We got an exclusive look at the AI dashboard VC firm TRAC uses to help its startups raise new funding

TRAC uses an algorithm to pick all of its startup investments. The firm says its

AI-powered VC firm TRAC doesn’t have the same firepower that some other VC firms do. It’s only four years old, writing checks up to $2 million a pop, and never leads funding rounds.

But, like all VC firms, TRAC still wants to bet on the best startups.

Unlike other VC firms, though, TRAC uses AI to pick all of its investments. To get into more of those highly coveted deals, it provides founders with a piece of its algorithm.

Once TRAC invests in a startup, the firm makes its portfolio company a custom “intelligence dashboard” using its algorithm, with tools that help a company more accurately value itself and direct the startup to new investors.

The firm has been building the tech for 10 years, according to TRAC founder and partner Fred Campbell.

“For us, it does one thing really well — it helps us get into every deal we want to get into,” Campbell said.

Legacy, an at-home sperm testing startup that TRAC first backed in July, shared a copy of its own dashboard with B-17.

Legacy founder and CEO Khaled Kteily said Campbell demoed TRAC’s dashboard on their first call. Kteily said he found the software “powerful.”

Campbell said his founders always find the dashboard most helpful when they’re looking toward their next raise.

“The reality is, every single portfolio company will use this when they’re thinking about fundraising,” he said.

Here’s an exclusive look at the AI tools powering TRAC’s founders.

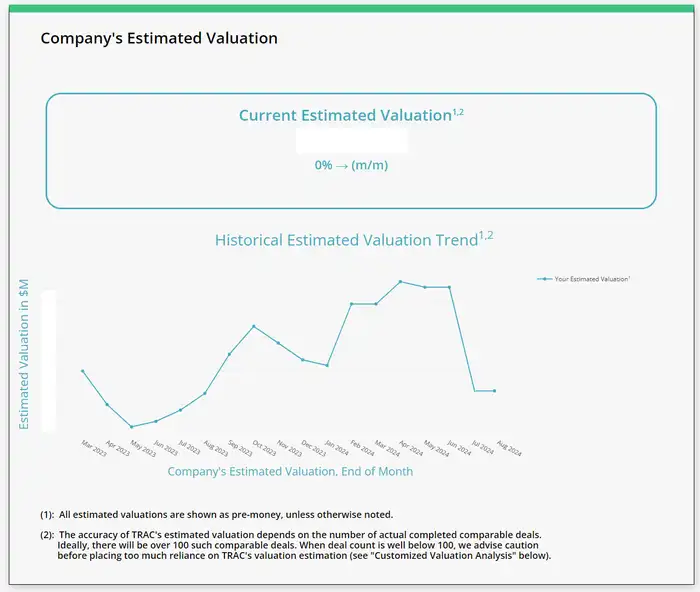

TRAC’s software can estimate a company’s “real” valuation and map it over time.

TRAC’s valuation estimation tool.

The first tool in TRAC’s dashboard estimates a company’s valuation and tracks it over time.

The firm uses comparable deals, raises from TRAC’s direct and indirect competitors at a similar stage, as well as the portfolio company’s metrics like its total capital raised, to help calculate that valuation.

“As a founder, one of the strangest parts of the process is figuring out how much to raise and at what valuation. None of it makes any sense,” Kteily said.

He said that, when Legacy raised its most recent round, TRAC’s estimated valuation was within $3 million of what TRAC actually landed in the fundraise.

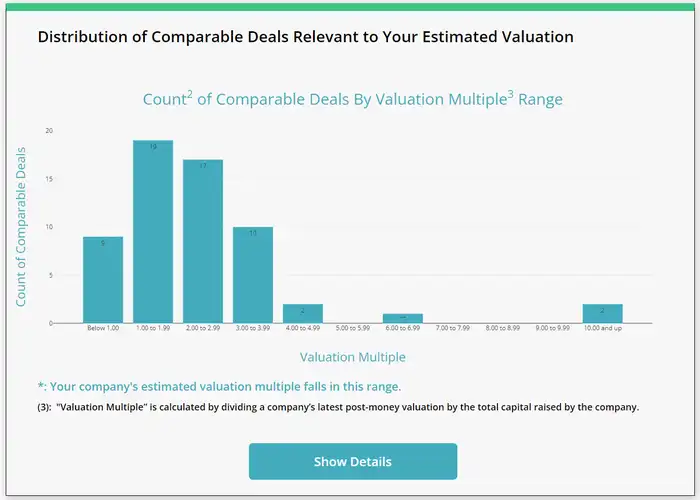

The dashboard compares the company’s valuation multiple with the valuation multiples of comparable deals.

