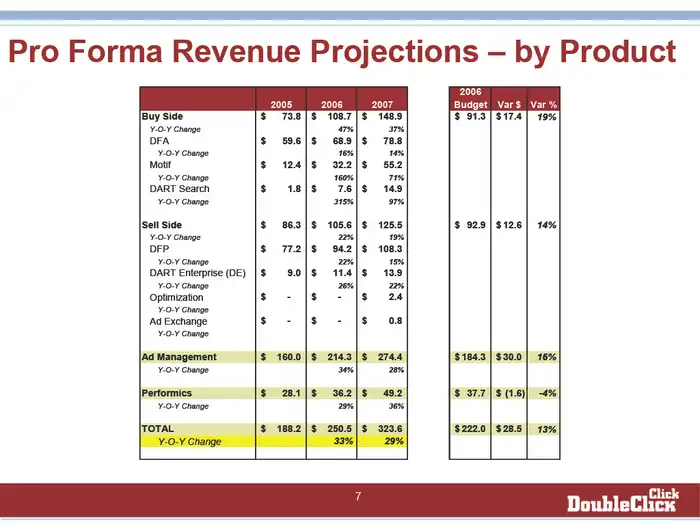

The entire DoubleClick business was projected to generate $323.6 million in revenue by the end of 2007.

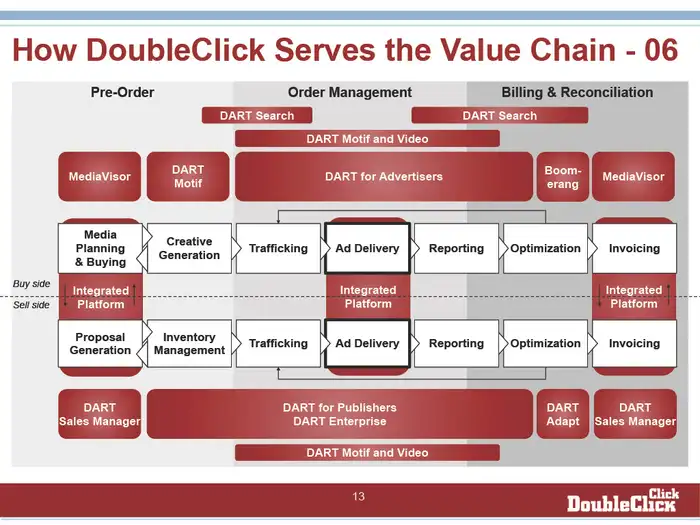

DoubleClick worked with advertisers, too. It positioned its offering as DART, which stands for Dynamic Advertising, Reporting, and Targeting.

The DOJ’s suit hinges on how through acquisitions, Google came to dominate both the publisher and advertiser side of the adtech stack — as well as the auction that takes place between them — and that it used that position to lock in its customers.

“Google feared that if a rival acquired DoubleClick, Google would not control all the tools that link Google’s advertisers with publisher inventory; in short, a rival could ‘disintermediate’ Google,” the DOJ says in its complaint.

The key phrase to look out for in this slide is ‘dynamic allocation.’

The phrase “dynamic allocation” appears 55 times in the DOJ’s complaint.

It refers to an auction mechanism where, the DOJ says, Google could configure its ad server to give its AdX ad exchange the first chance to buy a publisher’s ad inventory before it was offered out to rival ad exchanges — and at lower prices.

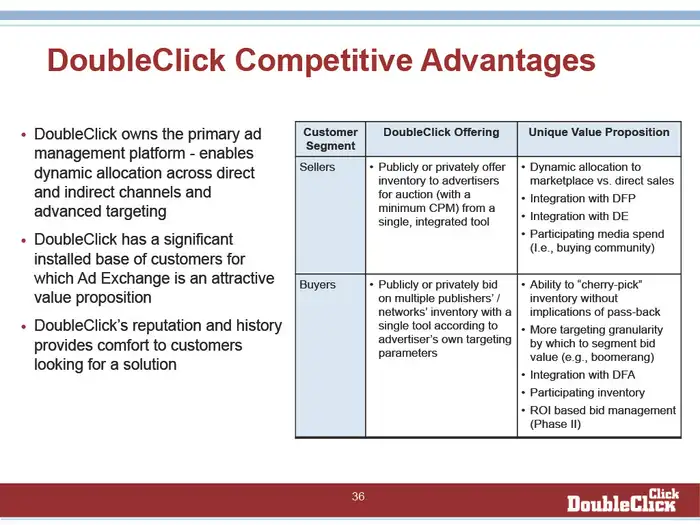

DoubleClick outlines that a competitive advantage was that its advertiser clients could ‘cherry-pick’ the best ad inventory.

