Why Trump is pushing hard to defuse the debt ceiling now and what it would mean for America

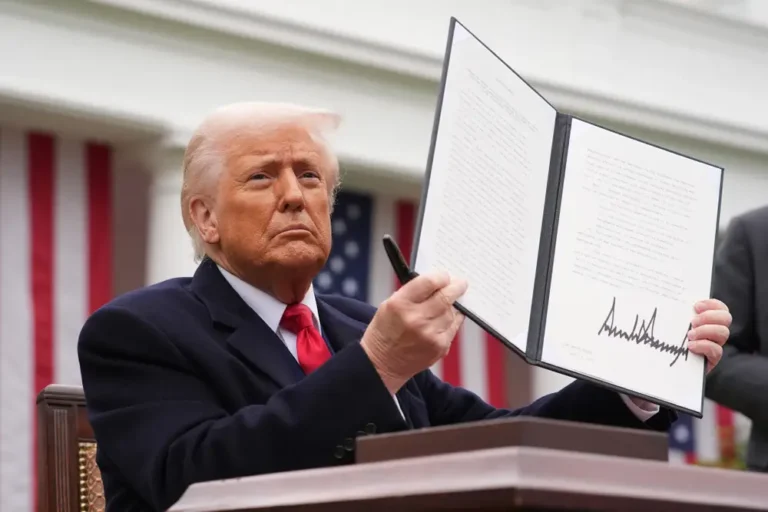

President-elect Donald Trump called on Congress to raise or eliminate the debt ceiling.

The debt ceiling is the unexpected debate in Washington this week after President-elect Donald Trump threw the annual holiday-season government funding talks into disarray.

Trump wants to raise or eliminate the limit on how much the federal government can borrow. Doing so now would mean the much-debated move would happen on President Joe Biden’s watch and be resolved before Trump takes office when he’ll want to implement his agenda without a fight over borrowing limits.

“Congress must get rid of, or extend out to, perhaps, 2029, the ridiculous Debt Ceiling,” Trump wrote in a Truth Social post on Friday. “Without this, we should never make a deal. Remember, the pressure is on whoever is President.'”

This all comes amid a chaotic scramble to reach a funding deal for the US government and avoid a shutdown at midnight on Friday. The debt ceiling was one of the sticking points Trump used to scrap a bipartisan deal to keep the government funded through March. Now he’s revisiting a much-used political tool.

“Trump is right to identify that he doesn’t want his fingerprints on increasing the debt ceiling, and he doesn’t want to have to deal with it in six months while he’s trying to pass what he considers a must-pass tax extension bill,” Elizabeth Pancotti, the director of special initiatives at the left-leaning Roosevelt Institute think tank told B-17.

A debt ceiling breach has become a political tool — one that Trump is trying to wield for the last time

The debt ceiling limits the amount of money the federal government is allowed to borrow to pay for its programs and operations. If it’s not regularly raised or suspended, the US government risks defaulting on its debt and failing to pay its bills.

This could compromise everyday Americans’ access to crucial government programs like Social Security, Medicaid, and housing vouchers. Len Burman, a fellow at the think tank Urban Institute, told B-17 that a default could also cause interest rates to rise drastically if investors no longer view the US government as a creditworthy borrower. That means Americans could face higher rates on mortgages and credit cards, potentially leading to a broader financial crisis and deep recession.

Due to these widespread consequences, the debt ceiling has evolved into a political bargaining chip, and the US has repeatedly come close to breaching it due to partisan disagreements, most recently in 2023. That’s why some Democrats have long advocated abolishing the ceiling, arguing that Republicans weaponize it to push spending cuts. Sen. Elizabeth Warren capitalized on Trump’s recent comments, writing on X on Thursday morning that she agrees with him on terminating the debt limit.

During recent debt ceiling standoffs, various plans to sidestep the limit were floated. Democratic Rep. Jamie Raskin told B-17 that the president could invoke a clause in the 14th Amendment that would declare a default and the debt ceiling that caused that default unconstitutional.

Other ideas to eliminate the debt ceiling have included minting a $1 trillion platinum coin, which some economists have said would allow the treasury secretary to deposit the coin to pay off debts.

In an interview with Fox News Digital on Thursday, Trump warned that Republicans who don’t support repealing the debt limit could face primary challenges; many Republicans have historically opposed getting rid of it, arguing that it’s a check on borrowing. Trump told NBC News that Democrats have signaled they want to get rid of the debt limit and that he would “lead the charge” to do so.

The country will technically hit the debt ceiling at the start of next year, but the Treasury Department can hold off default and keep paying the bills through various accounting tricks, likely until late spring or early summer.