7 housing-market charts showing ominous similarities between today and the years right before the 2008 crisis — and why some experts won’t declare another bubble just yet

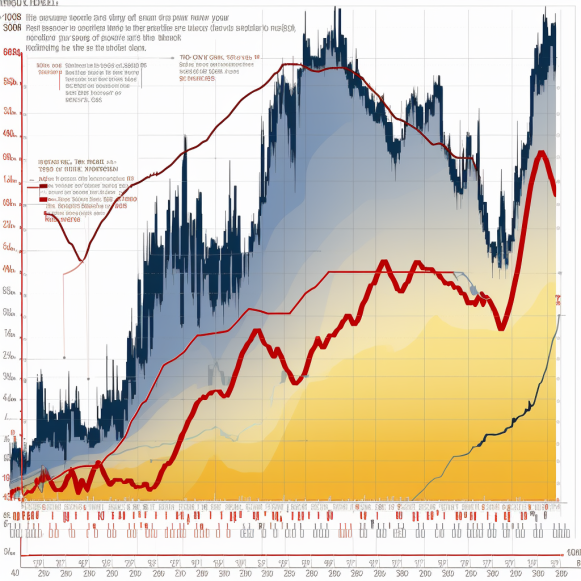

- Several indicators show parallels between today’s housing market and that of the mid-2000s.

- Some similarities include low affordability, falling furniture sales, and an investor pullback.

- Some differences, however, include tighter lending standards and fewer ARMs.

It is never a good idea to compare economic cycles. There are so many moving parts in geopolitics and policy that drawing exact parallels is impossible.

But, as the saying goes, history repeats itself. And looking at historical data on how markets have behaved is one way economists, investors, and strategists can try to predict what will happen in the future.

Looking at current housing market data, there are a number of trends emerging that occurred prior to the 2008 housing bubble burst. We’ve compiled seven of them below and explained what each one shows.

Again, no two comparisons are identical, and there are numerous data points indicating that the housing market is in a different place today.

Although several similarities exist in terms of home prices and affordability, the reasons for these trends differ. The 2000s bubble was fueled by demand and lax lending standards, whereas today’s affordability crisis is fueled by insufficient supply.

Consider the much lower number of homeowners who have an adjustable-rate mortgage.

Or the much stricter lending standards that banks now have.

However, if the economy weakens and enters a recession, which could be caused by a declining housing sector, home prices may suffer in the coming years.

Let’s look at the warning signs.