“DoubleClick owns the primary ad management platform — enables dynamic allocation across direct and indirect channels and advanced targeting,” the DoubleClick sales pitch reads.

The DOJ says in the suit that Google programmed its ad server to prevent publishers from offering better terms to other ad exchanges beyond AdX. Dynamic allocation, the suit alleges, “predictably reinforced publishers’ dependence on both AdX and DFP.”

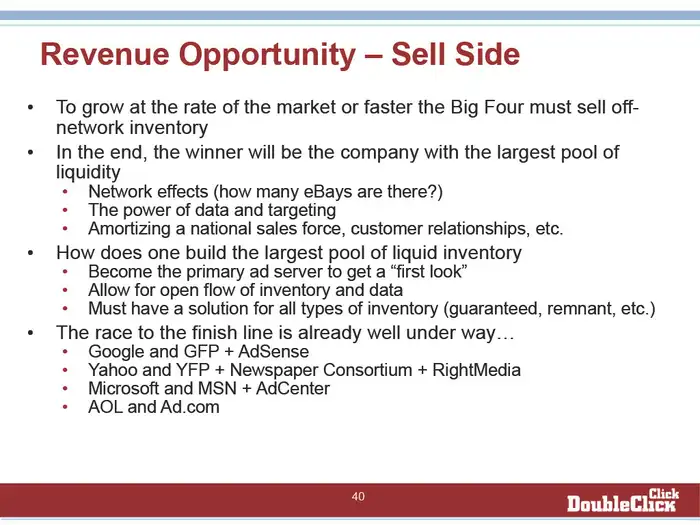

DoubleClick outlines the revenue opportunity for its eventual buyer as ‘a race to the finish line.’

“In the end, the winner will be the company with the largest pool of liquidity,” the slide reads. DoubleClick said the winner would achieve this by becoming the go-to ad server, by allowing for an open flow of ad inventory and data, and offering solutions for all types of different inventory.

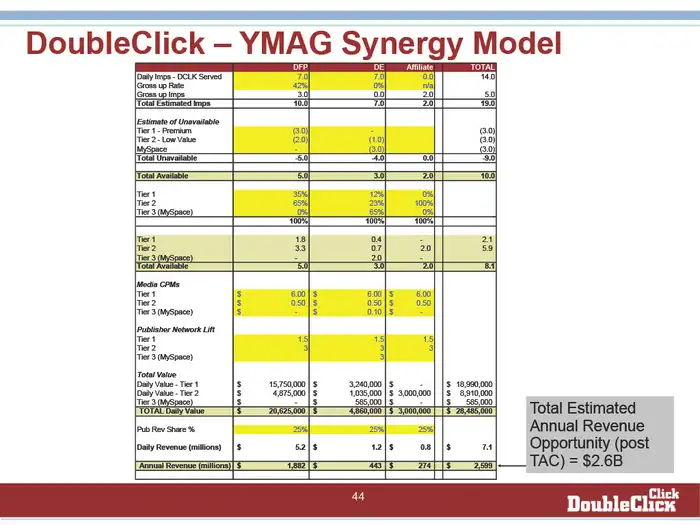

For Yahoo, which this particular deck was aimed at, the ‘total estimated annual revenue opportunity’ was $2.6 billion after the company had paid relevant traffic acquisition costs.

In 2020, Google’s Ad Manager, AdSense for Content, and DV360 adtech businesses generated $15 billion in gross revenue and $2.9 billion in net revenue, according to the published trial exhibits.

Industry analyst Brian Wieser, principal at Madison and Wall, estimated that Google had a nearly 50% share of the US ad server and exchange adtech market and around a third of the demand-side platform, or advertiser, side.