Why top tech analyst Gene Munster says investors have 2 years before the tech bubble bursts

The stock market’s tech-fueled frenzy has a few more years to run before the air comes out of investors’ favorite trade.

That’s according to Gene Munster, a top tech analyst and a managing partner at Deepwater Asset Management. Munster thinks artificial intelligence has fueled a big bubble in tech, and there’s probably another two years or so before it bursts, he told Business Insider.

The bust — which Munster sees coming in 2027 — could result in as much as a 30% decline in the Nasdaq Composite as growth slows and the AI hype train runs out of steam.

When the dust clears, the market’s top hardware stocks, like Nvidia and other chipmakers, could end up seeing the most severe losses, he predicted.

“I agree that Nvidia will have a day of reckoning — and the chip stocks, the whole trade. And the question for us isn’t, ‘Will the bubble burst?’ It’s, ‘How high will we go before the bursting of the bubble?'” Munster said.

Munster thinks two to three years is a reasonable timeframe for the tech trade to keep inflating, given that AI is “paradigm-shifting,” and that there are still more gains to be had from AI.

“AI today is largely a buzzword for most people. They actually don’t use it. Businesses are talking about implementing, most of them don’t. And when the substance of that starts impacting businesses, margins should go up, earnings go up,” he said.

At the same time, the market is flashing signs that the extraordinary growth seen in 2024 won’t be repeated in the coming years. The Nasdaq gained 29% last year, fueled largely by the mania for AI.

Nvidia, Apple, Amazon, Alphabet, and Broadcom — five tech stocks that have been the face of the AI trade — accounted for 46% of the S&P 500’s total return last year, adding around $6 trillion in value, according to Goldman Sachs.

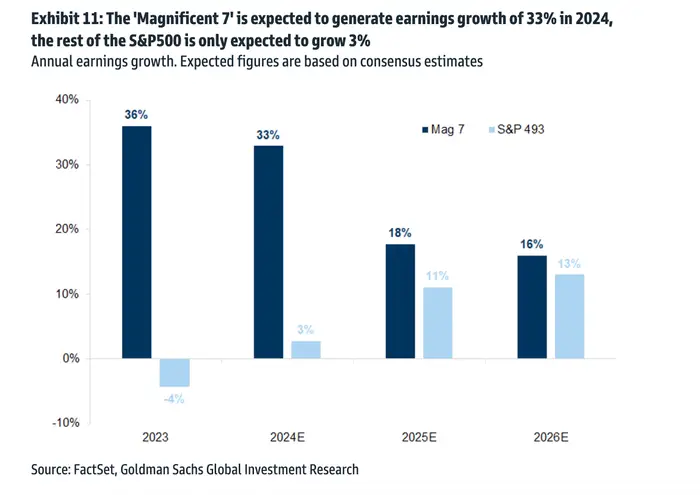

Growth expectations for tech stocks, meanwhile, outstrip expectations in other areas of the market. The Magnificent Seven group is expected to see 33% earnings growth in 2024, Goldman added, though other stocks in the S&P 500 are expected to see just 3% earnings growth.

Yet, the mega-cap tech group’s earnings are set to come down in the next two years.

The Magnificent Seven is expected to see 33% earnings growth for the year of 2024.

Investors are also setting themselves up for disappointment if they think the market’s high fliers can keep delivering consistent outperformance.

Munster pointed to Nvidia, the chipmaker that’s rocketed over 2,000% in the last five years, but has struggled to please investors in recent quarters despite its consistently strong results.

Munster predicted that investors will see the bubble starting to pop when Nvidia and other hardware stocks begin to fall short of investors’ expectations by more significant margins, sparking nervousness in the market and, ultimately, an unwinding of the tech trade.

“It’s just any little variations on that growth rate. It’s so scruntized, is going to have a big impact on the overall market,” he added. “The growth is going to — mathematically, it has to slow, and when that slows … then that’s the point where I think you start to see, at least the hardware part of the trade, come undone.”

Warnings of a potential stock market bubble have been brewing on Wall Street, with some forecasters warning of a significant correction as the excitement for AI hits a boiling point. Most strategists, though, see stocks enjoying another year of gains, albeit at a slower pace than in 2023 and 2024.