Volatility, higher rates, and surging bitcoin. Here’s what analysts are saying about Trump’s victory.

Analysts say Donald Trump’s victory ushers in a new era for US economic policy.

Donald Trump’s victory is set to herald a new era of higher inflation, tighter monetary policy, and surging cryptocurrencies, analysts said in initial reactions to the presidential election result.

The economic impact of Trump’s second term is likely to be volatile, said Lindsay James, investment strategist at UK-based Quilter Investments.

“While he, and others that surround him such as Elon Musk, want to cut the size of the state, public spending is likely to remain very high and taxes kept low,” she added.

“Many of his measures will be inflationary and likely to lead to a rise in bond yields, putting pressure on the Federal Reserve in its quest to bring interest rates down.”

The Federal Reserve cut rates for the first time in four years in September, and is expected to cut again at its November meeting on Thursday.

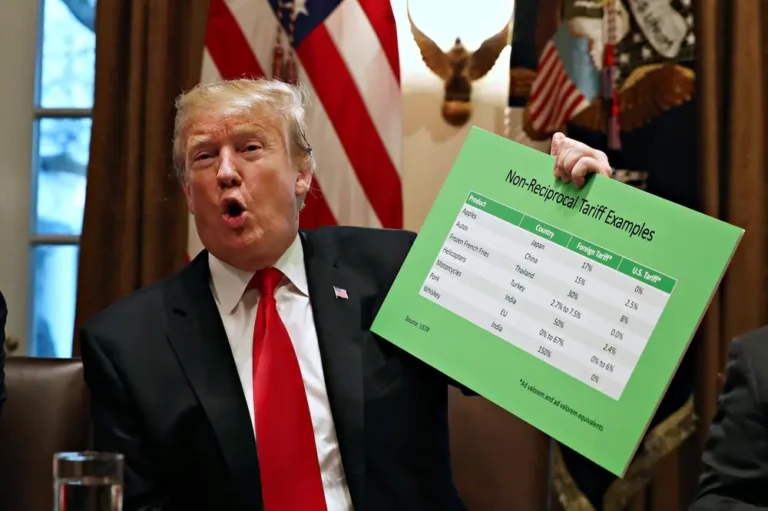

However, such cuts could be shortlived if Trump’s trade policies, which include proposed near-universal tariffs, prove to be inflationary as expected.

Thomas Matthews of consultancy Capital Economics wrote: “We suspect that the more important story for the bond market is just the inflationary effect of Trump’s policies, including the tax cuts but also the tariffs and immigration reductions, all of which would be likely to result in a higher path for the federal funds rate.”

Analysts at Dutch lender Rabobank shared that view, suggesting that the Fed could raise rates early next year.

“On the assumption that Trump will move to increase some tariffs relatively quickly, it is Rabobank’s view that the Fed’s easing cycle could be over early next year as policymakers react to the inflationary implications of tariffs,” they wrote.

This should keep the US dollar strong through 2025, while concerns about the potential impact of his policies could subdue the euro, Rabobank’s analysts added.

“While it will take time before the markets have the information needed to develop a strong narrative on the impact of Trump’s agenda on the international economy, the domestic inflationary impact of his policy does suggest a stronger dollar through 2025.”

Analysts at Swiss lender UBS took a different view, saying they expect the Fed to keep lowering rates through 2025.

“We expect the Fed to continue to move toward a neutral policy stance, and we do not expect it to immediately change its outlook given high uncertainty around policy execution remains,” Solita Marcelli, the chief investment officer of UBS’ wealth management business in the Americas, wrote.

UBS’s base case for rate cuts includes a 25-basis-point cut on Thursday, another in December, and 100 basis points of cuts in 2025.

“At the margin, the Fed may slow the pace of rate cuts if it perceives that changes to migration, trade, or fiscal policy may lead it to fear higher inflation,” Marcelli wrote.

Bitcoin could hit $100,000

One asset that analysts expect to surge in the wake of Trump’s victory is bitcoin, which rallied sharply early on Wednesday morning.

“Bitcoin is the one asset that was always going to soar if Trump returned to the White House,” wrote Russ Mould, investment director at online trading platform AJ Bell.

The victory has “fired up traders to speculate when, not if, it will smash through $100,000,” he added.

“Trump has already declared his love of the digital currency and crypto traders now have a new narrative by which to get even more excited about where the price could go.”