Why Paul Singer, the octogenarian founder of $72 billion Elliott Management, does not have fun at work

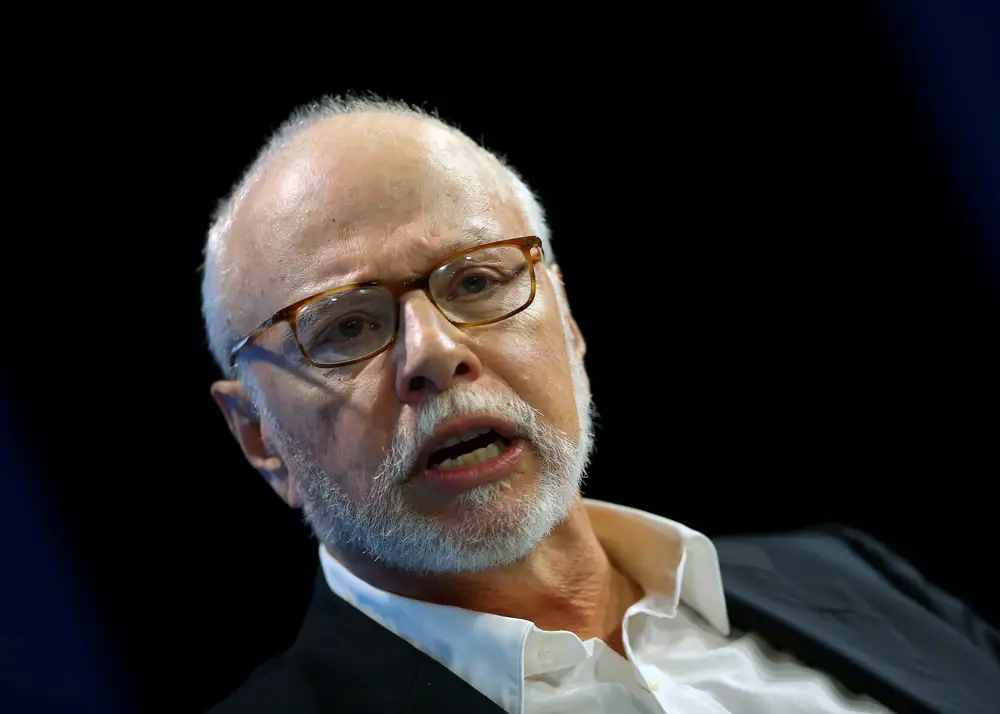

Paul Singer, the founder of Elliott Management.

Paul Singer, the founder of the $72 billion hedge fund Elliott Management, has made a fortune out of being stressed.

The billionaire, who launched his firm in 1977 and has famously lost money in only two years of a nearly half-century of investing, is famous for being worried about situations that seem far-fetched. His letters to investors often include doomsday scenarios he’s monitoring, involving things such as hackers or solar flares.

From the outside, it can seem like an unpleasant reality, but titans of finance often thrive under the pressure of delivering day in and day out, extracting their own version of fun from these daily tensions.

Not Singer. In a rare public appearance, speaking on the podcast of Nicolai Tangen, the CEO of Norway’s sovereign wealth fund, Singer was blunt about the difficulty in running his manager. When Tangen asked him if he was having fun, he said no.

Skiing, snowmobiling, sailing, hiking, biking, and playing music (he said he played the keyboard for “a couple of bands”) are what he enjoys.

Investing, managing risk, never losing his investors’ capital — these are challenges he’s enthusiastic about, he said, but not what he does for fun.

“If I want to be risk averse, I have to be risk averse all the time,” because markets never sit still, he said, adding, “You can’t get bored by not losing serious money.”

In the 40-minute conversation, which Tangen posted on Wednesday, the pair talked about Singer’s activism, risks in the market, and advice for young people.

Singer, whose firm took a $5 billion position in the oil giant BP this year, said most companies welcomed Elliott with open arms when the firm initiated a campaign.

“We’re not crusaders; we’re not just speaking to hear ourselves speak,” he said.

“We have a goal; we have a thesis,” Singer added, estimating that 70% of the firm’s campaigns were successful and the business and stock price improved.

Before he was the feared activist, Singer was losing his parents’ and friends’ money in the early 1970s, investing in stocks and options. The early struggles shaped his focus on risk, and he sees plenty of it today in the markets.

Stock markets are “just about as risky as I’ve ever seen,” he told the CEO of the fund that owns more equities than any other manager in the world. Government responses to market events like the pandemic, he said, have “lulled people into thinking they’ll always be bailed out.”

“Leverage is building and building, risk-taking is building,” Singer said. He pointed to valuations in the artificial intelligence industry, which he argued was “way over its skis.”

“There are uses, and there will be additional uses, but it’s way exaggerated,” he said.

He added that the US government’s support of cryptocurrency — which could affect the US dollar’s standing as the world’s reserve currency — “makes my head spin.”

Understanding geopolitical and market ripple effects is critical for Singer and his legions of investors, and it’s a big reason he recommends that young people study history, political science, and philosophy in college instead of business.

“If you specialize too soon, you get this narrow, deep skill set, and you’re not equipped for the things that are actually happening in the world,” he said.

And things are happening faster than ever. He said he no longer had time to read fiction — he’s a sci-fi fan — because of how complex markets have become.

But that doesn’t mean he plans to give up the keys anytime soon — his advice on rocking it is to do it “till you can’t do it anymore.”