We heard from 1,000 older Americans: Here are some of their biggest regrets

Older Americans said they wished they had saved more for their retirement and emergencies.

Over 1,000 Americans between the ages of 48 and 90 told B-17 their biggest regrets in life. Those insights show how perplexing retirement and planning for it can be.

Responses to an opt-in B-17 reader survey, along with interviews with 20 respondents, show that preparing for retirement while juggling life’s many obstacles is often a trial-and-error process. Many said they couldn’t crack the code on balancing how much to save, where to invest, when to retire, and how to be fiscally responsible when raising a family. Others said they took Social Security too early or didn’t pursue career opportunities that may have led to higher pay.

Janis Carroll, 79, said she was in the middle class for much of her life and made decent wages, but she is now struggling to live comfortably on about $25,000 in Social Security each year and $35,000 in savings.

Though she retired over a decade ago with enough to get by, she said not being more savvy with investing, moving too frequently, and draining an IRA account to buy a home she lost $50,000 on have contributed to her fears about the future. She’s considered returning to work, but she’s worried it would be too physically and mentally taxing.

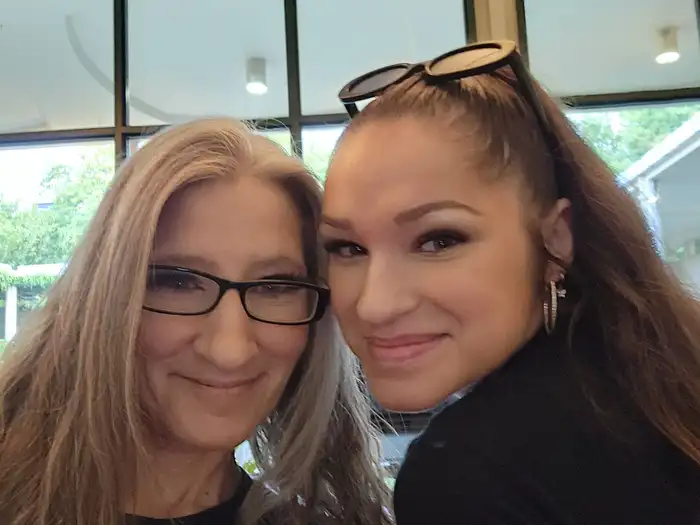

Janis Carroll wishes she was more proactive about her retirement.

“I don’t have the money to go to the movies or go anywhere,” said Carroll, who lives in Eugene, Oregon. “I have no idea what’s going to happen to me if I’m going to have an emergency.”

The median 55-year-old has less than $50,000 in retirement savings, according to a Prudential survey — which was conducted by Brunswick Group between April and May and interviewed 905 Americans ages 55, 65, and 75. According to the National Council on Aging and the LeadingAge LTSS Center, which analyzed the data of 11,874 households from the Health and Retirement Study, nearly 50% of Americans 60 or older say they have household incomes below what’s necessary for meeting their basic needs.

To be sure, three in four retired Americans say they have enough money to live comfortably compared to less than half of non-retirees, according to a Gallup poll conducted in April which surveyed 1,001 people and was published in August.

Many respondents’ regrets are partially out of their control, from a cancer diagnosis disrupting financial stability to an unexpected divorce or layoff.

B-17 analyzed over 1,000 responses to a callout in previous stories asking about older Americans’ life regrets, in addition to dozens of emails reporters received, to determine four of the main regrets they have about their lives.

We want to hear from you. Are you an older American with any life regrets that you would be comfortable sharing with a reporter? Please fill out this quick form.

1. Not saving enough for retirement

After navigating various job losses and undergoing cancer treatments, Jan Hoggatt, 69, is unsure she can ever retire and works part-time.

“I wish I hadn’t assumed I’d be able to work into my 70s,” said Hoggatt, who lives in the St. Louis suburbs and receives about $1,800 monthly in Social Security.

Jan Hoggatt works part-time to supplement her retirement income.

She regrets not better preparing financially for an emergency, adding that she never knew exactly how to go about saving for retirement or what resources were available.

Dozens, like Hoggatt, remarked that their parents, employers, or professors never taught them investing basics, adding that there weren’t many accessible resources for financial planning in their early careers. Some described saving for retirement as a trial-and-error process, noting that they wished they had worked with a financial advisor or taken courses on growing their wealth.

Meanwhile, nearly every respondent wished they had saved more for retirement. Many said they lived too much in the moment and didn’t consider putting money into retirement accounts or investments throughout their lives.

