Why Jerome Powell may regret his ‘rifle shot’ Jackson Hole speech, according to economist Adam Posen

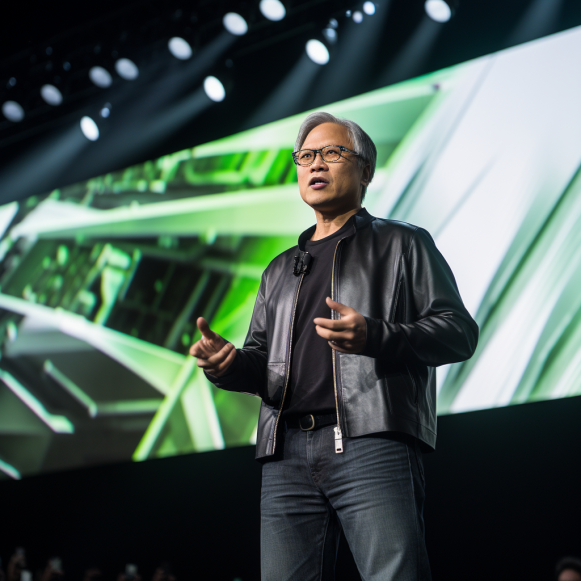

Federal Reserve Bank Chair Jerome Powell

Federal Reserve Chair Jerome Powell harped on recent labor market data in a short, 16-minute speech at Jackson Hole last week, in which he acknowledged that the central bank was about to pivot on monetary policy as it took in weaker labor market data.

However, economist Adam Posen said on a Bloomberg podcast on Friday that Powell’s speech was too limited and failed to address other economic factors, which could muddle the overall economic picture.

“The labor market is first among equals in terms of determinants of inflation in the business cycle, but…there are other things,” Posen said, pointing to productivity growth, fiscal policy, supply shocks, and trade policy.

“Acting as though these other factors don’t matter, that all that matters is the labor market, I think is misleading,” Posen added.

While the labor market isn’t as hot as it was about a year and a half ago, when employment hit a post-pandemic low of 3.4%, the US is still seeing some positive data, Posen said.

Labor force participation is at a multi-year high, and while unemployment rose to 4.3% in July in a surprise increase, it’s still at a level that economists consider to be full employment.

Posen said those numbers don’t seem to imply a pending recession.

“This again is why I would like a little bit more complex, nuanced, broader discussion by the chair,” rather than solely focusing on the last few months of labor market and inflation data, Posen said.

Posen likened the style of Powell’s speech to the brief, no-nonsense address he gave in 2022, though, at that time, his curt approach was more warranted, Posen said.

“Two years ago, Powell gave what I consider a perfect speech. It was a rifle shot. It was only eight minutes long, and all he was saying was they’re going to keep going until the inflation beast is slain,” Posen said.

But now, Posen thinks Powell could have touched on a wider timeframe rather than just focusing on the next few months and could have mentioned a few key themes one would expect from a Fed conference.

“In the context we are now, where we’re not facing a crisis, where you’re basically doing risk management over the next couple of months, which means just trying to balance things, having the rifle shot is, to me, misleading the public. It’s not a good speech,” Posen added.

Powell didn’t discuss how the economy got to where it is now (“the victory lap,” according to Posen) or how interest rates can change the course of the economy, Posen said.

Posen said the speech’s focus on such a short time frame is both a result of politics—the Fed does not want to be seen as partisan ahead of the presidential election in November—and of “a fundamental change” in the Fed’s philosophy.

Investors are pricing in a 25 basis point cut at the Fed’s September 17-18 policy meeting, with lower odds of a 50 basis point cut, according to the CME FedWatch tool.

The next jobs report is scheduled for September 6