Billionaire VC Vinod Khosla was one of the first investors in OpenAI. Now he thinks most AI startups have become way overvalued.

- Vinod Khosla, worth a reported $6.2 billion, is one of Silicon Valley’s most successful VCs.

- Khosla wrote the first check into OpenAI when it switched to a “capped-profit” model in 2019.

- But now Khosla says he is passing on most AI deals because they have become too expensive.

When OpenAI, the now-sizzling hot startup behind ChatGPT, transitioned from a non-profit to a “capped-profit” company in 2019, Vinod Khosla, one of Silicon Valley’s most successful venture capitalists, boldly stepped forward with the first check.

His firm invested $50 million, which was twice the size of any investment made by Khosla Ventures in its 15-year history.

For at least a decade, Khosla has been a strong believer in artificial intelligence as a transformative technology; in 2012, he wrote two eerily prescient essays about how doctors and teachers could be easily replaced by AI.

But then, at the start of this year, Khosla witnessed a flood of investors who seemed to want to back any AI company they could get their hands on.

“I think most people came back from Christmas break saying, we missed this boat, now let’s get in a small row boat and paddle hard,” Khosla told Insider.

That’s when Khosla says he decided to do what he’s done so well throughout his career: row in the opposite direction by cutting back on most AI investments.

“Most of these valuations in AI that are in the hundreds of millions or billions of dollars will correct themselves because there will be more of a winner take all phenomena than we realize,” he said. “Investing in momentum is a bad idea.”

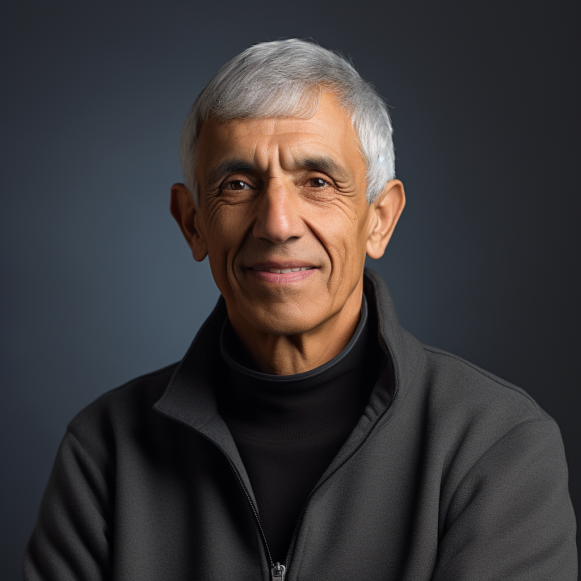

Khosla, now 68, founded Sun Microsystems in 1982 and also played key roles in AMD and Juniper Networks’ early days. He worked for the legendary firm Kleiner Perkins Caufield & Byers (now known as Kleiner Perkins) for 18 years before launching his own fund, Khosla Ventures, in 2004. According to Forbes, he made early bets on Affirm, DoorDash, and Instacart, which helped catapult his net worth to $6.2 billion.

Khosla spoke with Insider over the course of an extended interview at the recent Wall Street Journal Tech Live in Laguna Beach, where he was a featured speaker. Unlike most guests of Khosla’s stature at large conferences, Khosla stayed late into the night. He was happy to answer questions from young founders eager to fist bump with a VC legend, though Khosla politely declined handshakes.

According to Khosla, only a few AI winners will emerge.

Khosla is one of the few top venture capitalists actively investing in the current market, and he has also worked during other transformative cycles that he believes will rival AI – social media, mobile growth, and the personal computer.

“If you go back to the eighties there were tens of thousands of software companies, but only a few large winners,” says Khosla. “Most people and businesses lost everything.” I believe the same thing will occur here.”

Instead of AI, Khosla claims to be “making lots of fundamental investments in esoteric areas.”

He recently backed a startup that is still in stealth mode, which he claims can help discover more mineral resources, and he claims lithium and cobalt have become a major focus. He is also interested in companies that improve the efficiency of airplanes and automobiles.

“We’re investing heavily in those but those aren’t overhyped,” Mr. Khosla said.

According to PitchBook data compiled for Bloomberg, funding for AI companies increased 27% globally in the third quarter compared to the previous year, despite a 31% drop in overall startup deals.

Khosla has not participated in recent mega rounds for Anthropic (now seeking funding at a reported valuation of up to $30 billion), character.ai. (seeking a valuation of more than $5 billion), Hugging Face ($4.5 billion valuation), or Adept (reported $1 billion valuation).

Khosla is quick to point out that he isn’t avoiding all AI startups. The firm made a $1.16 billion post-money investment in Replit, a generative AI tool for software development, earlier this year.

There’s also OpenAI, which has benefited from the AI hype as much as any other startup. Bloomberg reported that it is in talks to sell existing shares for $86 billion.

Khosla declined to comment on the offering or confirm or deny any reported valuation, but he did say that OpenAI is one example where he believes the hype is justified given how quickly the company is growing; it recently increased its annualized run rate from $1 billion to $1.3 billion in a matter of months, according to The Information.

“Investing in fundamentals is different than being a sheep and following the herd,” said Khosla. “I’m pretty arrogant about not following what others are saying.”