TRAC compares a company’s valuation multiple with the valuation multiples of comparable deals.

The dashboard also helps founders see where their valuation multiple stacks up to the valuation multiples of competitors.

Because private companies rarely share revenue information, TRAC calculates these competitor valuation multiples by dividing their latest post-money valuation by the total amount of money they’ve raised.

An additional tool, which has been redacted from this story, shows what valuations and multiples Legacy’s big-name competitors in fertility care received when they were at Legacy’s stage.

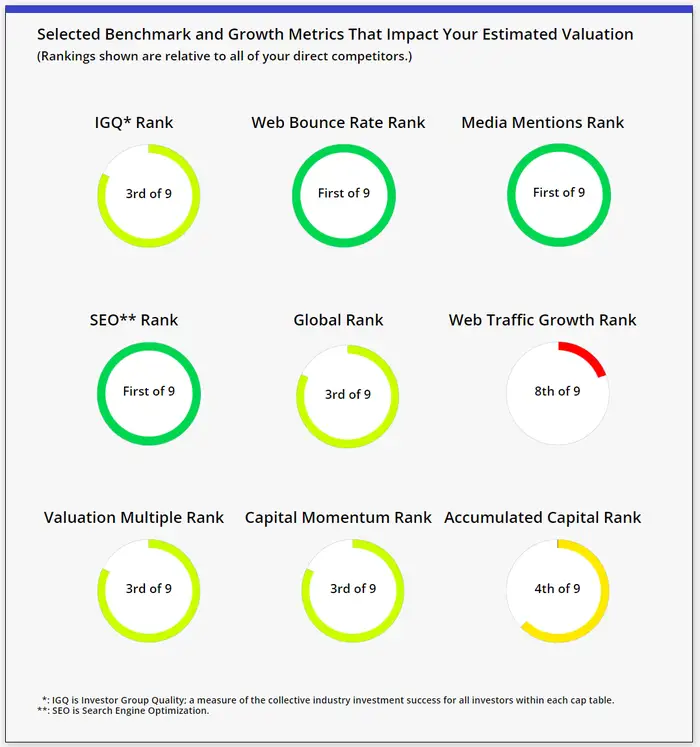

Founders can see how TRAC’s AI ranks their company on certain metrics relative to their competitors.

TRAC shows the company where it ranks on certain metrics relative to its competitors.

To determine which startups to invest in, TRAC’s algorithm ranks companies on a number of metrics — the quality of their existing investors, how much traffic their website is getting, and other characteristics.

The dashboard for its founders, in turn, shows portfolio companies how they measure up on those metrics against their competitors.

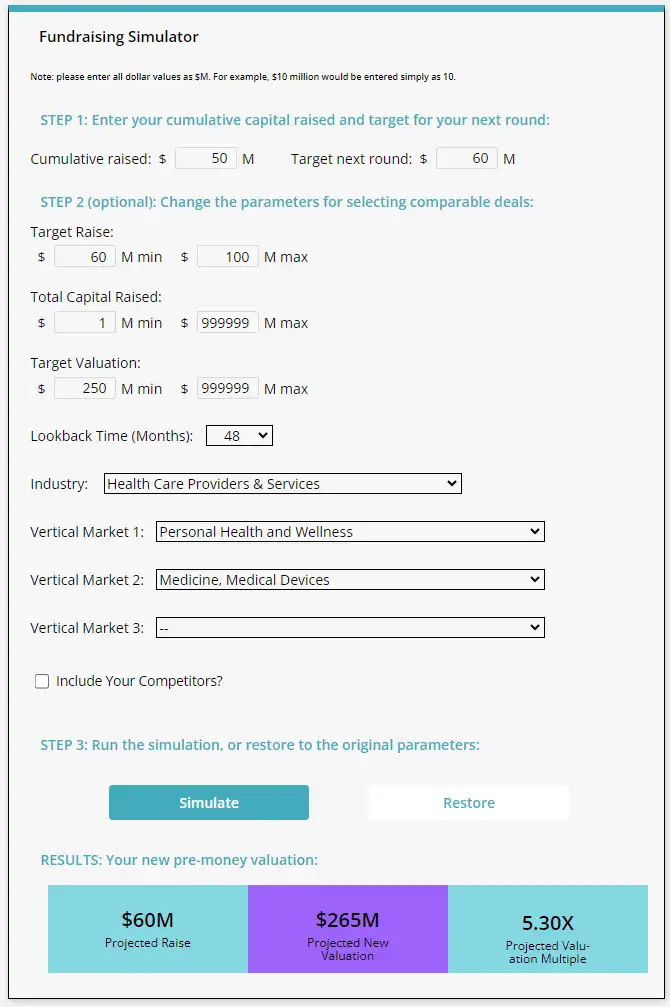

Founders can test out different capital and valuation targets in TRAC’s fundraising simulator.

