Trump’s trade plan could mean higher prices, and avoiding the impact won’t be simple

Welcome back! As Black Friday deals start rolling in, you might be looking to update your wardrobe. Before you buy any shoes, check out what trends stylists say are in (and out) this season.

In today’s big story, Trump’s trade plans could spell trouble for prices, and preparing for it isn’t so easy.

What’s on deck:

- Markets: Everything you need to know about Scott Bessent, Trump’s pick for Treasury secretary.

- Tech: Amazon is coming for Nvidia’s chip dominance with its latest Anthropic investment.

- Business: D.C. lobbyists are preparing to set up shop in the Sunshine State.

But first, get it while the gettin’s good.

The big story

A Trump bump on prices

It’s beginning to look a lot like tariffs.

With less than two months until the presidential inauguration, the potential impact of one of President-elect Donald Trump’s key proposed policies is getting increased attention.

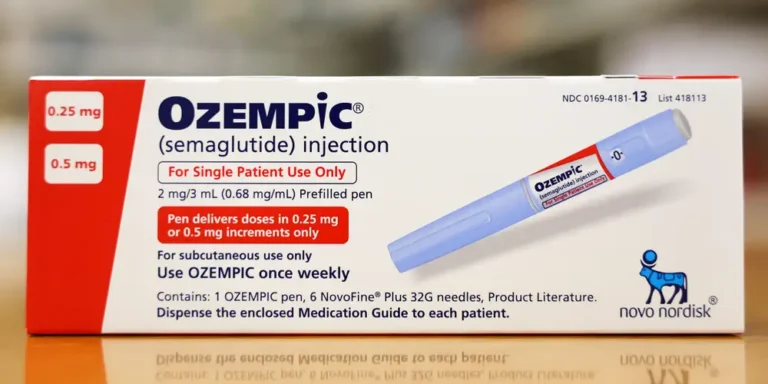

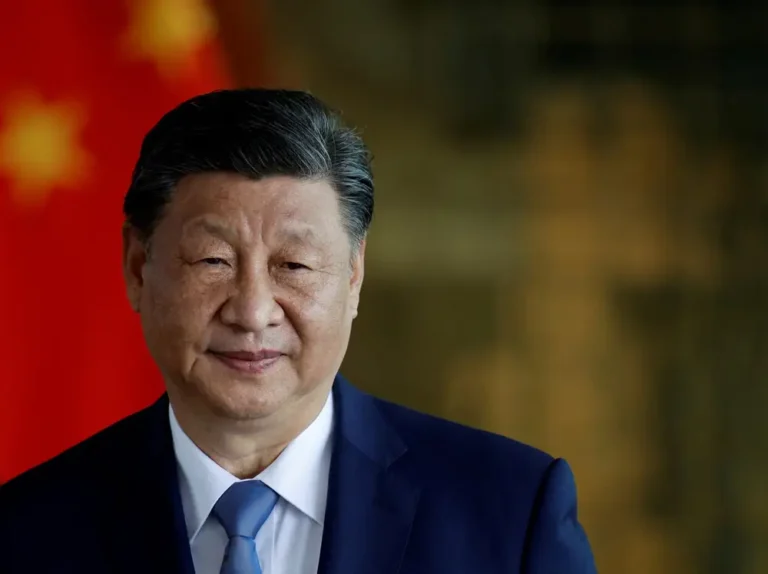

Businesses are starting to telegraph what wide-ranging tariffs — 60% on goods from China and as much as 20% on imports from everywhere else — will mean for their customers. (Hint: They’re going to raise prices.)

B-17 dove into Trump’s crackdown on imports and how consumers can prepare.

The prevailing theory among many economists is Trump’s plan will increase prices and inflation as companies pass the cost of the taxes down to their customers.

We’re already starting to see that play out. AutoZone CEO Philip Daniele didn’t sugarcoat it on a September earnings call: “We will pass those tariff costs back to the consumer.”

Walmart wasn’t as direct, but CFO John David Rainey said last week that the retail giant, which imports a third of its products, would “probably” raise prices in some cases.

There’s also a chance prices could increase for stuff not even impacted by the new taxes. As was the case with inflation a few years ago, tariffs are a convenient cover for companies to raise their prices and enjoy a boost to their profits.

With so much uncertainty, consumers don’t have a ton of options to prepare for tariffs.

Some economists told Emily that buying big-ticket items sooner rather than later could be beneficial. Electronics, furniture, and cars are among the items expected to be impacted.

But it’s a tricky balance considering nothing is official. Trump hasn’t wavered from his trade plans, but some still question how realistic they are.

Nobel laureate Simon Johnson said the tariffs won’t be as extreme as initially advertised. He told B-17 he views them more as a negotiation tactic with China and American companies with operations there.

And trying to get ahead of supply-chain issues can sometimes put you in an even bigger hole.

As the threat of port strikes loomed earlier this year, Target rerouted shipments to ensure it wouldn’t run out of products. The strike ended after only a few days, leaving the retail giant with a surplus of inventory that proved difficult to move.

While he didn’t regret doing it, Target CEO Brian Cornell partially blamed the entire episode on helping to drag down its third-quarter earnings result.

3 things in markets

- Baby boomers’ retirement regrets. Nearly 1,200 older Americans shared with B-17 their regrets when it came to saving and investing for retirement. From taking Social Security too early to not being prepared for unexpected setbacks, like divorce or a cancer diagnosis, here’s what boomers wish they’d done differently.

- The Treasury pick is in. Scott Bessent is a billionaire investor who spent years working for George Soros before starting his own hedge fund. The 62-year-old has shown support for Trump’s proposals around tariffs and deregulation.

- Dreaming of a bitcoin-backed US. Crypto bulls are eager to see Trump establish a “bitcoin strategic reserve,” which enthusiasts believe could help manage the country’s debt. Still, some experts told B-17 they foresee obstacles to making it a reality.

3 things in tech

Bluesky has surpassed 21 million users.

- Bluesky’s COO talks crazy growth — and growing pains. Rose Wang, the platform’s chief operating officer, told B-17 that the network’s 20-person team is in “firefighting mode” as it races to accommodate the sudden influx of new users. Bluesky blew past user growth projections so much that it’s racing to get new servers to keep it up and running.

- TSMC’s Phoenix chip factories aren’t a silver bullet. The move will boost chip production in the US, but not enough to end its reliance on Taiwan. Sector experts told B-17 the massive chipmaker will continue to make its most advanced tech in Taiwan.

- Amazon makes a massive downpayment to dethrone Nvidia. The cloud giant announced it was investing another $4 billion into AI startup Anthropic. It’s an all-out assault on Nvidia, which dominates the AI chip market, as Amazon aims to get developers to move away from using Nvidia GPUs.

3 things in business

- Concert math = big shows or bust. Stadium tours for mega stars like Beyoncé and Taylor Swift sell out within minutes. But thanks to a slowdown in post-pandemic revenge spending, tickets for smaller artists are going unclaimed as fans opt to save their money for once-in-a-lifetime shows. The result? R.I.P. mid-tier concerts.

- The new K street. Ahead of Trump’s return to the White House in January, a dozen leading lobbyists told B-17 that having a significant presence in Florida is now an essential part of doing business in Washington. The consensus among lobbyists is that they’ll also have to ditch their cookie-cutter tactics if they hope to influence Trump this time around.

- Could these federal workers be caught in DOGE’s crosshairs? Elon Musk and Vivek Ramaswamy’s government-efficiency commission wants to cut the headcount at several federal agencies. See the 20 federal jobs that make the most money — all of which have average salaries of more than $160,000.