Your landlord might be using an algorithm to raise rents. If Kamala Harris has her way, that could be banned.

Vice President Kamala Harris, the Democratic presidential nominee, recently unveiled an ambitious plan for US housing that includes cracking down on abusive landlords.

Harris announced she’d back legislation banning landlords from using algorithms that are said to allow them to collude to raise rents in coordination with other property owners. The bill, called the Preventing the Algorithmic Facilitation of Rental Housing Cartels Act, is designed to regulate companies like the real-estate tech firm RealPage, which is facing lawsuits alleging it’s using its price-setting algorithm to overcharge renters.

“Some corporate landlords collude with each other to set artificially high rental prices, often using algorithms and price-fixing software to do it,” Harris said in a recent speech on economic policy. “It’s anticompetitive, and it drives up costs.”

Housing costs have skyrocketed in recent years, largely because of a severe housing shortage. Rents across the US have risen by about 19% since 2019, and more tenants than ever are rent burdened, meaning they spend more than 30% of their income on rent and utilities. American voters are acutely concerned about it; in a recent survey, 83% of Democrats and 68% of Republicans said they thought a lack of affordable housing was a significant problem.

Rent-setting algorithms are facing legal scrutiny

Companies like RealPage have attracted heavy scrutiny from law enforcement following investigative reports into their practices. RealPage, based in Texas, sells software called YieldStar that recommends apartment rent prices to its clients — landlords and property managers — based on nonpublic information it gathers in a given real-estate market.

The attorneys general of Arizona and Washington, DC, have filed lawsuits against the company, alleging that it illegally colluded with its clients to set rent prices above competitive levels. And on Friday, The New York Times reported that the US Department of Justice had sued RealPage, alleging anticompetitive, collusive behavior.

Kris Mayes, Arizona’s attorney general, said landlords who used RealPage “are not charging what the market can bear — they are controlling the market.”

She said she found that 70% of rental homes in Phoenix and 50% in Tucson were owned by companies that used RealPage. In DC, the attorney general accused RealPage and its clients of operating a “District-wide housing cartel” that controlled more than 30% of multifamily units in the city.

“They’re promising higher prices by a small but significant amount, even though occupancy is going down,” Maurice Stucke, a law professor at the University of Tennessee who was formerly a DOJ antitrust-division prosecutor, told B-17 last year. “Typically, that’s the telltale sign of collusion.”

A spokesperson for RealPage didn’t immediately respond to a request for comment.

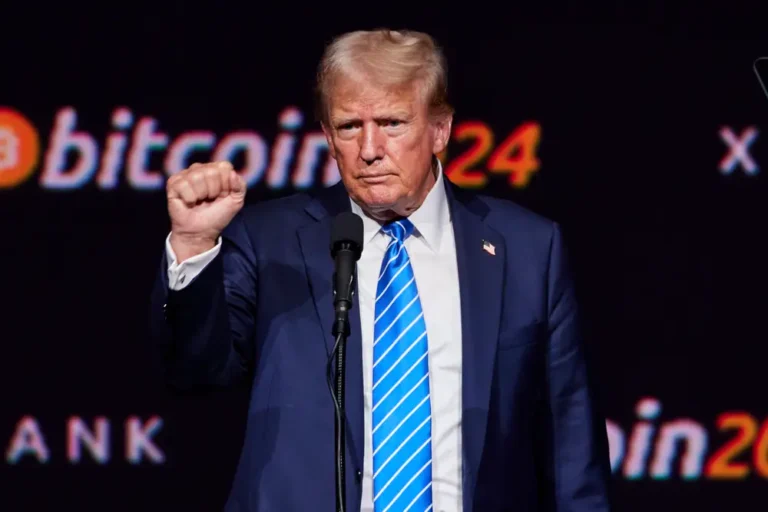

Kamala Harris has centered her housing plan in her presidential campaign.

Addressing the housing shortage

In addition to targeting landlords using price-setting algorithms, Harris backed a piece of legislation designed to crack down on Wall Street investors who buy homes in bulk. But these efforts would address the housing crisis only on the margins.

While rent-setting algorithms might be driving up prices in some markets, much bigger supply and demand forces are to blame for the broader affordability crisis. But it’s politically popular to go after Wall Street investors and landlords engaged in predatory behaviors. Republican lawmakers, including JD Vance, have supported cracking down on investors buying up homes.

“There’s sort of a belief that big landlords have more power than they actually do,” Jenny Schuetz, an expert on urban economics and housing policy at the Brookings Institution, told B-17. But she argued that trying to prevent these practices isn’t a bad idea. “The question is what do you do at the end of the investigation, and is there actually action that’s going to help consumers?” she added.

There’s a risk that regulating landlords, either in how they set rents or in which homes they purchase, could backfire by reducing investment in homes and thus hurting supply. “If you actually cracked down really hard on private equity, it would be less capital going into this space, less capital going into investing in new homes,” Ben Metcalf, the managing director of the Terner Center for Housing Innovation at , told B-17

Redfin’s chief economist, Daryl Fairweather, argued that Harris was prioritizing regulating predatory behavior by landlords as a way to appeal to first-time homebuyers and renters who feel taken advantage of and outcompeted in the market. It can be harder for the average voter to understand how supply and demand affect the cost of their housing, so Harris is targeting a clear adversary in addition to addressing the underlying issue of the housing shortage, she said. A large part of Harris’ housing plan focuses on boosting the supply of housing, with a pledge to build 3 million homes in four years.

“Harris is acknowledging the way that everyday people feel the housing market is broken,” told B-17. “She’s addressing a lot of the specific concerns of first-time homebuyers who feel like they’re being outcompeted by investors and their landlords are jacking up rent.”

Has your landlord raised your rent significantly? Are you willing to share your story? Reach out to this reporter at erelman@b-17.com.