Respondents also commonly thought they would be able to survive on Social Security once they retired and wouldn’t need hefty savings. Well over a quarter said they have little savings and receive between $1,000 and $2,000 monthly in Social Security, forcing some to work part-time jobs or move into low-income housing.

“The benefits that we’re providing for people as they age are not keeping up with the cost of living,” Jessica Johnston, senior director for the Center of Economic Wellbeing at the National Council on Aging, told B-17. She added that the asset limit people can have to receive Supplemental Security Income, which is $2,000 for individuals and $3,000 for couples, hasn’t changed since 1989.

To be sure, dozens said they rarely had enough money to set aside each week for retirement savings. A few dozen said they were single parents working two or three jobs to put food on the table. Others went on disability earlier in life and had only enough income to pay rent.

2. Making mistakes during the retirement process

Hundreds wrote that they were lost on how much to save, what to invest in, when to retire, and what to do financially during retirement. A few dozen wished they had more guidance on what pitfalls to avoid, how to live comfortably after working for decades, and what to do when a spouse dies.

Steve Watkins and his wife both worked for 50 years at their respective employers and retired with enough to live comfortably. Then his wife died in January.

Watkins, 74, receives about $3,100 a month in Social Security and has more than $1 million in savings. However, Social Security rules dictate that he cannot collect his wife’s $1,300 monthly benefits because her amount is lower than his. That lack of income worries him, as he doesn’t know how long his savings will finance his remaining years.

“You either have to go get another job to make up for it or suffer by losing that amount of money,” said Watkins, who lives outside Los Angeles.

Over two dozen respondents said they claimed Social Security too early and received less money each month than if they had waited until their full retirement age to collect more. Some had to collect Social Security early because they needed the money, though others didn’t realize how much more they could get if they waited.

Americans can collect Social Security as early as age 62, though benefits are reduced until reaching the full retirement age of either 66 or 67, depending on your birth year. People can delay taking their benefits until 70, which increases the amount.

Similarly, dozens regretted retiring too early without an insufficient nest egg. Then, they needed part-time work to supplement their Social Security payments. A handful noted that even though they waited until 65 to retire, they wished they had delayed retirement until 70 to pad their accounts and feel more financially secure.

3. Not making the right career choices

Along with not saving enough, hundreds of respondents said they should have been more aggressive during their careers to secure higher-paying roles.

Dozens said they stayed too long in dead-end jobs and avoided developing marketable skills. More than 100 respondents said they wished they had gone into higher-paying sectors or applied for more prestigious positions where they could have made more money.

Those in corporate positions wished they had tried harder to get promoted instead of settling. Over two dozen wished they had networked more outside their companies in case of job loss; many said they’re now facing unemployment in their 50s and 60s.

At least a dozen said they should have stayed more up-to-date on the skills necessary for securing new positions, such as new coding languages or online tools.

Alternatively, some wished they had been less ambitious. A few dozen regretted leaving stable careers to start businesses, some of which failed and put their founders in the red. Michael R., 70, told B-17 he lost over $650,000 in savings and had to declare bankruptcy after his New York-based business crashed during the 2008 recession. He asked to use partial anonymity due to privacy concerns.

4. Not prioritizing education enough

Hundreds of respondents wrote they should have pursued education more. Though a few dozen said they lacked the money to attend higher education institutions — or were not told about the benefits of college — those with the means wished they had gotten an associate’s or bachelor’s degree to better prepare for the workforce.

However, respondents were divided over student loans. Over two dozen said they regretted not attending college and taking out loans to pursue higher education, as it may have opened more doors for them. Another dozen wished they took out fewer loans or worked throughout college to fund their tuition. These people are still paying off loans from 50 years ago.

To be sure, at least a dozen said they regretted attending college and not going into the workforce immediately. They said college didn’t prepare them well for more advanced careers.

A few said they went to college later in life, which opened more doors for them professionally, though they said it was difficult attending classes while juggling a job and raising children. Still, many said this decision was fulfilling for advancing their careers.

Carol Brownfield, 48, is going back to community college to become a therapist counselor. The Washington resident said she has lots of experience, from running a casino and resort, though she wanted to “better myself and do what I want to do.”

Carol Brownfield is going to college at 48.

“Going back to school is for a career that pays better and just matches with my morals,” Brownfield said. “My daughter sees that. She says, ‘I’m right behind you, Mom,’ and she wants to do it too.”