TRAC allows founders to run fundraising simulators to test out different conditions.

TRAC’s estimated valuation tool can help founders “back into” how much money they should raise and at what valuation, Kteily said.

To make it even simpler, portfolio companies can also play around with the dashboard’s fundraising simulator.

The simulator can take into account how much money a startup has already raised, what valuation it may hope to notch, and what vertical it’s in, among other factors.

When a startup is ready to raise more money, TRAC’s tool shows them what investors are already in their network.

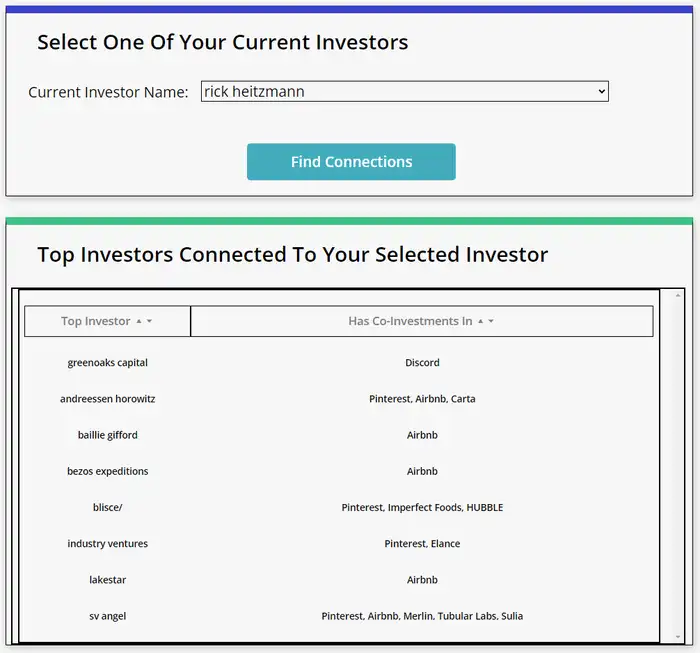

TRAC’s connected investors tool.

One of the dashboard’s key tools helps founders hone their outreach to new investors.

The table lets founders pick one of their existing investors to see what other firms or individuals that investor has previously made bets alongside.

Rick Heitzmann, one of Legacy’s existing investors, has co-invested with top VC firms including Andreessen Horowitz, according to TRAC’s tool.

Kteily said these capabilities will be extremely helpful to him when Legacy goes to raise more money — “Otherwise, you’re doing all of this manually.”

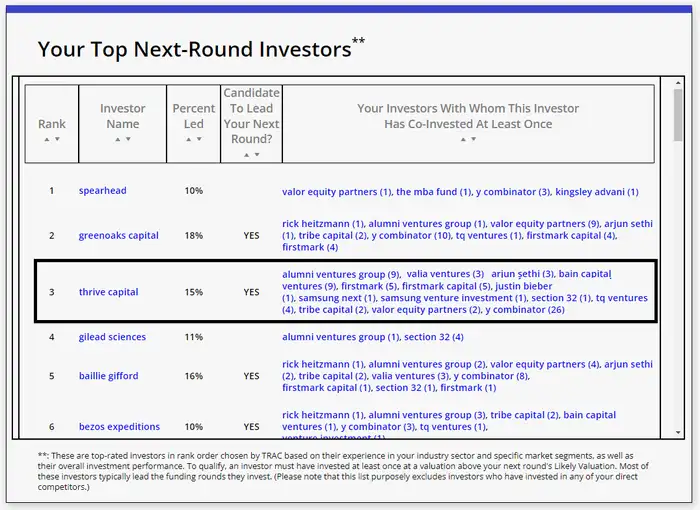

The dashboard also highlights investors who would be good candidates to lead a startup’s next fundraise.

TRAC’s tool shows founders who might lead their next round.

Cold reach-outs are generally frowned upon in the VC world. Founders always want to connect with new investors through their existing investors, or through other founders already in an investor’s portfolio.

TRAC’s dashboard makes it easier for its portfolio companies to do just that, while also narrowing down which investors could actually lead their next round, based on what percentage of rounds they’ve led in the past.

Kteily called this particular tool “fantastic.” He said knowing which investors to reach out to also reduces the burden on his existing investors, whom he might otherwise call up and ask what firms could be good fits.

Another table not shown here lists the investors behind the startup’s direct competitors. Founders should stay away from taking meetings with those investors, Campbell said, in case those VCs are just digging for competitive information.

“This is a founder’s shield against unscrupulous VCs,” Kteily said.