Trump promised to lower gas prices. His tariffs could have the opposite effect.

President Donald Trump’s plan to slap tariffs on Canada and Mexico as soon as February 1 threatens to undercut one of his key campaign promises: lowering prices at the pump.

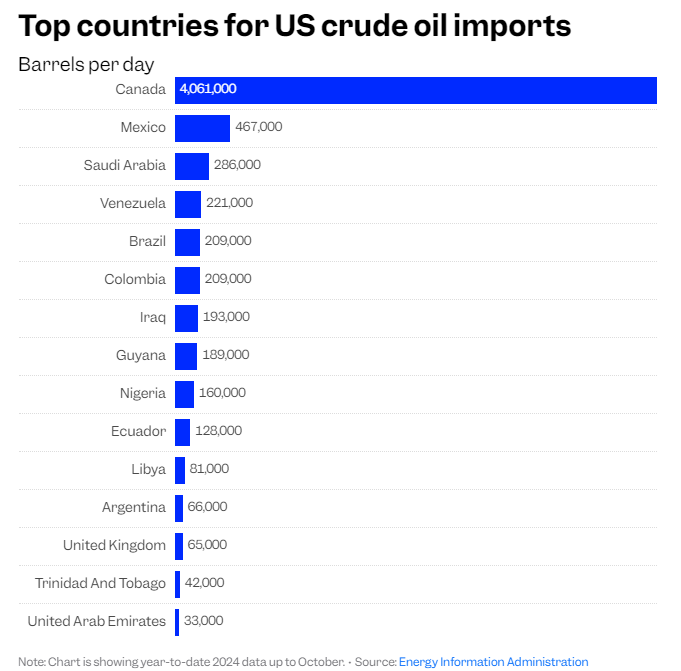

The US imports around 40% of the crude oil it refines into gas for your car and other vehicles. In 2024, about half of that came from Canada and 11% from Mexico. Economists told B-17 that slapping those imports with tariffs could strain consumers’ wallets at the gas station and have ripple effects across industries.

“Tariffs on crude oil is going to flow right through to the US consumer,” Ed Hirs, a lecturer on energy economics at the University of Houston, said. “Canada may absorb some of the cost, but the US will absorb a lot of it, too.”

Shortly after taking office, Trump said he could impose a 25% tariff on Mexico and Canada on February 1 as a way to push those countries to crack down on illegal immigration and drugs entering the US. White House spokesperson Karoline Leavitt on Tuesday said the plan “still holds.”

Trump told reporters on Thursday in the Oval Office that he’s still considering whether to include oil from Canada and Mexico in his tariffs.

Patrick De Haan, head of petroleum analysis at GasBuddy, told Fox Business on Thursday that consumers in the Great Lakes and Midwest regions would likely experience some of the largest impacts of tariffs. He said gas prices there could rise by more than 20 cents within days of the tariffs taking effect.

The US is producing record amounts of crude oil with domestic production amounting to about 60% of crude refined in the US, per the Energy Information Administration. But many refineries aren’t equipped to process the light crude from US shale basins, Hirs said. Refineries in states like Michigan, Wisconsin, and Indiana rely on heavy crude from Canadian oil sands and it would be costly and time-consuming to convert the technology.

Hirs said it’s difficult to predict how much prices will rise, in part because it depends on what OPEC+ does. The oil cartel has been postponing production increases to boost global prices. Trump has called on OPEC+ to slash prices, and ministers meet on February 3 to discuss his demands.

Even if crude prices rise, Hirs said the signal won’t be strong enough for US drillers to boost production. US refineries that handle domestic crude already have more than enough supply.

“Tariffs that increase costs but lower revenue are going to be poisonous for the US oil industry right now,” Hirs said.

The American Petroleum Institute, which lobbies on behalf of the US oil and gas industry, is opposed to additional tariffs. The group in December asked the Trump administration’s top trade official to exempt crude oil and natural gas from levies because they would “directly undermine energy affordability and availability for consumers while eroding the U.S. oil and natural gas industry’s competitiveness both domestically and globally.”