This startup wants to make nature a balance sheet-grade asset. Check out the 19-slide pitch deck The Landbanking Group used to raise $11 million.

- German startup The Landbanking Group wants to become a depository bank for nature assets.

- It creates balance sheet-grade assets from ecosystem uplifts, similar to carbon credits.

- We got a peek inside the 19-slide pitch deck it used to raise an $11 million seed round.

A climate fintech startup with the goal of making nature a balance-sheet asset has just received $11 million in seed funding.

In 2022, the Landbanking Group established a software platform for landowners and investors. The Munich-based startup assesses, verifies, and tracks land ecosystems using satellite monitoring, in-situ camera traps, and sound recordings, as well as machine learning.

The company then creates assets that are linked to natural uplifts such as increased biodiversity, water storage capacity, or the amount of carbon sequestered. These assets can then be sold to investors or corporations looking to decarbonize their supply chains.

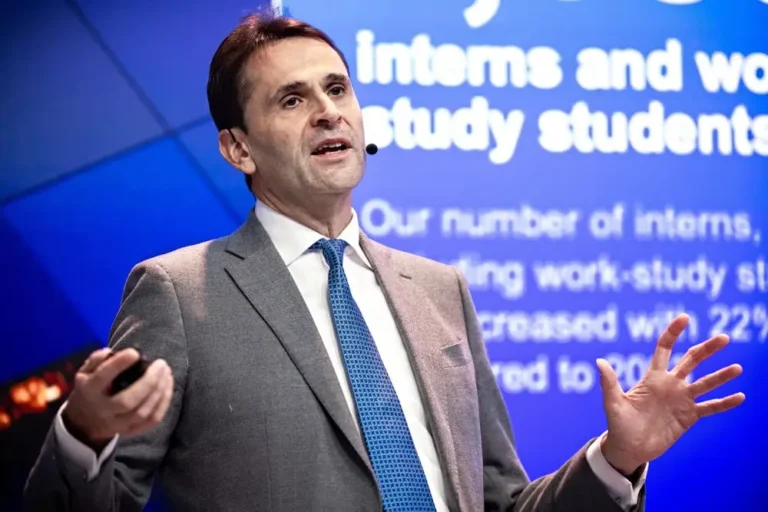

Martin Stuchtey, founder of sustainability consultancy Systemiq and former McKinsey senior partner, and serial entrepreneur Sonja Stuchtey created it. Ultimately, the couple hopes to increase investment in nature.

“Could it be that nature is our most important critical infrastructure?” Martin Stuchtey, a geologist and economist, stated. “Without it, an economy, a society, a business, doesn’t work.” As a result, it would be the only infrastructure category that is difficult to invest in for maintenance and expansion, he added.

Global ecosystem services, which include pollination, water purification, and carbon sequestration, are estimated to be worth $140 trillion per year. Due to the difficulty in monitoring and tracking these services, there has been a surge in interest in remote monitoring and verification technologies. Startups at the intersection of climate technology and fintech have also benefited from a surge in investor interest.

One solution is the voluntary carbon market, in which credits representing one ton of carbon emissions reductions or avoidances are bought and sold. However, in compensation markets, “you need to do harm first, before you have an incentive to actually engage with nature,” according to Stuchtey.

“And we saw that as neither philosophically nor practically nor politically right.”

The startup essentially expands on the concept of carbon credits. It uses “natural capital accounts” assigned to specific land areas to convert entire ecosystem data, rather than just carbon, into balance-sheet-grade assets. It records land use and improvements in areas such as carbon capture and habitat diversity.

When a specific result is achieved, it can be sold as an asset to investors, corporations decarbonizing their supply chains, offsetters, and insurers. The startup is then positioning itself as a depository bank where natural assets are held, exchanged, and settled.

The agri-food industry has been identified as the company’s initial market. A food company, for example, may support a farmer in its value chain to transition to regenerative agriculture, a concept known as insetting. This would strengthen the company’s resilience and reduce its climate risk, both of which must be disclosed under The Task Force on Climate-Related Financial Disclosures framework, which is followed by many countries.

Customers in the long run include energy, resource, and infrastructure companies, as well as insurers. For example, an insurance company could invest in a forestry project focused on wildfire mitigation strategies. This helps them in the long run because if a fire is less likely, they are less likely to have to pay out for damage to nearby homes or offices that they have underwritten.

BonVenture led the round, with participation from 4P Capital, Vanagon, and Planet A.

The additional funding will be used to expand the product. The company will automate the collection of remote monitoring and verification data, such as soil nutrient retention, that is currently collected manually, and will broaden its coverage of land types. Structured finance products will also be developed by the 40-person startup.