‘World’s safest asset’ proves anything but amid wild Treasuries

Market watchers say there’s a recipe for sustained volatility for months to come.

A surprisingly strong economy in the United States, combined with mixed signals from the Federal Reserve, has fueled some of the wildest swings in Treasuries in recent memory. Add geopolitical uncertainty and a surge in debt supply, and market observers predict months of sustained volatility.

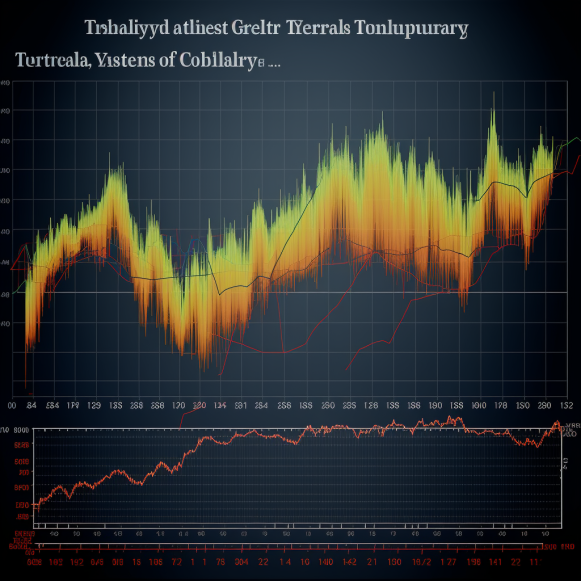

Treasuries have been dubbed the “world’s safest asset,” but dramatic changes in yields have become almost daily occurrences. Last week, the 10-year yield swung nearly 40 basis points, buffeted by crosscurrents such as resilient retail sales and jobless figures, a slew of Fed officials’ comments, and rising demand for safe-haven assets amid concerns about an escalating conflict in the Middle East.

“It’s going to be a rough ride, so buckle up,” Wells Fargo Securities’ head of macro strategy Mike Schumacher said on Bloomberg TV. Interest-rate volatility is expected to “remain quite high, at least through the middle of next year, possibly longer as the Middle East settles down” and until the market gains more clarity on the Fed.

The ICE BofA MOVE Index, which measures expected swings in Treasury yields priced into one-month options, has risen for five weeks in a row. Indeed, according to Bloomberg data, swings in long-term interest rates are outpacing those in equities for the first time in at least 18 years.

According to Mohamed El-Erian, chief economic adviser at Allianz SE and a Bloomberg Opinion columnist, this is partly because the Fed is struggling to signal a longer-term vision for where interest-rate policy is headed.

“We are going to remain in this situation of great uncertainty because there is no vision as to where this economy is going,” El-Erian said on Bloomberg TV on Friday. “They need to pivot from excessive data dependence to data dependence that has a greater forward-looking component.”

Nothing caused more havoc last week than Fed Chair Jerome Powell’s comments on the path of monetary policy on Thursday. At an event at the Economic Club of New York, he suggested that the US Federal Reserve is likely to hold interest rates steady at its next meeting, while leaving the door open for another hike later if policymakers see further signs of resilient economic growth.

In response, the yield curve aggressively steepened, with short-dated yields falling while longer-maturity yields climbing to new multiyear highs.

Supply and geopolitics

Price swings were also fueled by growing fears that the conflict between Israel and Hamas would spread throughout the region, potentially drawing in the United States.

Reports of drone attacks in Iraq and Syria, cruise missiles fired toward Israel by Houthi rebels in Yemen, and Israeli strikes against Hamas and Hezbollah prompted a reactionary bid for safety among investors, causing 10-year yields to fall from near-5% highs to end the week around 4.91%.

Concerns about the United States’ fiscal future are also influencing investor sentiment.

Rising US debt issuance has pushed up the so-called term premium by more than a percentage point in the last three months, fueling a dramatic rise in long-term rates. Traders are already bracing for the Treasury to announce additional auction size increases at its next quarterly refunding on November 1.

“Volatility breeds volatility,” said William Marshall, BNP Paribas SA’s head of US rates strategy. “There is just a general lack of strong conviction at this stage as to where things ought to be anchored.”

Looking ahead, a pause in Fed commentary this week due to the central bank’s customary blackout period ahead of the Nov. 1 policy meeting may provide traders with a welcome reprieve.

Nonetheless, the coming days will provide some important readings on the economy’s price pressures, including Friday’s personal-consumption expenditures data, the Fed’s preferred inflation measure. On the same day, the University of Michigan’s inflation expectations survey will be released.

What to look out for

- Economic information:

The Chicago Fed’s national activity index was released on October 23.

October 24: Philadelphia Fed non-manufacturing activity; S&P Global US manufacturing and services; Richmond Fed manufacturing index/business conditions

MBA mortgage applications; new home sales on October 25

Wholesale inventories; advance goods trade balance; GDP; Personal consumption; retail inventories; GDP price; durable goods; Core PCE price; initial jobless claims; pending home sales; Kansas City Fed manufacturing

Oct 27: Personal income/spending; PCE deflator; sentiment in the state of Michigan; Kansas City Fed services activity

- No Federal Reserve speakers are scheduled during the self-imposed quiet period preceding the November 1 rate decision.

- Auction calendar:

Oct. 23: 13-, 26-week bills

Oct. 24: 42-day cash management bills; 2-year notes

Oct. 25: 17-week bills; 2-year floating rate notes; 5-year notes

Oct. 26: 4-, 8-week bills; 7-year notes