Why Nvidia stock could soar over 500% by the end of the decade, former consulting exec says

NVDA shares could notch $800 each by 2030, former BCG exec Phillip Panaro predicted.

Nvidia is headed for a meteoric run-up by the end of the decade, according to one former consulting exec.

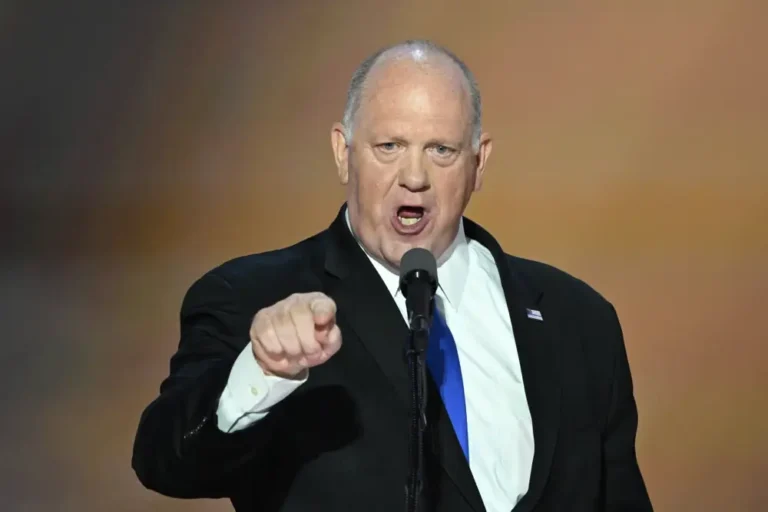

Phil Panaro — a former senior advisor at Boston Consulting Group who also served as CEO of a BCG subsidiary — says shares of the AI chipmaker will reach $800 by 2030. That implies another 545% upside for the stock, which traded around $122 a share mid-day Friday.

The Jensen Huang-led firm will benefit from the artificial intelligence revolution, as well as migration from Web2 to Web3, Panaro predicted, referring to the idea that the internet’s next era will be denominated by blockchain technology.

Those developments could result in big spending from Nvidia’s customers, he said, pointing to estimates from Goldman Sachs, Citigroup, and Morgan Stanley that Web3 could fuel trillions of added value in the market.

“Nvidia powers all of the accelerated computing, to make that happen, so they’re going to have a major share of that,” Panaro said in an interview with Schwab Network on Thursday. He later estimated that the firm’s revenue could scale by a factor of 10, from $60 billion in the last fiscal year to $600 billion by 2030.

Investors may not have to wait long to see some of those gains. Panaro foresees a “huge explosion” in the stock after Nvidia releases Blackwell, its next-gen AI chip, though he didn’t specify his short-term price target.

“Not to sound overconfident — it’s actually inevitable provided that they can continue to make these chips,” he later added of the firm’s upside potential. “The AI penetration in the economy right now is literally less than 1%. So you still have all the corporates, the cities, the municipalities, the governments, the military, that are going to be spending money to make sure they leverage AI effectively. So tons of money still to be spent.”

Some strategists have been skeptical over Nvidia’s rally, with the stock up a monster 2,733% over the last five years. Analysts have attributed some of that growth to “hyperscalers,” a small group of Big Tech firms buying Nvidia’s chips in large quantities.

But despite concerns those customers could eventually pull away, the small group of buyers is actually a good sign Nvidia’s business will scale, Panaro said.

“That’s actually the best case for why it’s actually going to go up. Because if you look at all the other customers they’re not getting to, there’s 490 other Fortune 500 firms that haven’t really adopted AI to the fullest because they don’t understand it. You have all these cities and governments that are going to be redoing all their infrastructure from Web2 to Web3, and you then have the AI arms race, with countries and their militaries, which Nvidia hasn’t penetrated for the most part,” Panaro said.

He continued: “The stock can go to the moon, essentially, provided that they deliver.”

Panaro’s prediction leans on the extreme end of forecasters, but Wall Street is generally feeling bullish about the chipmaker’s stock, which has climbed 152% since the start of the year. Analysts have issued an average price target of $152 a share for the stock, according to Nasdaq data, implying around 25% upside from current levels.