TSMC’s Phoenix chip factories likely won’t erase the US’s reliance on Taiwan

Some US businesses could rely on TSMC chips made in Taiwan for the foreseeable future.

Some US businesses are likely to continue depending on TSMC chips made in Taiwan for the foreseeable future, even as the company builds factories in Arizona.

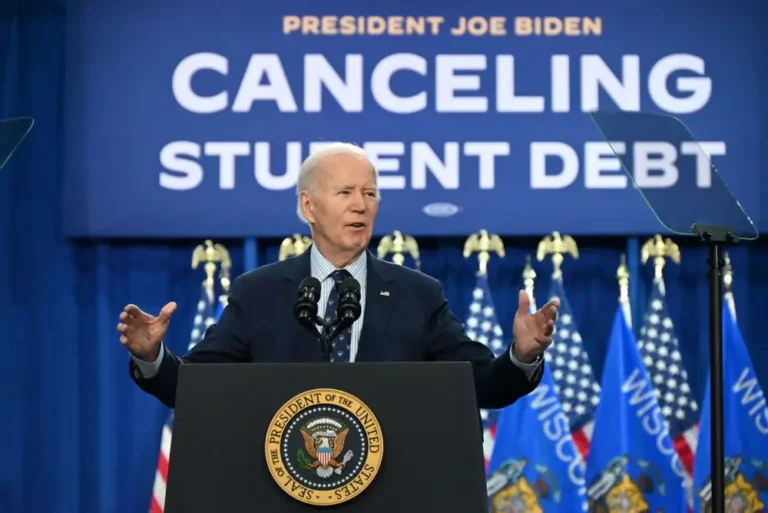

On November 15, the Biden administration announced that the Commerce Department had awarded TSMC — the world’s leading chipmaker — with up to $6.6 billion in funding to aid the construction of three chip factories in Phoenix. The first factory is expected to begin full production levels in early 2025.

In a press release, the Biden administration said the announcement was “among the most critical milestones yet” in the implementation of the CHIPS Act. Supporters of the law hope it will create US jobs, secure supply chains, and make the US less reliant on advanced chips from Taiwan — which faces the possible threat of a Chinese invasion. TSMC produces an estimated 90% of the world’s advanced chips, which power everything from iPhones to cars.

While TSMC’s Phoenix factories are expected to boost semiconductor chip production in the US, the company isn’t making its most advanced chips stateside, industry experts told B-17.

Jeff Koch, an analyst at the semiconductor research and consulting firm SemiAnalysis, told B-17 that chips made in TSMC’s US factories are expected to be one to two levels behind the company’s more advanced Taiwan-made chips. For example, chips produced using 4 nanometer (nm) technology are expected to be made in the first Phoenix factory, while TSMC’s Taiwan factories are already producing chips using 3nm technology. The smaller the nanometer number, the more transistors manufacturers can fit on a chip, making it more powerful and energy-efficient.

While 3nm chips are expected to be produced in TSMC’s second Arizona factory — which is slated to begin full production in 2028 — Koch said this would likely come after the production of 2nm chips begins in Taiwan, which is estimated to happen next year, according to TSMC.

Stephen Ezell, the vice president for global innovation policy at the Information Technology and Innovation Foundation, told B-17 that by the time TSMC’s Phoenix factory starts making 2nm chips, he’d expect the company to be producing even more advanced chips in Taiwan.

“The United States will be dependent on chips from Taiwan for a long time to come,” he said. “Even if the CHIPS Act is wildly successful, it’ll barely get the US back to 17% to 20% of global chip production.” The US currently produces about 10% of the world’s chips.

The Department of Commerce told B-17 that as TSMC’s Arizona fabs become operational, it expects to see the production of TSMC’s most advanced chips transition into the US over the coming years.

TSMC declined to comment on whether the company’s most advanced chips will continue to be produced in Taiwan.

Keeping TSMC’s most advanced chips in Taiwan gives the island leverage

Companies that prefer to use the most cutting-edge technology — like Nvidia, Apple, Qualcomm, and AMD — will likely continue to source chips from Taiwan, said Chris Miller, a nonresident senior fellow at the American Enterprise Institute who focuses on semiconductors.

“I think TSMC’s plants in Arizona are significant, but given current policies and investment trends, the US will be using large volumes of chips made in Taiwan for many years into the future,” added Miller, who is the author of “Chip War: The Fight for the World’s Most Critical Technology,”

TSMC’s most advanced chips are made first in Taiwan, in part, because that is where the company conducts its research and development — which makes it easier to roll out more sophisticated technologies. Additionally, keeping that level of production in Taiwan could help the island retain its essential role in the chipmaking industry, which is crucial to the global economy, Koch said.

He added that this dynamic could make the US more likely to provide Taiwan with military support if China invaded.

“It’s very unlikely that the Taiwanese government would allow TSMC to build its most advanced fabs in the US without a few years’ lag,” he said, adding, “This is Taiwan’s most valuable strategic capability. Without it, extracting a US security guarantee or support from the Trump administration goes from hard to impossible.”

William Alan Reinsch, a senior advisor at the Center for Strategic and International Studies, a national security think tank, told B-17 the Biden administration’s goal was to boost domestic chip production — not to completely erase US businesses’ reliance on foreign-made chips.

What’s more, efforts to develop and foster the US semiconductor industry could help protect America’s supply chains from geopolitical events, even if some US businesses continue to source chips from Taiwan.