World governments need to curb spending or risk being ‘too late’ when markets panic, BIS warns

Global politicians need to act on rising debt levels or risk facing a revolt from global markets, the Bank for International Settlements said this week.

Claudio Borio, a senior economist at the institution, warned that governments must rein in their spending before bond investors stage a protest. The monetary and economic department head told reporters that it will be “too late” if governments wait for a wake-up call from markets.

“The global fiscal outlook remains acutely worrying,” Borio said during a presentation of a quarterly report, as quoted by Bloomberg. “Government debt trajectories represent the most serious threat to macroeconomic and financial stability.”

BIS, which facilitates collaboration between world central banks, has long been apprehensive about ballooning debt levels. The latest quarterly report observed that fiscal concerns are emerging in several jurisdictions, prompting government debt holders to demand higher yields on the bonds.

For instance, data provided in the report shows that US long-term bond yields are hovering around their 2007-2008 average, when the global financial crisis roiled markets. Bond yields rise when prices fall, which happens in times of weaker demand as traders become less certain of the safety and soundness of government debt.

“There’s a certain US exceptionalism because of the outsized role of the dollar in the global financial system,” Borio said. “It might take longer for the warning signs to show up. But once they show up, the impact on the global economy is bigger.”

Economists have actively raised alarm bells over US overspending, warning of ramifications including inflation, market volatility, and eroding quality of life for Americans. Fiscal policy was a major talking point during the latest presidential campaign, and some worry that Donald Trump’s plans could boost the US deficit.

As the government has yet to halt or even slow its borrowing, Wall Street is monitoring the Treasury market for “bond vigilantes,” investors who purposefully dump bonds in protest, sending yields spiking.

The issue isn’t unique to the US, either.

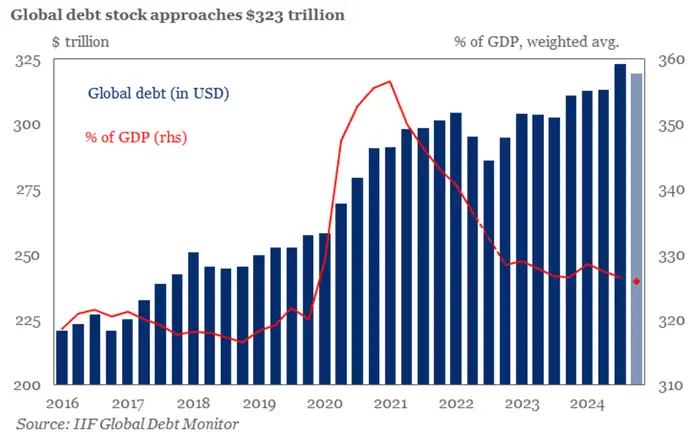

According to a December report from the Institute of International Finance, global debt surged over $12 trillion in the first three quarters of this year, hitting a record of nearly $323 trillion. By 2028, IIF expects government debt levels to rise by more than a third.

Markets already appear to be reacting. In France, yields jumped this month as investors digested the government’s failed attempt to deliver austerity measures. The now-ousted prime minister Michel Barnier argued these were necessary to stabilize national finances.

Meanwhile, in November, Brazil’s currency hit a record low amid growing worry over its public finances, FT reported.