Tariffs and sanctions could disrupt the tech supply chain. Here’s how to derisk it.

Megan Reiss has been very busy since the election. The CEO and founder of SolidIntel, a D.C.-based supply chain advisory firm, has been fielding calls from current and prospective clients looking to understand what Trump’s second term could mean for their manufacturing, supply, raw materials, foundry, and businesses across sectors.

SolidIntel’s clients also want to know how to derisk their operations as talk of tariffs sends markets into a volatile turn.

“People concerned about tariffs are very interested in moving their supply chains out of China as quickly as possible because they see it as the potential for everything to get really expensive, really quickly,” Reiss told B-17.

The rare earth minerals and raw materials underpinning the AI boom and its countless clusters of chips may soon be in the spotlight because of where they’re produced. Though President-elect Trump’s Monday post named Mexico and Canada, all eyes are on China.

“Our technology is dependent on these rare earth minerals. China has a lot of opportunity to turn off the spigot,” Reiss said.

Friend shoring to allies

Friend shoring, or moving supply chain, manufacturing, and operations to non-adversarial countries to have continuity, is one step to derisking tech’s supply chain.

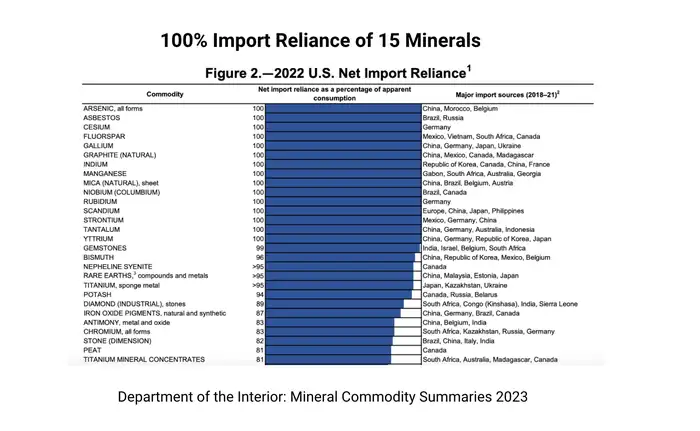

Rare earth minerals used to make AI chips are almost exclusively imported from China.

The potential for export controls and sanctions are also top of mind for SolidIntel’s rare earth mineral clients. These raw materials serve as the building blocks for wafters, and semiconductors that power advanced AI chips. The vast majority of these minerals are commercially mined in China or quarries owned by Chinese companies.

In 2023, the U.S. imported more than 95% of rare earth compounds and minerals from China, Malaysia, Estonia, and Japan, according to the U.S. Department of the Interior.

Nearshoring and friend-shoring manufacturing and vital supply chains away from China are also important for national security and could bolster a sovereign tech sector. The near-term investment is difficult but ultimately more beneficial in the long term.

Since 2023, SolidIntel, which uses generative AI and machine learning to identify supply chain risks, has helped companies track how bad actors end up in supply chains and connects companies with compliant suppliers.

“The more these supply chains are not hung over our head, and we make national security choices that are in the best interest of the U.S., the less afraid we are that an adversary is going to try to kill our commercial sector, that’s a good thing,” Reiss said.

There are closer to home alternatives that could become more viable depending on the incoming administration’s policies, how relations with China play out, and if Trump makes good on his tariffs talk.

“My fear is not that we will not find alternative sources because there are a lot of rare earth minerals, and they’re not just in the U.S.; they’re in friendly and allied countries. I’m worried about us doing it fast enough. It can take a decade or more to bring a mine online, and it can’t take that long in this case,” Reiss said.

Create redundancy in manufacturing

To derisk the supply chain, create redundancy. In other words, reducing parts of supply chains that are dependent on one country is a way to cut down on risks and diversify manufacturers’ options.

“If I were a manufacturer and I had a couple of chokepoints in my supply, say two of three, difficult-to-source parts that are only produced in a couple of countries, you would ideally want to have production lines in multiple countries,” Reiss said.

Though streamlining production to fewer or one country can be cheaper and more efficient, it only works until something goes wrong she said.

Regulation of the supply chain may increase, but tech companies are their suppliers and could find solutions in data. “Technology cannot do it unto itself, because you can only rely on the data you can get to understand the whole length of the supply chain. It’s about open-sourced intelligence and closed data sets, ” Reiss said.

“It’s not just ‘is this a foreign manufacturer, it’s ‘what are the foreign ownership control and influence risks in partnering with a company or in having a certain investor,” Reiss said. “There’s a lot more to it that people are just starting to build out their understanding of.”